Trading position (short-term; our opinion): Small (half of the regular size) short positions (with a stop-loss order at $61.13 and the initial downside target at $52) are justified from the risk/reward perspective.

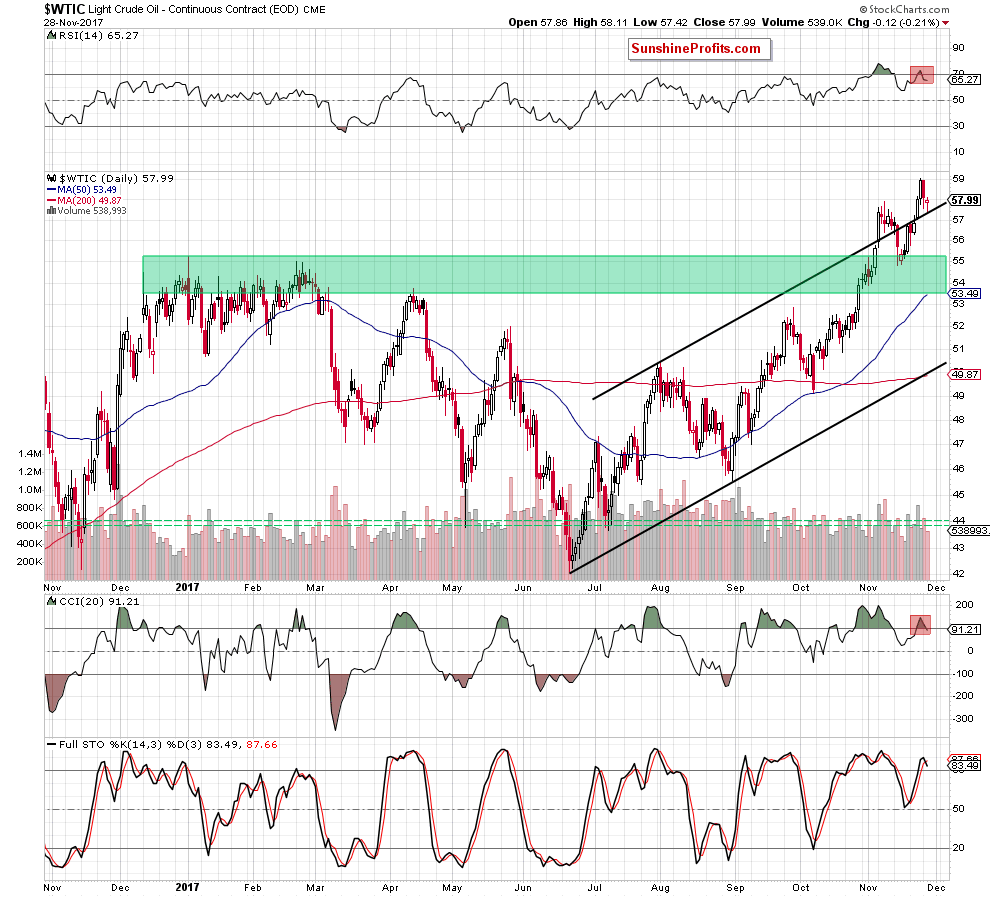

The crude oil didn’t do much during yesterday’s session and it’s not doing much in today’s pre-market trading and this means two things. One thing is that the price of black gold remains above the rising, short-term trend channel, and the other thing is that at the same time it remains below the upper border of a medium-term trend channel. What are the implications? In which way is crude oil likely to move next?

Well, the clear implication is that the situation is quite tense – crude oil will either break above the medium-term resistance, which (if the breakout is confirmed) could have very bullish implications, or it will invalidate the short-term breakout, which will serve as a powerful sell signal. As long as oil price remains between these two levels, it will continue to be like a coiled spring.

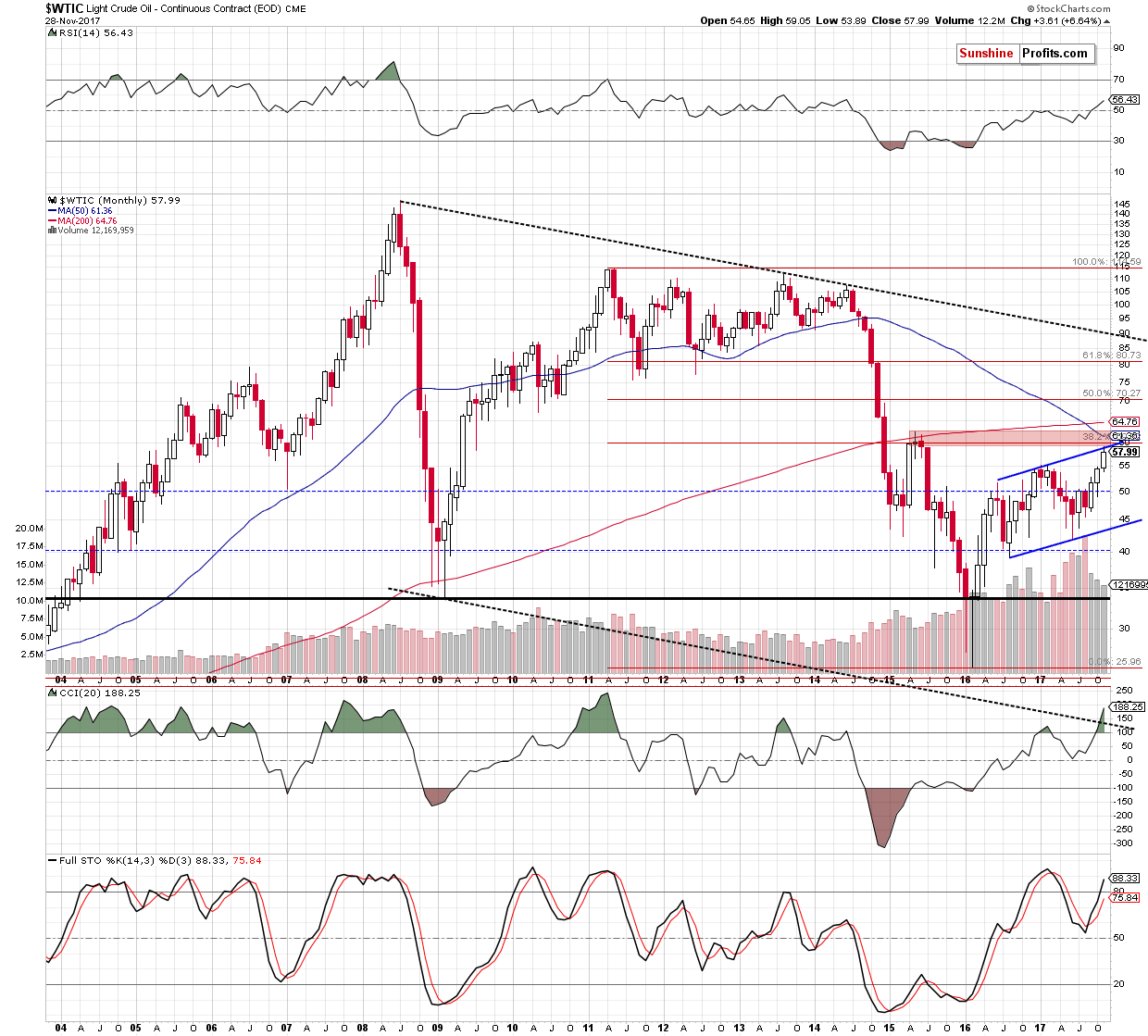

Which end of the spring will hold? The indicators and the general observation of capital markets seem to favor the bearish picture. As far as the latter is concerned, please note that long-term developments – in general – are more important than medium-term ones, which in turn are more important than the short-term ones. Since the medium-term resistance suggests a move lower, that’s the more likely outcome.

What about the indicators? Let’s take a look at the charts (charts courtesy of http://stockcharts.com).

The short-term chart provides the key details. All indicators that we plotted on the above chart have just flashed sell signals: Stochastic, CCI, and even RSI (by moving again below 70).

Summing up, while the crude oil didn’t move much yesterday and it’s not moving much so far today, it’s still likely to decline in the coming days and – likely – weeks. It’s not extremely likely, so we don’t think that a full short position is justified, but it seems that the risk to reward situation is favorable enough to justify a small short position at this time.

Very short-term outlook: mixed with bearish bias

Short-term outlook: bearish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): Small (half of the regular size) short positions (with a stop-loss order at $61.13 and the initial downside target at $52) are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

As a reminder – “initial target price” means exactly that – an “initial” one, it’s not a price level at which we suggest closing positions. If this becomes the case (like it did in the previous trade) we will refer to these levels as levels of exit orders (exactly as we’ve done previously). Stop-loss levels, however, are naturally not “initial”, but something that, in our opinion, might be entered as an order.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts