Trading position (short-term; our opinion): Short position with a stop-loss order at $68.54 and the initial downside target at $58.71 is justified from the risk/reward perspective.

Last week, crude oil finished higher. And over the weekend, OPEC pointed to extending the output cuts. Yet, oil bulls haven't broken above the key resistances ahead. Their efforts look to be sputtering. A look at the volume reveals where the odds of the next oil move are. Will it be the bears or the bulls that would celebrate?

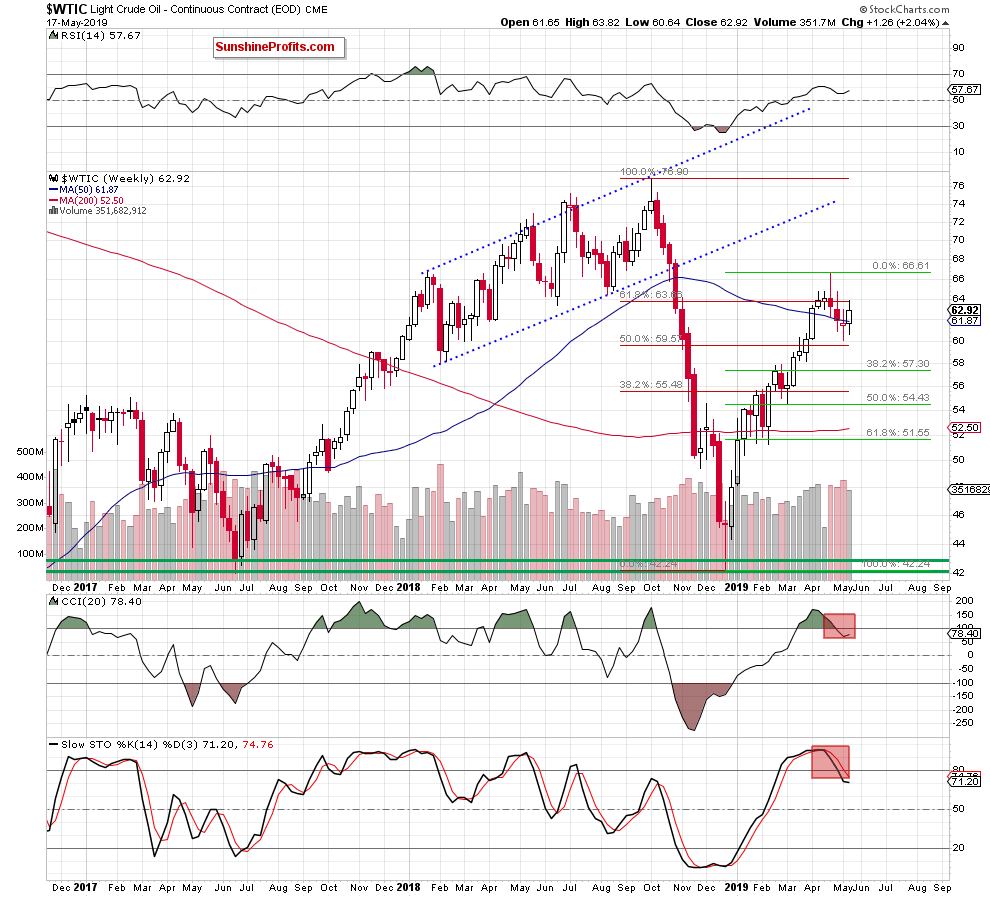

Let's take a closer look at the weekly chart below (charts courtesy of http://stockcharts.com).

Crude oil rose and closed last week above the previously-broken 50-week moving average. This means it had invalidated its earlier breakdown below it.

While it's a positive development for the bulls, the weekly indicators' sell signals remain on the cards. The volume comparison also reveals that the volume of this upswing was slightly lower than during previous upswings. This is as bearish a sign as the significant upper knot of last week's candle is. Together, they raise subtle doubts about the bulls' strength.

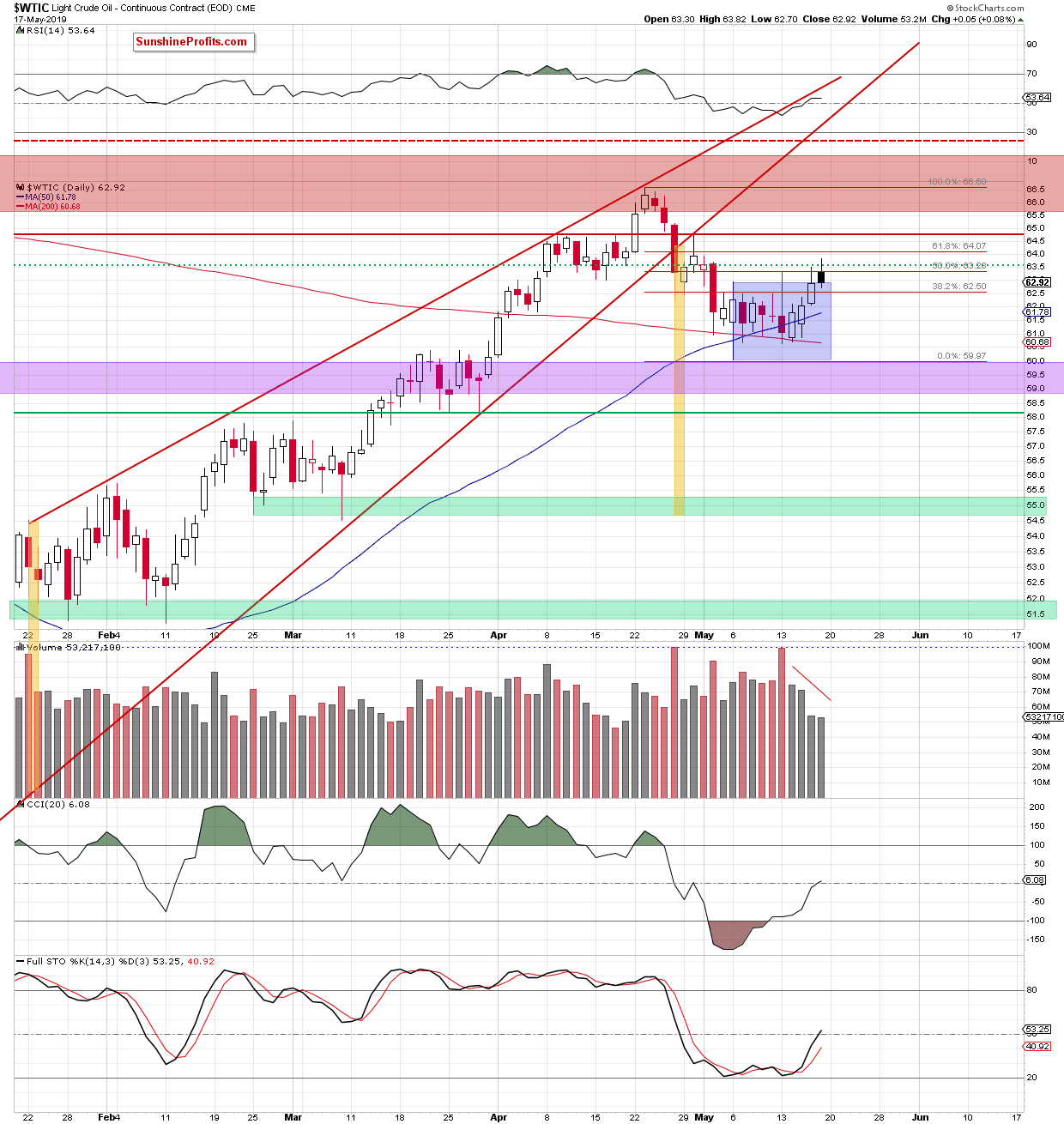

The daily chart shows Friday's unsuccessful attempt to come back above the previously-broken mid-April lows. We also see the earlier today's attempt at the very same objective. So far, black gold looks to have reversed lower as it trades around $63.00. Neither has any of both attempts managed to break above the 50% Fibonacci retracement based on the April-May downward move.

The volume tells a convincing story here. On each successive daily upswing, it just decreased. It reveals serious doubts about the bulls' short-term strength.

All the above factors suggests that we could see another reversal from here and decline this week. If this is the case and the price of the commodity moves lower from current levels, we'll see at least a test of the lower border of the blue consolidation.

Summing up, the outlook for oil remains bearish. Oil is still trading inside the blue consolidation and below the previously-broken red horizontal line. Attempts to break above either of these look to have failed. The decreasing daily volume coupled with Friday's significant upper knot points to decreasing strength of the bulls. Besides, the weekly indicators still supports the downside move. The short position continues to be justified.

Trading position (short-term; our opinion): Short position with a stop-loss order at $68.54 and the initial downside target at $58.71 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist