Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Wednesday, the black gold extended gains and hit a fresh July high after the EIA weekly report showed a bigger-than-expected decline in crude oil inventories. Additionally, the gasoline and distillate stockpiles fell more-than-expected, encouraging oil bulls to act. Thanks to these positive numbers light crude broke above the nearest resistances and hit a fresh July high. Will we see further rally?

Crude Oil’s Technical Picture

Let’s take a closer look at the charts and find out (charts courtesy of http://stockcharts.com).

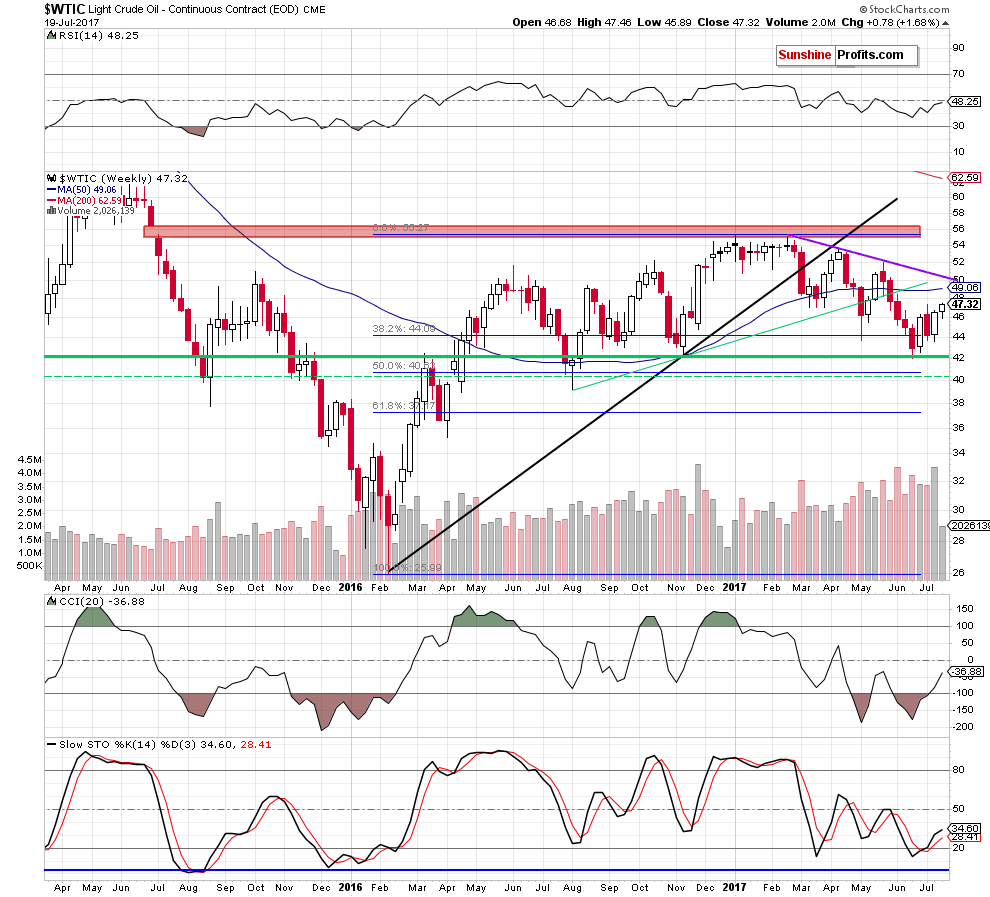

From the very short-term perspective, we see that crude oil extended gains and broke above the nearest resistances - the 50-day moving average, the 50% Fibonacci retracement and the early July high of $47.32.

What Does This Breakout Mean for Crude Oil?

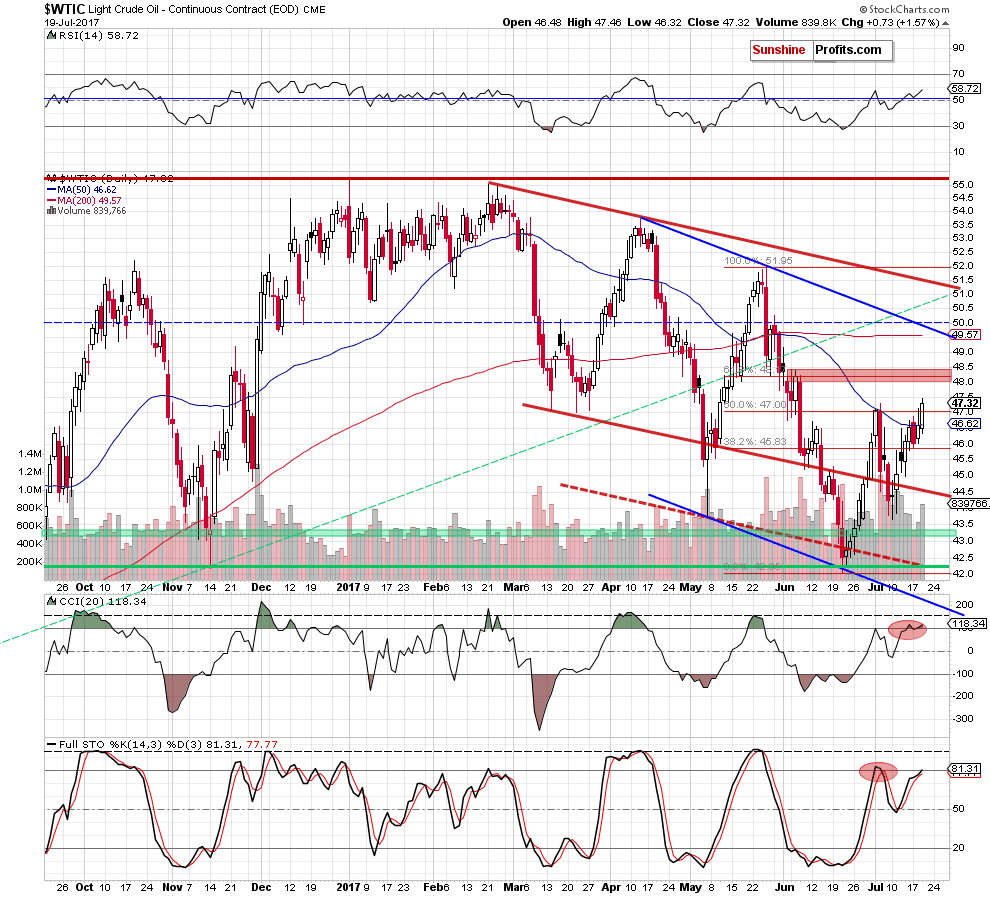

Looking at the daily chart, we see that yesterday’s move materialized on higher volume, which suggests that oil bulls could regain strength. Additionally, the buy signal generated by the Stochastic Oscillator remains in place, supporting further improvement (at the same time, the CCI came back to its overbought area, which means an invalidation of the earlier sell signal). Taking these facts and the above-mentioned breakout above important short-term resistances into account, we think that crude oil will increase once again and test the red resistance zone (created by the 61.8% Fibonacci retracement and the early June highs) in the coming days.

Summing up, crude oil extended gains, breaking above the nearest resistances, which opened the way to the red resistance zone created by the 61.8% Fibonacci retracement and the early June highs.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts