Trading position (short-term; our opinion; levels for crude oil’s continuous futures contract): Full (100% of the regular position size) speculative short positions in crude oil are justified from the risk to reward point of view stop loss $45.63 at and $30.22 as the initial target price.

Crude oil is dropping lower for two weeks in a row now, even though the USDX hasn’t rallied and the evident general stock market growth. Thus, we must conclude that there has not been a change in the black gold market for today as well, and the fact that crude oil declined further instead of rising shows us exactly the direction in which the marketplace is going.

The decline is in tune with the global energy demand concerns that will only grow higher as the COVID-19 infections continue to rise, and the turbulent U.S Presidential race. The fading U.S stimulus promises, as well as another period of global lockdown due to the pandemic, are all here to continue affecting crude oil prices as well.

For a better context about our most recent outlook, please take a look at the chart from Monday, October 12th below.

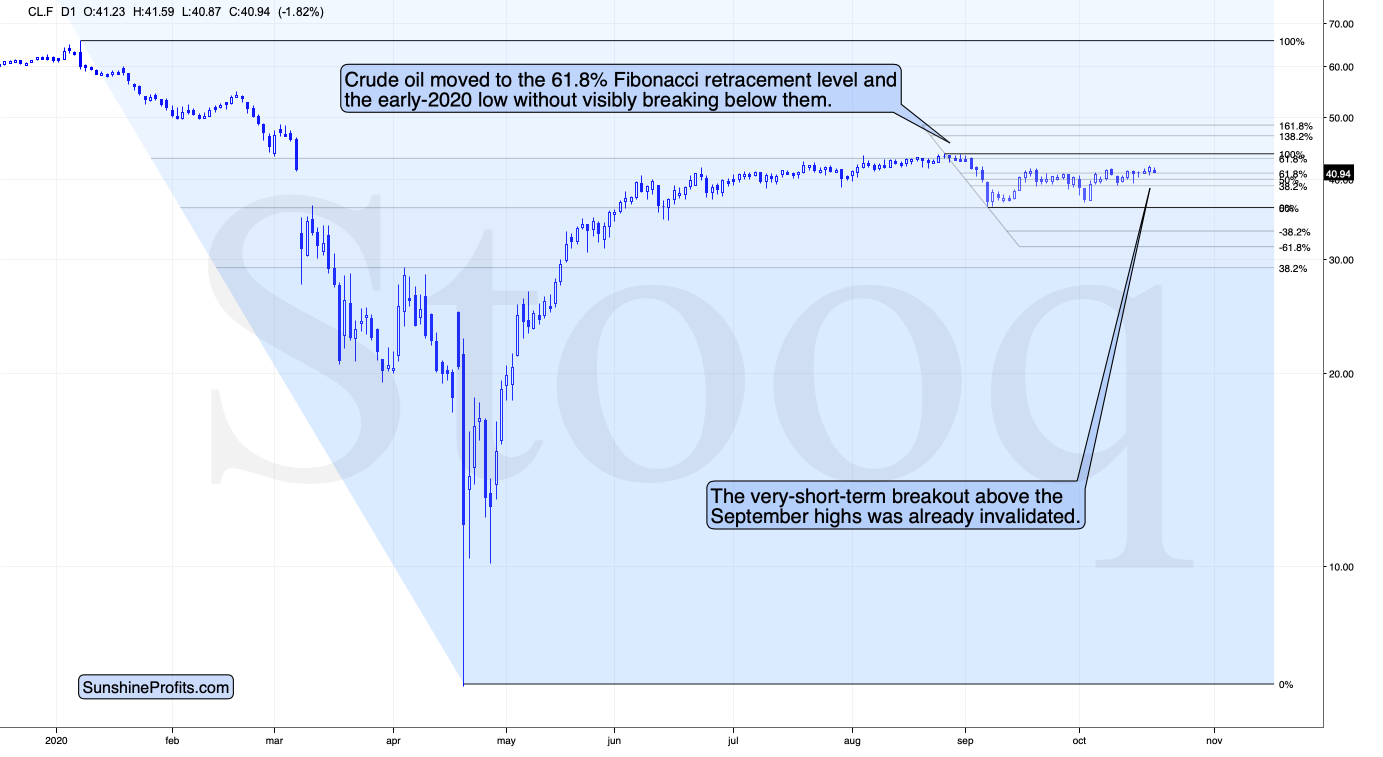

Yesterday's breakout in crude oil was already invalidated in today's pre-market trading, which is a sell signal by itself. Consequently, the situation is in fact more bearish than it was before crude oil's fake attempt to break higher.

For weeks now, our marketplace predictions turned out to be accurate. Crude oil couldn’t move above the 61.8% Fibonacci retracement and the upper border of the huge March price gap.

As a result, the medium-term rally that started back in April has most likely ended, and the next big move will probably be on the decline, confirmed by the bearish link between the USD Index and crude oil.

It is evident that in the past few months, the black gold’s price hasn’t been doing much. However, once it breaks below the September lows (which could happen shortly), the decline would likely accelerate.

To summarize, for the upcoming weeks, the outlook for crude oil stays bearish, and the most recent upswing did not change that at all.

As always, we’ll keep you, our subscribers well informed.

Trading position (short-term; our opinion; levels for crude oil’s continuous futures contract): Full (100% of the regular position size) speculative short positions in crude oil are justified from the risk to reward point of view stop loss $45.63 at and $30.22 as the initial target price.

In the future contracts that are more distant than the current contract, we think adding the premium (the difference between the July and other contracts) to both: stop-loss and initial target prices is justified.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager