Trading position (short-term; our opinion): Short positions (with the stop-loss order at $68.15 and the initial downside target at $56.57) are justified from the risk/reward perspective.

Yesterday, black gold wavered around the Fibonacci retracement and one of the moving averages, but finally closed the day above them. Does it mean that oil bears have no more strength for further battle?

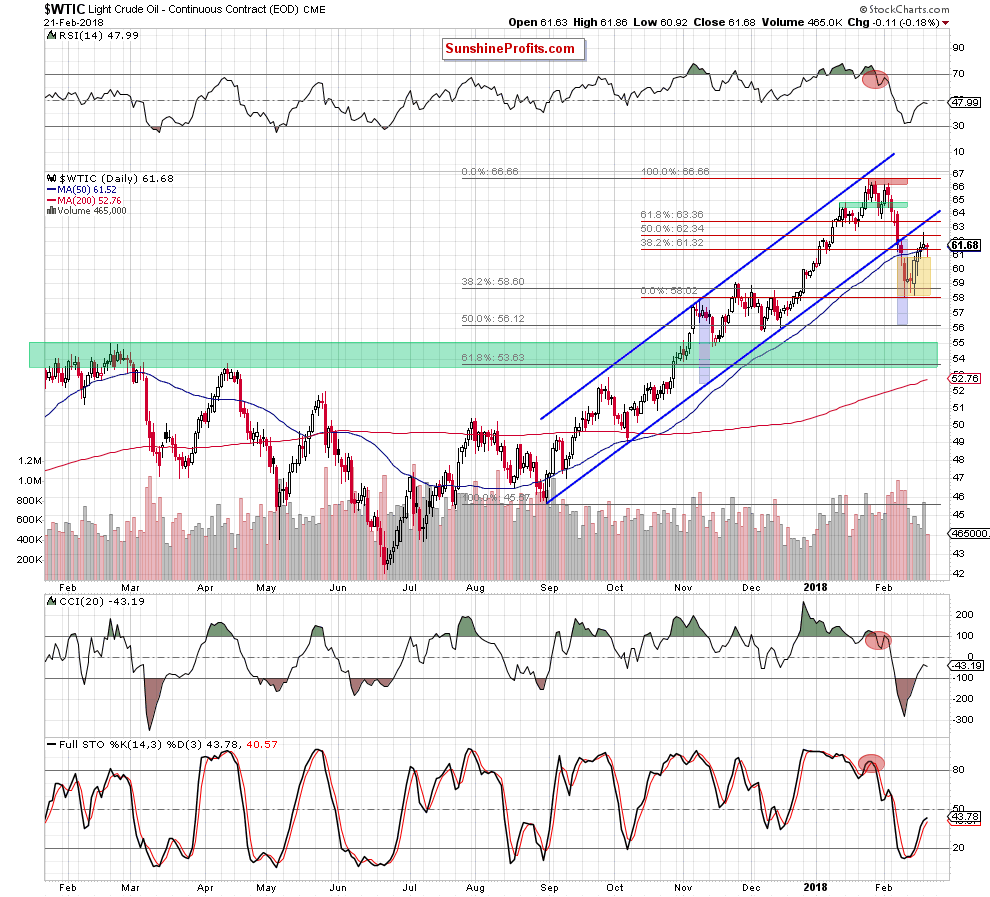

Let's take a look at the chart below (charts courtesy of http://stockcharts.com).

Looking at the daily chart, we see that the overall situation hasn’t changed much as crude oil is trading in a quite narrow range around the 38.2% Fibonacci retracement and the 50-day moving average.

As we mentioned earlier, oil bears triggered a decline after an unsuccessful attempt to move higher, which took black gold to the previously-broken upper border of the yellow consollidation. This support encouraged buyers to act, but the volume, which accompanied yesterday’s rebound from an intraday low raises some doubts about the buyers’ strength.

We clearly see it was significantly lower than the day before, which together with today's rather disappointing reaction of crude oil futures to yesterday's API report, suggests that another attempt to move lower may be just around the corner.

This scenario is also reinforced by the shape of the recent ccandlesticks about which we wrote in our yesterday’s alert:

(…) the commodity created another white candle with a smaller body, which somewhat undermines the credibility of the indicators and the buy signals generated by them in previous days. On one hand, they suggest further improvement, but on the other hand smaller bodies shows that oil bulls’ strength decreases from session to session.

(…) Additionally, yesterday’s candlestick looks like a shooting star (a negative formation), which gives oil bears one more reason to act in the coming days. Nevertheless, we think that another move to the downside will be more likely after the release of crude oil and its products inventories reports.

Finishing today’s alert please note that after yesterday market’s closure the American Petroleum Institute reported that U.S. crude inventories fell by 907,000 barrels in the week ending February 16, compared to expectations for a 1.3 million increase. Despite this bullish news, the price of crude oil futures hasn’t surged earlier today, which increases the probability that oil bears will return to fight for lower values of black gold – especially if today’s government report shows another increase in the U.S. production.

Summing up, taking all the above-mentioned factors into account, we believe that short positions continue to be justified from the risk/reward perspective. As always, we’ll keep you - our subscribers - informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts