Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading position (short-term, our opinion; levels for crude oil’s continuous futures contract): No positions are currently justified from the risk/reward point of view.

It’s been a great bullish week for the barrel, as crude oil prices hit all our projected targets! Let’s get some overview of what happened this week:

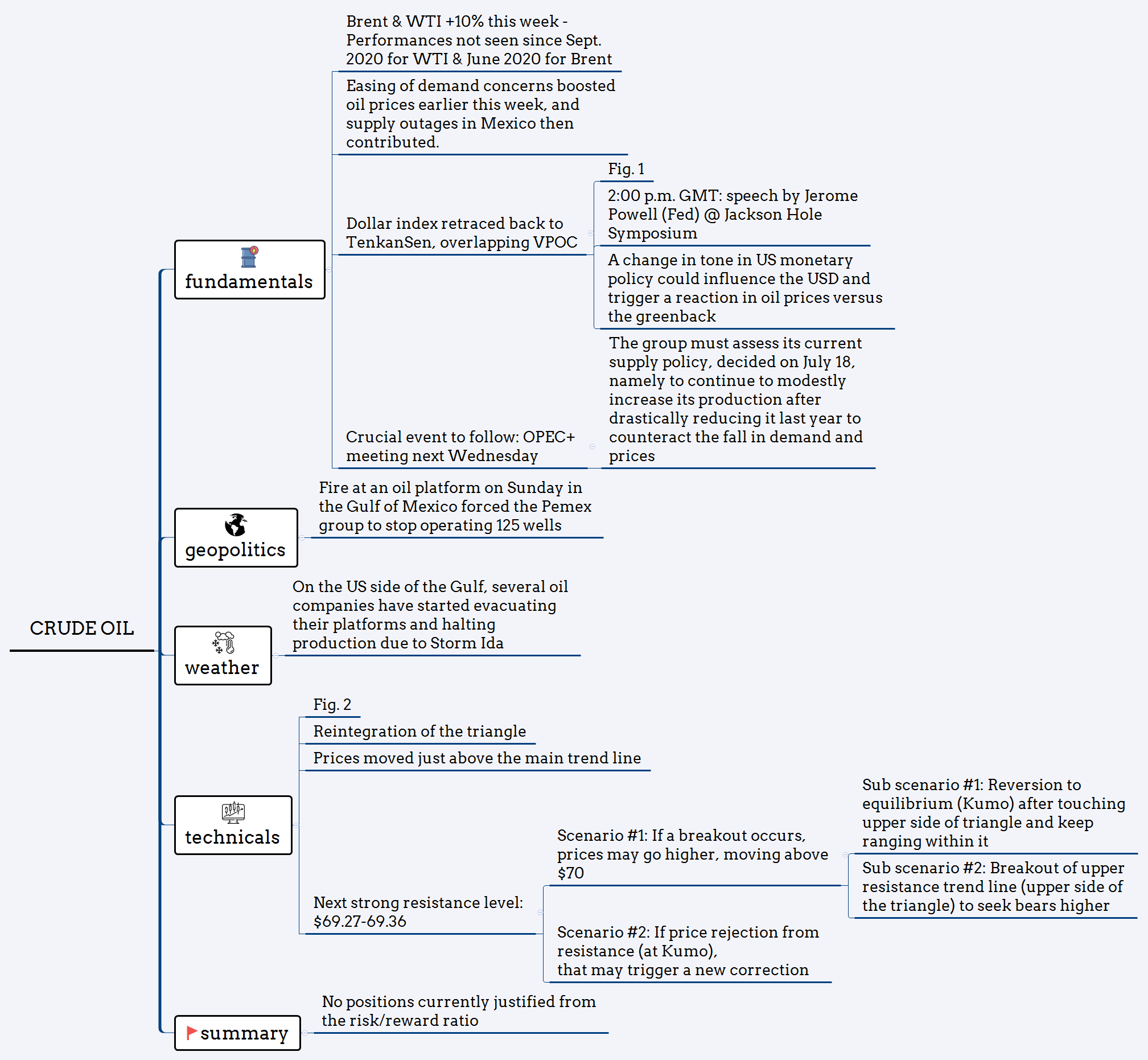

Overview Map

Friendly reminder: you can click on the chart to enlarge it!

Assisting Figures

Figure 1 – Dollar Index (DXY) Futures (Continuous contract, daily)

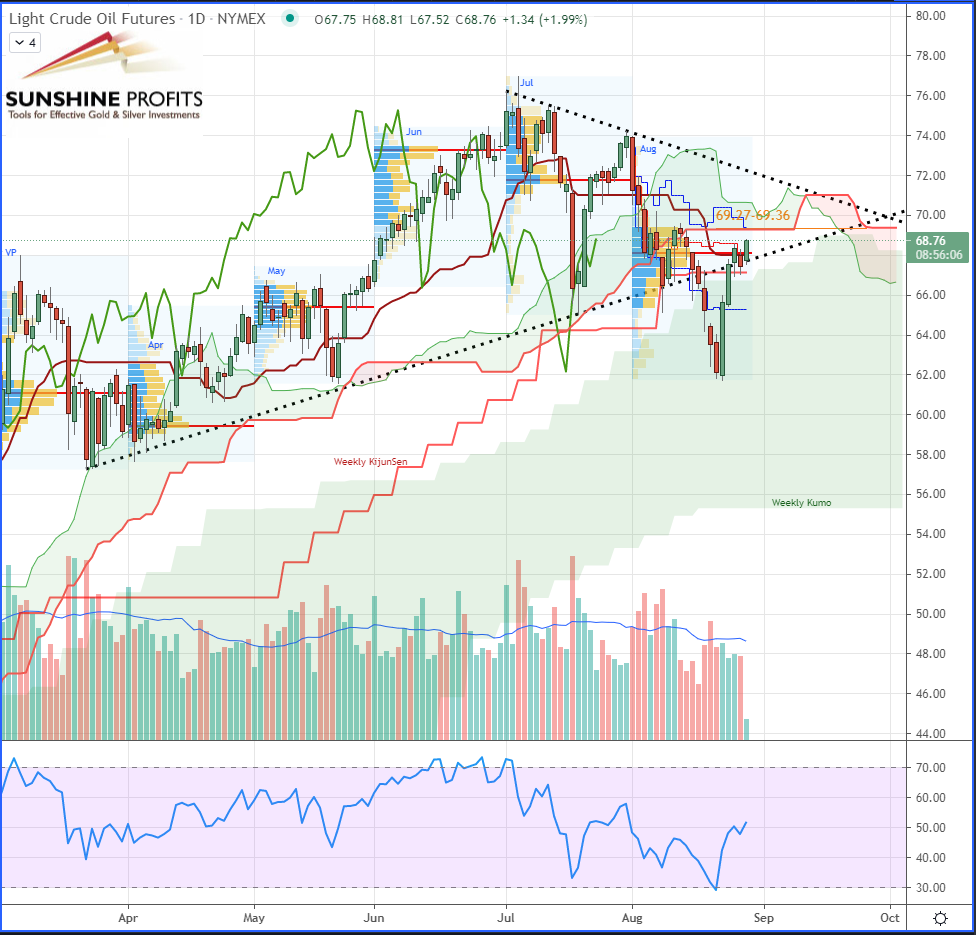

Figure 2 – WTI (CL) Crude Oil Futures (Continuous contract, daily)

In summary, we just drew your attention to some events and scenarios that may be worth keeping an eye on next week.

As always, we’ll keep you, our subscribers well-informed.

Please note that due to market volatility, some of the key levels may have already been reached and scenarios played out.

Trading position (short-term, our opinion; levels for crude oil’s continuous futures contract): No positions are currently justified from the risk/reward point of view.

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist