Trading position (short-term; our opinion): Profitable short positions with a stop-loss order at $71.34 and the next downside target at $66 are justified from the risk/reward perspective.

Although oil bears moved black gold lower after yesterday’s market open, their opponents decided to fight for higher prices in the following hours. As a result, light crude came back above the previously-broken Fibonacci retracement, but is this event as positive as it may seem?

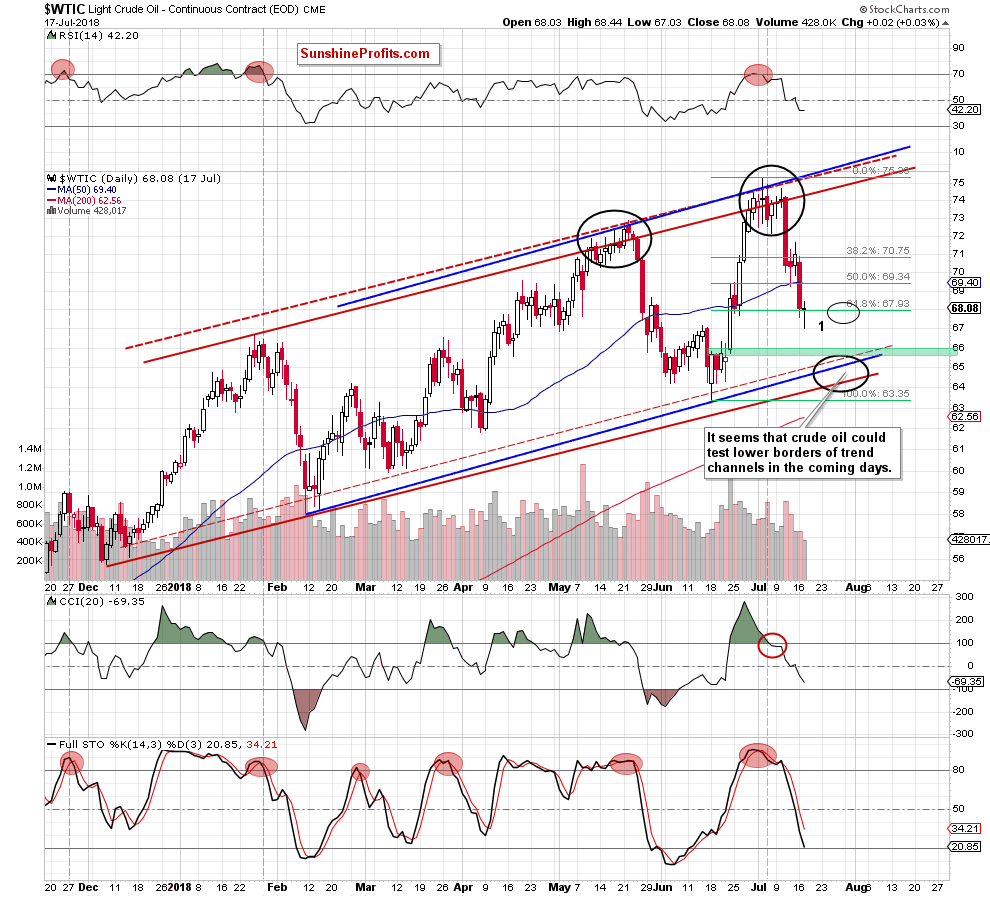

Let’s examine the charts below to find out (charts courtesy of http://stockcharts.com).

Technical Picture of Crude Oil

Looking at the daily chart, we see that black gold extended losses after the market’s open, which resulted in a drop to $67. Despite this decline, oil bulls triggered a rebound, which pushed the price above the previously-broken 61.8% Fibonacci retracement.

Additionally, the commodity closed the day above this level, invalidating the earlier breakout. At the first sight, it is a quite bullish development.

Nevertheless, when we consider all pro-bearish signs about which we wrote in our previous Oil Trading Alerts and combine them with the sell signals generated by the indicators and the volume, which accompanied yesterday’s upswing, we think that lower prices of black gold are still ahead of us.

At this point, please note that yesterday’s volume was the lowest in almost two months (lower volume we saw in mid-May), which doesn’t confirm the buyers’ strength. What’s interesting, a similar drop in volume in mid-June preceded a final decline in the previous month, which suggests that we can observe something similar in the near future.

All the above-mentioned assumptions were reflected earlier today when oil bears attacked once again, taking crude oil below $68 (at the moment of writing these words the commodity loses about 0.60% compared to yesterday's closing price). Therefore, in our opinion, it’s time to lower the stop-loss level (to protect our capital) and the downside target.

So, how low could black gold go in the coming days?

We think that the next downside target will be around $65.75-$66, where the nearest support area (marked wit green) is. Nevertheless, if crude oil drops below it, we’ll likely see a test of lower borders of the rising trend channels in the following days (we marked this area with the black ellipse on the daily chart).

Summing up, profitable short positions continue to be justified from the risk/reward perspective as all negative factors about which we wrote in our previous alerts remain in the cards, supporting oil bears and lower prices of crude oil in the coming week.

Trading position (short-term; our opinion): Profitable short positions with a stop-loss order at $71.34 (in other words, whatever happens, our capital will not suffer) and the next downside target at $66 are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts