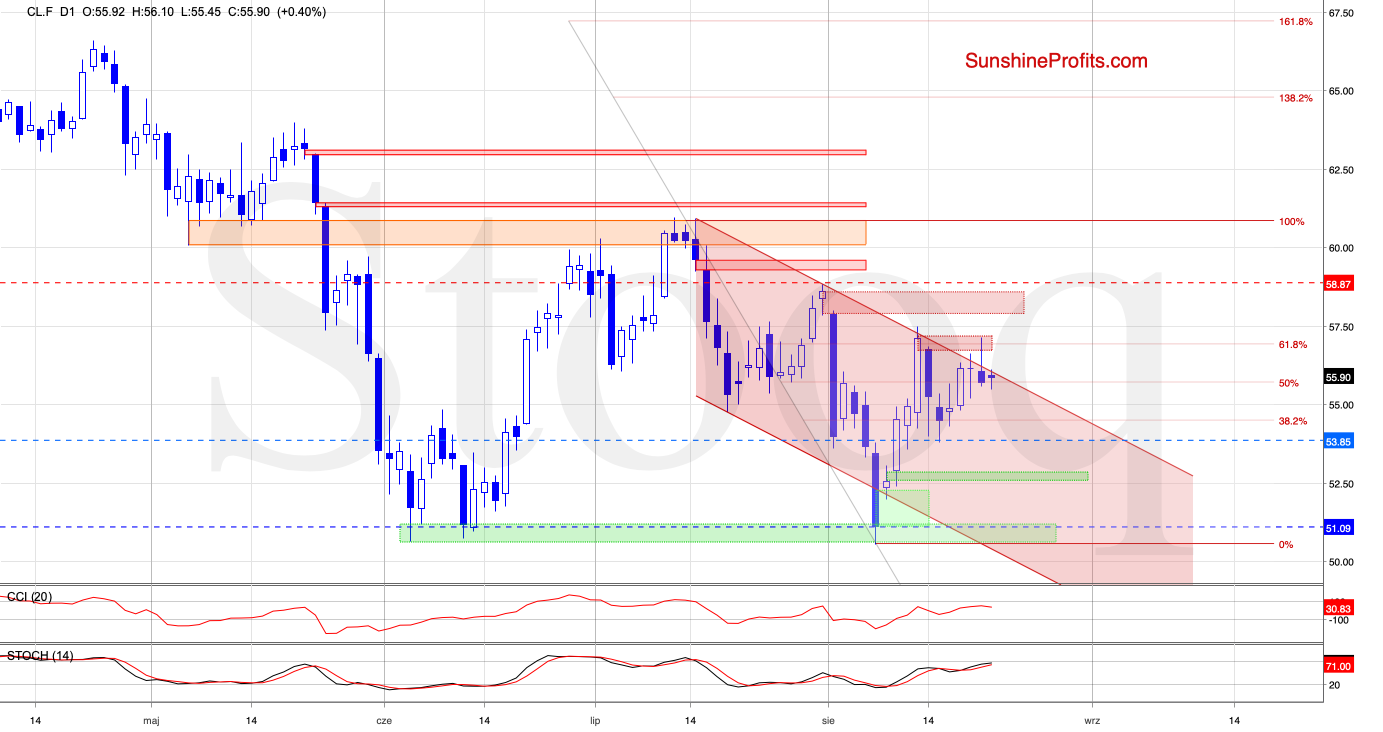

Trading position (short-term; our opinion): Already profitable short position with a stop-loss order at $58.87 and the initial downside target at $53.85 is justified from the risk/reward perspective.

The bulls' upswing attempt didn't quite stick yesterday, and prices headed lower. This didn't surprise us, to the contrary. The bulls have opened higher today though - will they be able to build on their gains? They've repelled decline's continuation earlier today already...

Let's take a closer look at the charts below (charts courtesy of http://stockcharts.com and www.stooq.com ).

Yesterday brought us a repeat of the price action a day earlier - crude oil moved higher initially. It broke above the 50-day moving average, the 200-day moving average and the declining red resistance line based on the previous peaks.

This upswing took the commodity to the nearest resistance area created by the red gap and the 61.8% Fibonacci retracement. The bulls however ran out of breath, and the commodity pulled back.

Light crude closed the day below all three resistances, invalidating all earlier intraday breakouts in the process. This suggests further deterioration possibly just around the corner - especially so when we factor in the increasing volume that points to increasing participation of the bears.

How did yesterday's action reflect upon oil futures trading earlier today?

The bulls tried to push crude oil futures higher, but the upper border of the declining red trend channel stopped them. Prices pulled back to trade at around $55.85 as we speak, which increases the probability of another downswing in the very near future.

Let's continue refining the outlook with at the 4-hour chart below.

We wrote these words yesterday:

(...) Additionally, the CCI and the Stochastic Oscillator generated their sell signals, which increases the probability of a move to the downside and at least a test of the lower border of the formation in the very near future (maybe even later today after today's crude oil inventory report).

And indeed, the futures slipped below the lower border of the green trend channel earlier today. While the bulls pushed prices higher in the following hours, they only reached the previously-broken support, which looks like a verification of the earlier breakdown.

If the breakdown was indeed merely verified, we'll likely see another attempt to move lower soon, probably coupled with a test of our initial downside target in the very near future.

Summing up, oil bulls have given up all of their gains and then some yesterday. Their intraday breakout attempts above several important resistances have been invalidated. The continued combined technical factors of multiple resistances, the Stochastic Oscillator's sell signal and the 4-hour chart daily indicators' sell signals indicate that a continuation of yesterday's oil downswing is very likely, and our profitable short position remains justified.

Trading position (short-term; our opinion): Already profitable short position with a stop-loss order at $58.87 and the initial downside target at $53.85 is justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist