Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

The first session of this week brought both a test of the main short-term support zone and a re-test of the nearest resistances. Despite these activities, none side of the market gained a clear advantage over their rivals. What does it mean for the price of black gold?

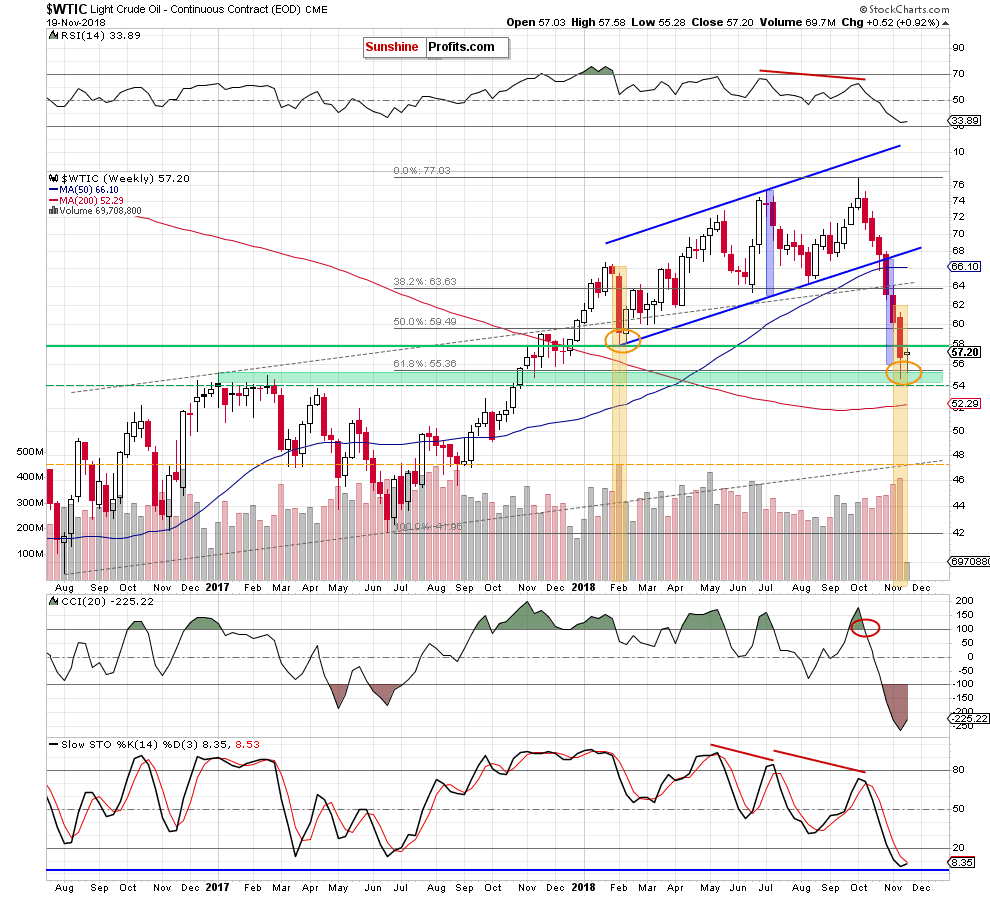

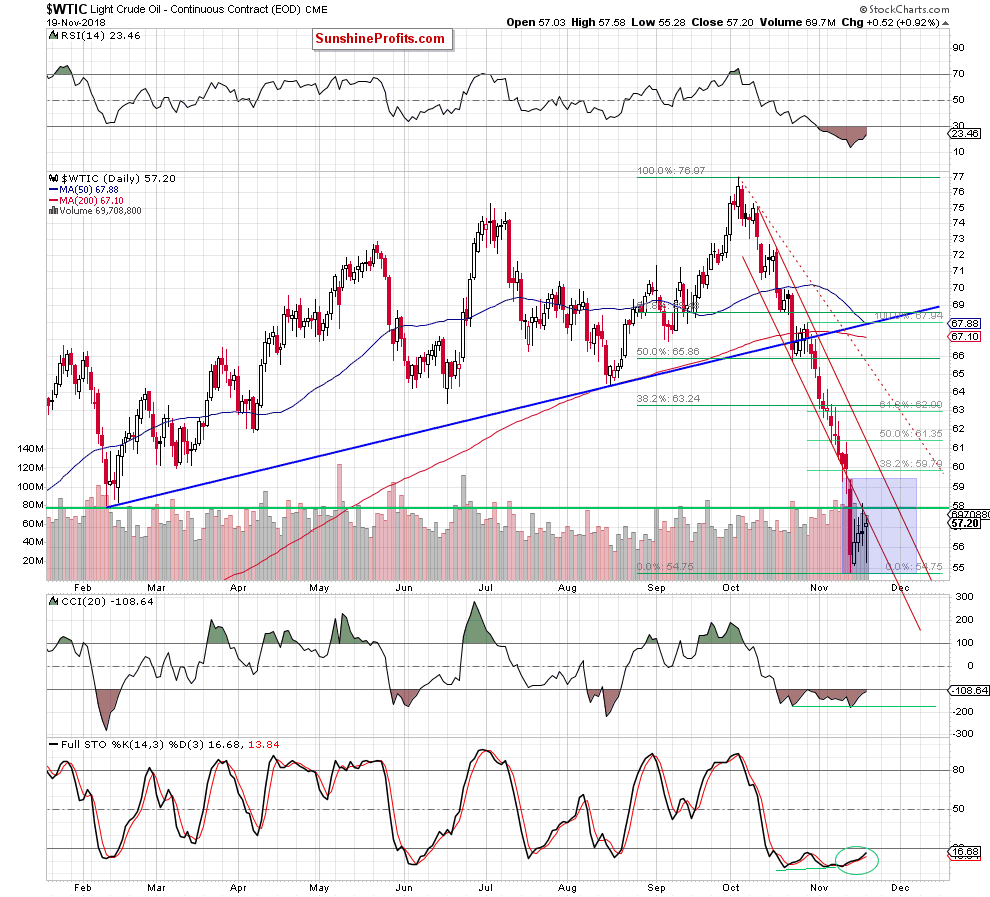

Let’s examine the charts below (charts courtesy of http://stockcharts.com).

Looking at the above charts from today’s point of view, we see that although the bears and the bulls tried to gain further points for themselves, their actions did not bring much effect, because black gold ended the day once again in the narrow range between the green support zone and the 61.8% Fibonacci retracement (which together block the way to the lower levels) and the previously-broken February low and the lower border of the short-term red declining trend channel, which continue to keep gains in check.

Taking these facts into account, we believe that the comments that we made on Friday (we described the very short-term bullish and bearish scenarios depending on the behavior of the buyers and the sellers in the area of the aforementioned resistances) and yesterday (Monday’s alert contains a description of the similarity between the current situation and what we observed earlier this year in February and its potential consequences in a wider than very short-term perspective) remain up-to-date also today.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective, but if we see a confirmation of oil bulls’ strength, we’ll consider opening long positions. On the other hand, if the bears manage to push the price of black gold under this week’s lows, we’ll consider going short. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Administrative Note Regarding This and Next Week’s Publication Schedule

The long Thanksgiving weekend is approaching. There will be no / limited trading in the final part of this week and we will be taking this opportunity to take some time off from our regular analyses. Tomorrow’s Alert will be published normally, and Wednesday’s Alert will likely be very brief. There will be no regular Alerts on Thursday and Friday. The Monday’s (November 26th) and Tuesday’s (November 27th) Alerts will most likely be very short as well.

However, the above does not mean that we will stop monitoring the market entirely. Conversely, the time is quite critical, so despite taking time off from regular tasks, we will be monitoring the market and if anything urgent happens, we will let you know through a quick intraday Alert.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts