Trading position (short-term; our opinion): Short position with a stop-loss order at $68.54 and the initial downside target at $58.71 is justified from the risk/reward perspective.

After the downswings since late April, oil looks to be taking a breather for most of May so far. How will its current rest on the support turn out? Time to examine the minute details and how they fit in the bigger perspective. What kind of effect does it have on our open position?

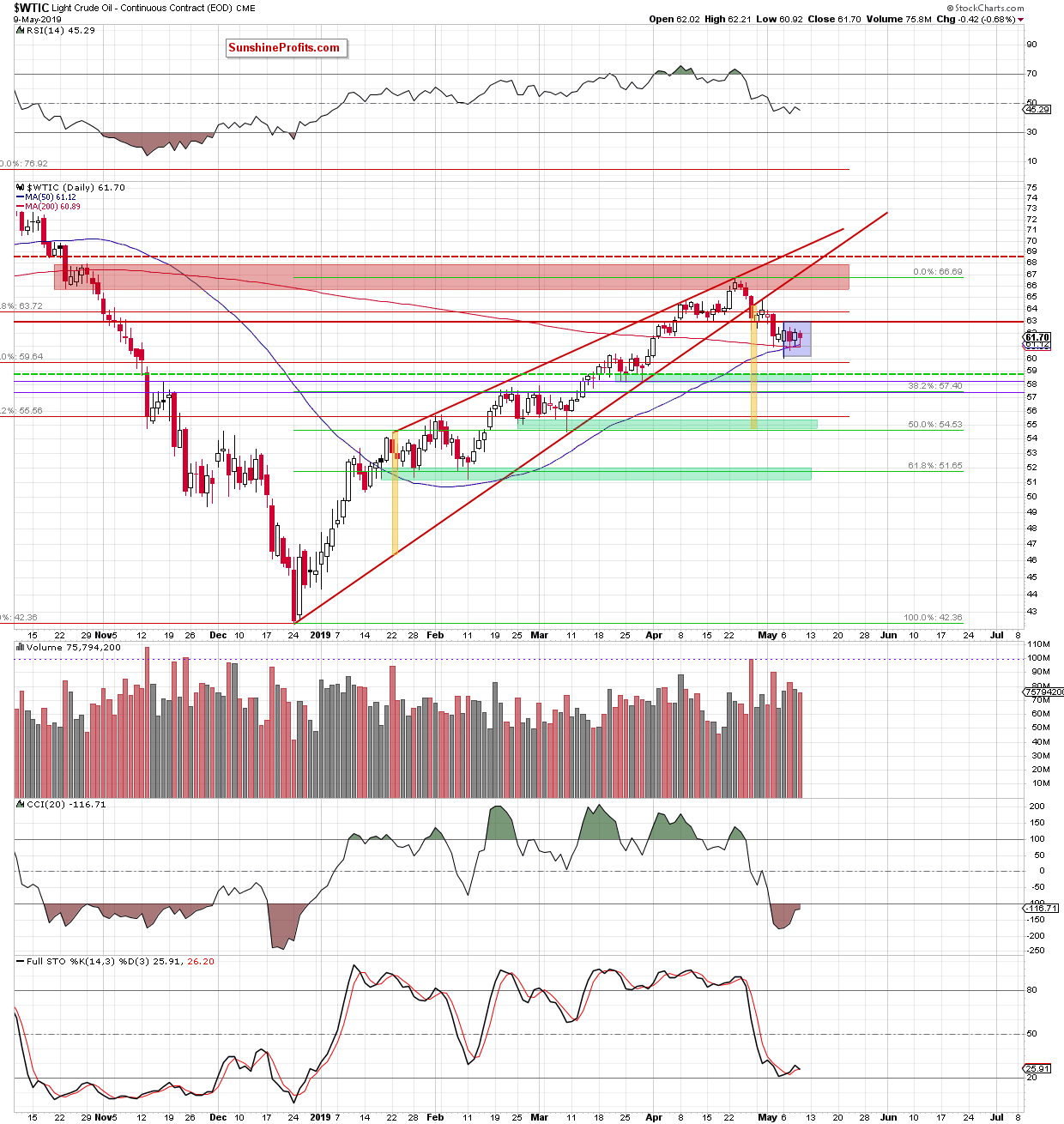

Let's take a closer look at the chart below (chart courtesy of http://stockcharts.com).

Looking at the daily chart, we see that the situation remains basically unchanged. Black gold remains stuck inside the blue consolidation between the previously-broken mid-April lows and the 200- and 50-day moving averages. Neither today's trading has brought much new as oil price hasn't left the consolidation yet though the scales are ever so slightly tipping in the bears' favor.

If oil declines from here, we'll likely see a drop to the first green support zone. Even the 38.2% Fibonacci retracement isn't out of question. Remember that periods of low volatility (as is the case currently) are followed by those of higher volatility.

Summing up, the outlook for oil remains bearish. Despite the price trading still inside the consolidation, recent daily reversals have been erased and the bears look to be holding the upper hand. Oil has recently verified the breakdown below the red horizontal resistance line that's based on mid-April lows and keeps trading below it. The current breather doesn't change the fact that the short position continues to be justified.

Trading position (short-term; our opinion): Short position with a stop-loss order at $68.54 and the initial downside target at $58.71 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist