Trading position (short-term; our opinion): Short positions (with the stop-loss order at $68.15 and the initial downside target at $56.57) are justified from the risk/reward perspective.

Friday's session was not good for oil bears. The lack of another attack on the main bulls’ support zone encouraged them to act, which translated into a breakout above the upper line of the triangle. Does this positive event undermine the sellers’ opportunity to open the way to the south?

Let's take a closer look at the charts below to find out (charts courtesy of http://stockcharts.com).

Technical Analysis of Crude Oil

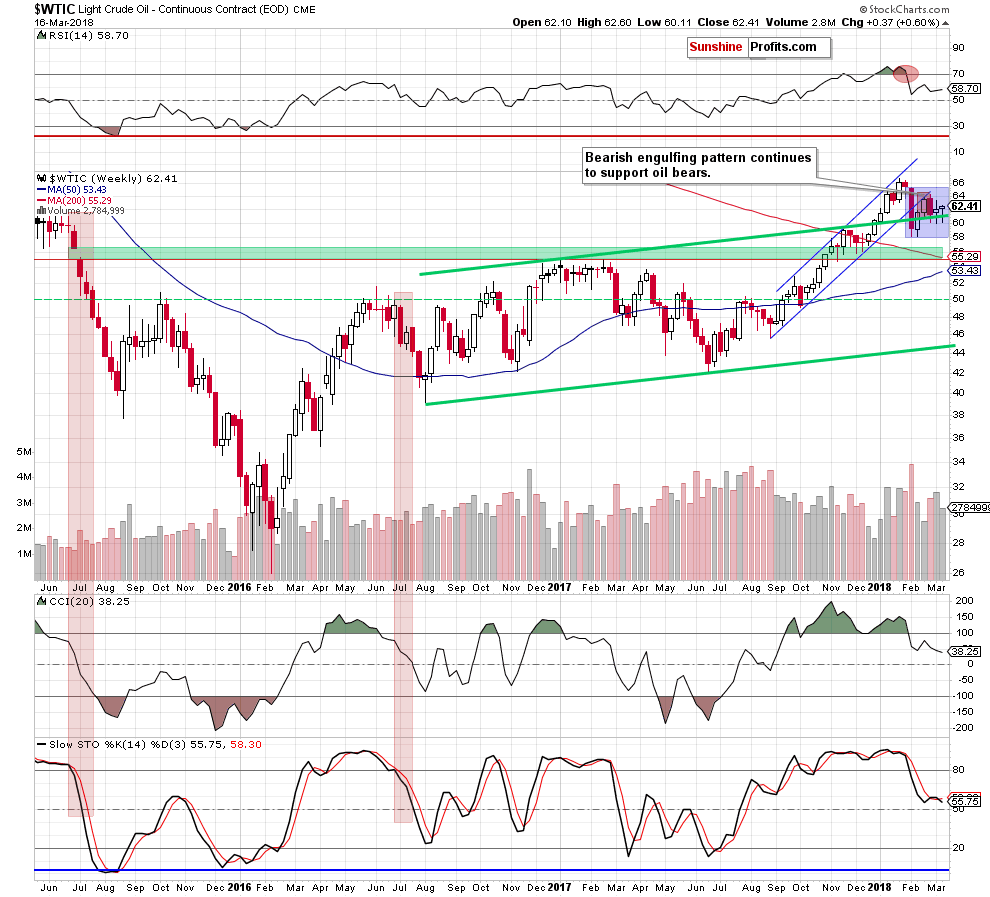

From today’s point of view, we see that although crude oil bounced off the previously-broken upper border of the green rising trend channel once again, weekly volume, which accompanied the last week’s price action was visibly smaller than a week earlier.

Very similar situation we saw in the second half of February. Back then, two weeks of increases ended in a decline, which created the bearish engulfing pattern on the medium-term chart. Additionally, despite the last week’s upswing, the sell signals generated by all indicators remain in the cards, supporting oil bears.

How did this move affect the very short-term picture of the commodity? Let’s check.

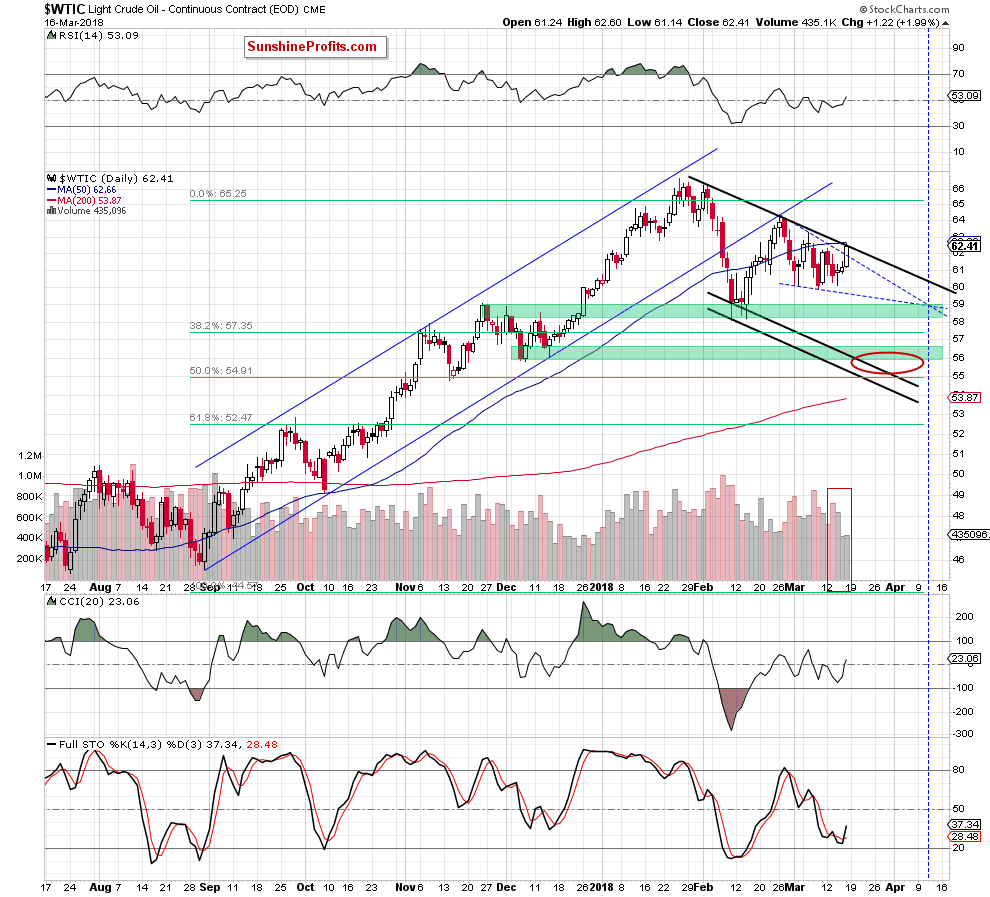

Looking at the daily chart, we see that Friday’s increase took black gold above the upper border of the blue declining trend channel, signaling further improvement.

Nevertheless, despite this increase, the price of light crude is still trading under the previously-broken 50-day moving average and the black declining resistance line based on the previous highs, which continues to keep gains in check since the beginning of the month.

Additionally, when we focus on volume, we clearly see that Friday’s move materialized on tiny volume (compared to what we saw during declines), which raises some doubts about oil bulls’ strength – similarly to what we saw at the end of the previous month and the beginning of March. In both previous cases, moves to the upside not confirmed by the size of volume, translated into reversals and downswings.

On top of that, the Friday’s Baker Hughes report showed the seventh U.S. rig count rise in eight weeks (as a reminder, U.S. drillers added 4 oil rigs, bringing the total count to 800) and the U.S. Commodity Futures Trading Commission said that hedge funds and other money managers cut their bullish bets on U.S. crude oil futures and options in the previous week, which was the second consecutive week in which speculators cut their net long positions in the market.

Taking all the above into account, we think that another reversal and one more test of the major supports (the barrier of $60 and the upper border of the green rising trend channel seen on the weekly chart) is more likely than not in the following days.

Summing up, short positions continue to be justified from the risk/reward perspective as crude oil is still trading under the short-term resistances, which continue to keep gains in check.

Trading position (short-term; our opinion): Short positions (with the stop-loss order at $68.15 and the initial downside target at $56.57) are justified from the risk/reward perspective. As always, we’ll keep you - our subscribers - informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts