Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Those entering the market now can do so by holding long positions with entry at $63-63.5, with $59.7 as a stop-loss and $68.20 as the initial price target.

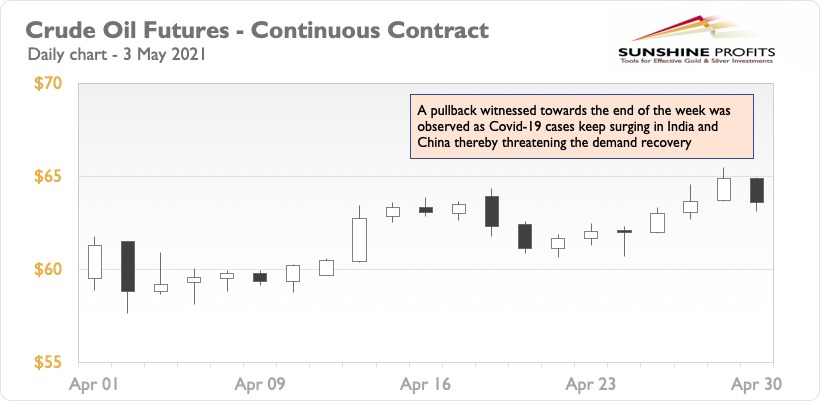

Last week was a good week for oil. A steady price rise ended, however, with a dip on the last day. Will this trend repeat itself this week?

US gasoline demand rose by 9.1% this Saturday (May. 1) compared to last Saturday (Apr. 26). There is an increase in weekend family outings as the driving season has arrived with milder weather. The higher and higher rate of vaccination also makes people feel more secure, go out and partially resume their pre-Covid lifestyle. US gasoline demand has been on an exponential rise since mid-Feb 2021 and thus, it was a key reason for support of WTI prices. In April, however, the demand was in a slow decline, contrary to expectations. Perhaps it was a psychological impact because of rising virus cases across the world (mainly in Europe, Brazil and India) that made people play safe. Now, the return of the previous demand surge is reassuring and could impart a bullish flavour to the oil market.

As can be seen from the chart above, there was a dip in prices on the last day of the week, as concerns over demand recovery remained strong while some booked profits after a good week on the oil front. Another bearish factor is that on the supply side, there has been a gradual increase from OPEC+ as the quotas have been relaxed. Russia, for instance, increased its oil production in April 2021 by 1.9% compared to March.

India’s Covid cases surge peaked at 0.4 million new cases on Friday (Apr 30.) and, thankfully, declined during the weekend with 0.368 million new cases recorded on Sunday (May 2.). If this decline happens as fast as the virus surge, we should see a near-normalcy situation in India by the end of May. Coupled up with strong US demand, this double booster can surge oil prices past $70.

Another positive statement for oil prices came as Iraq considered buying a stake in Exxon and stated that oil is likely to remain at $65 levels in the coming months.

Iran’s oil supply continues to grow despite US sanctions still in place. The talks are ongoing between the US and Iran to return to the 2015 nuclear deal and are quite likely to end in success – Iran oil will come online officially in a moment this happens. However, the market has not responded to this development, thereby indicating that Iran may not be a major factor to move oil prices significantly.

To summarize, oil keeps its strong position as demand surges in the US. India’s Covid cases plateaued during the weekend and, hopefully, if the decline continues, it will bring back the demand from one of the top oil importers.

As always, we’ll keep you, our subscribers, well-informed.

Trading position (short-term; my opinion; levels for crude oil’s continuous futures contract): Those entering the market now can do so by holding long positions with entry at $63-63.5, with $59.7 as a stop-loss and $68.20 as the initial price target.

Thank you.

Nishant Jain, MBA, CPSM

Oil Trading Strategist