Trading position (short-term; our opinion): Short positions with a stop-loss order at $70.11 and the initial downside target at $62.85 are justified from the risk/reward perspective.

Despite several attempts oil bulls didn’t manage to push the price of crude oil above the upper border of the rising trend channel in recent days. This show of weakness encouraged their opponents to comeback and act, which resulted in a bearish development that could have serious consequences for the short-term picture.

Technical Analysis of Crude Oil

Let's examine the charts below (charts courtesy of http://stockcharts.com).

In our last alert, we wrote the following:

(…) a fresh 2018 peak created on Friday. Is this a positive sign? Yes. Is it bullish? In our opinion, not as bullish as it may seem at the first glance.

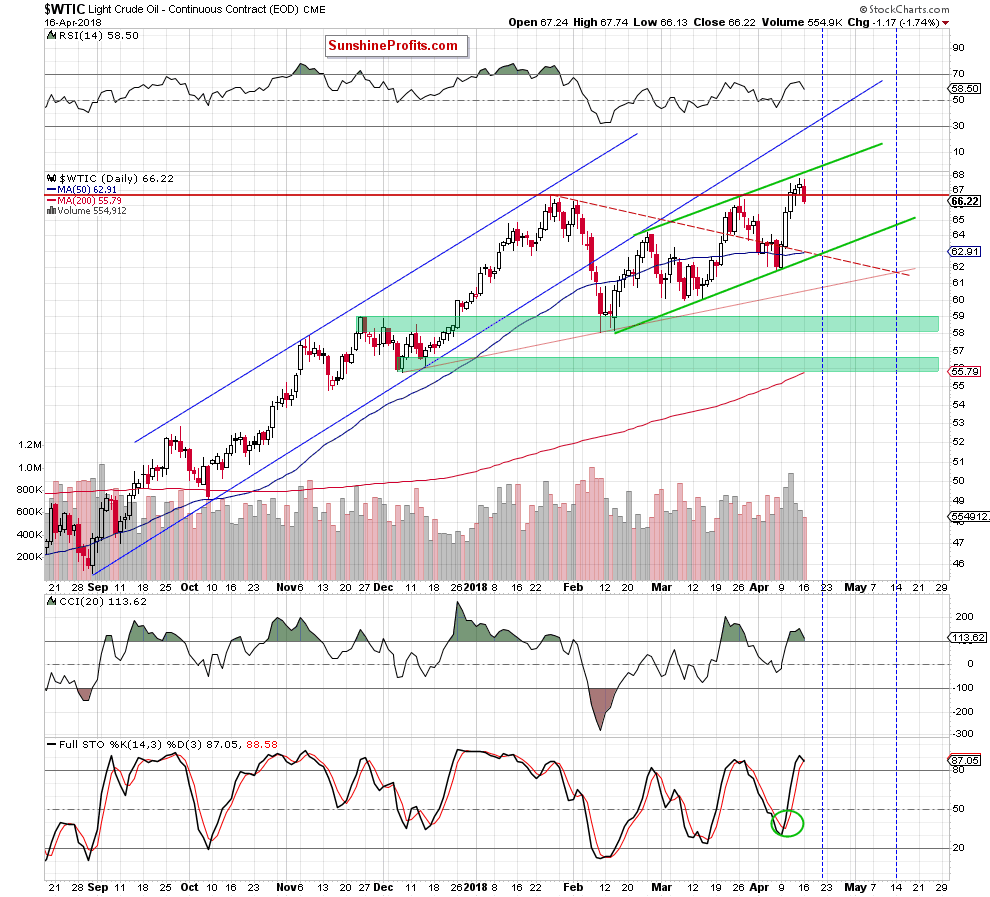

Why? Although black gold hit a new peak (only 21 cents higher than Wednesday’s intraday high), it is still trading under the upper border of the green rising trend channel.

Additionally, the shape of Friday’s candlestick doesn’t look encouraging (but only from the buyers’ point of view). (…) If this candlestick is drawn on the market, it means that the forces of the bulls and the bears have leveled out, and the market has lost strength for further increases (as in our case) or decreases.

However, the spool formation itself is not a strong prognostic formation. It should usually be confirmed by more candles. If the spool appears in the uptrend, the next black candle should appear to confirm the formation. Will we see it in the coming days?

(…) Looking at the volume, such scenario seems very likely, because although light crude hit new high, Friday’s upswing materialized on the smallest volume in whole week, which doesn’t confirm oil bulls’ strength.

On top of that, the CCI and the Stochastic Oscillator climbed to their overbought areas, which suggests that we can see sell signals in the very near future. Additionally, there is also a bearish divergence between the price of black gold and the CCI, which increases the probability of reversal in the very near future.

Therefore, we still think that as long as the commodity remains inside the green channel oil bulls may have problems with further rally.

From today’s point of view, we see that the situation developed in tune with our assumptions as crude oil reversed and dropped yesterday. Looking at the daily chart, we see that although oil bulls pushed the commodity higher after the market’s open, they didn’t even manage to hit a fresh high not to mention a test of the upper border of the green rising trend channel.

This show of weakness, encouraged their opponents to act, which resulted in a decline. As you see on the above chart, yesterday’s downswing took black gold under the previously-broken January peak, which means that the commodity invalidated the earlier breakout.

This is a bearish development, which together with the current position of the daily indicators (the Stochastic Oscillator generated a sell signal, while the CCI is very close to doing the same), suggests that further deterioration is just around the corner.

How low could crude oil go from current levels?

In our opinion, if light crude extends losses, we’ll see a comeback to the previously-broken red declining dashed line based on January and February highs and the lower border of the green rising trend channel.

Taking all the above into account, we think that opening short positions with a stop-loss order at $70.11 and the initial downside target at $62.85 is justified from the risk/reward perspective at the moment of writing these words.

As always, we’ll keep you - our subscribers - informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts