Trading position (short-term; our opinion; levels for crude oil's continuous futures contract): Full (100% of the regular position size) speculative short positions in crude oil are justified from the risk to reward point of view stop loss $45.63 at and $30.22 as the initial target price.

In the Oil Trading Alerts posted last week, we described the reason due to which crude oil's long and boring consolidation is likely coming to an end. This reason was the rising support line that was being tested. We precisely wrote the following:

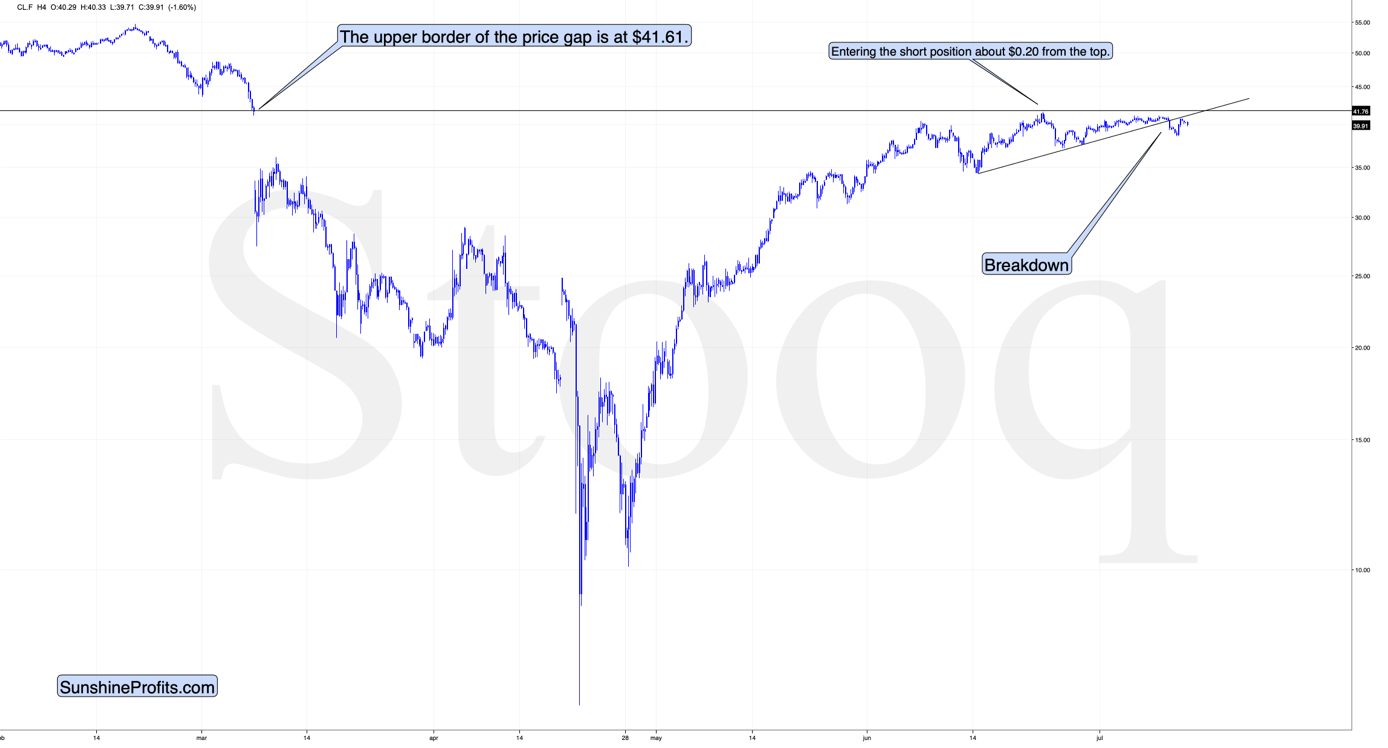

"After failing to rally back above the upper border of the March price gap, crude oil declined and then started to slowly climb back up at a certain pace. The rising support line shows this pace.

The thing is that crude oil is breaking below this line, which means that the little momentum that crude oil had, is waning. This is bearish, because it shows that the buying power is drying up or that it's almost gone.

This means that the consolidation - and boredom - are likely almost over. Once the breakdown is verified, the odds for a quick slide will greatly increase.

Given the fundamental news that are reaching (and likely to reach) the market - the increasing Covid-19 cases in the U.S. and globally - it seems that black gold is unlikely to have enough strength to keep pushing higher. Based on the Covid Tracking Project, the latest daily increase in the U.S. Covid-19 cases is over 50k, which is well above the previous high.

To be precise, the situation is not yet as severe as it was in April, because back then, the number of tests conducted was about half of what it is right now. Still, the breakout in nominal terms is likely to catch media's (and thus investors') attention - especially once the dire economic implications become obvious. The next wave of big fear is likely to unfold in our view. And crude oil is likely to fall once again.

(...) crude oil finally moved below this line. It didn't do so through a big decline, but rather thanks to doing... nothing. The line is ascending, so by trading sideways, the price should at some point move below it. This happened today, and while it's not a confirmed breakdown yet, it is an indication that the move lower is likely just around the corner"

As black gold has declined on Thursday and Friday, its breakdown is now clearly visible.

Thanks to the subsequent move higher that took oil only to the previously broken line and not above it, we see that the breakdown was verified. That's an important development as it indicates that the decline was not accidental. Conversely, it shows that despite the positive implications of the general stock market's rally, crude oil resisted the buying pressure and declined once again. This means that crude oil really wants to move lower in the next several days or perhaps weeks.

The breakdown was the first crack in the dam and the verification was the second, bigger crack that made a louder sound.

The upswing really ended in early June, then crude oil made another attempt to move higher - and it failed. The most recent sideways trading was just traders looking at each other waiting who will finally sell first. Someone did and others followed as the buyers were more or less absent. The short positions that we entered on June 23 are likely to become much more profitable in the following days.

Summing up, the short-term outlook for crude oil is bearish based on both the technical indications (in particular, because of crude oil's short-term breakdown and its verification) and on the rapidly increasing Covid-19 cases in the U.S., and we see signs that the bigger decline is likely to finally start.

As always, we'll keep you - our subscribers - informed.

Trading position (short-term; our opinion; levels for crude oil's continuous futures contract): Full (100% of the regular position size) speculative short positions in crude oil are justified from the risk to reward point of view stop loss $45.63 at and $30.22 as the initial target price.

In case of the futures contracts that are more distant than the current contract, we think that adding the premium (difference between the July and other contracts) to both: stop-loss and initial target prices is justified.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager