Trading position (short-term; our opinion): No positions in crude are justified from the risk to reward point of view.

In yesterday's Oil Trading Alert, we wrote that the next two days might include a reversal in black gold, and that if we saw a confirmation that it is indeed the case, we would consider opening a trading position.

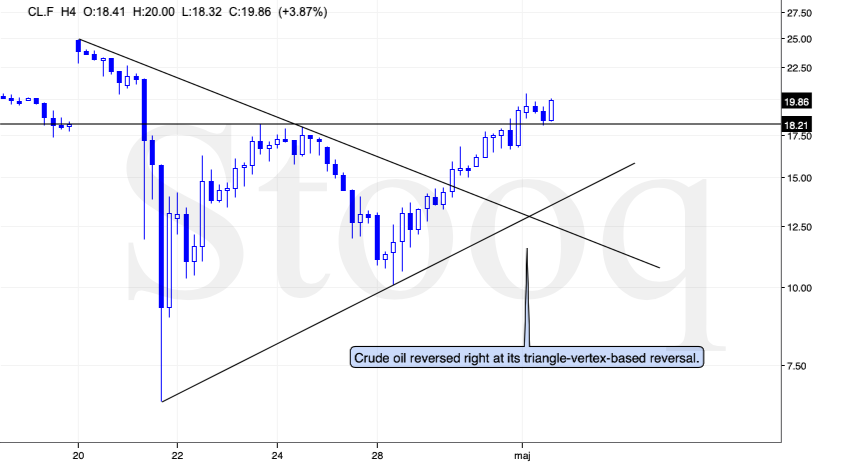

And we did see a reversal, just as the 4-hour chart and the triangle-vertex-based reversal had indicated.

The problem, however, is that this reversal took place right after crude oil futures broke above their recent highs and all the reversal triggered, was a pullback to the previously broken resistance (previous highs), which was just verified as resistance.

This means that while the reversal technique proved to be useful once again, it didn't increase the clarity regarding next moves in the black gold.

Did the breakout's verification confirm the bullish outlook? Or did the recent reversal actually imply something more than just a pullback? The jury's still out.

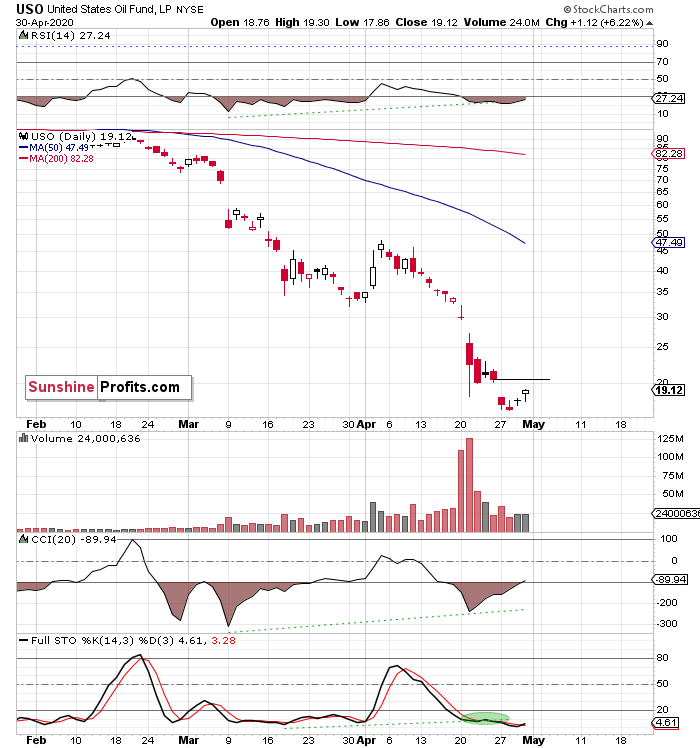

The USO ETF failed to close the day above the upper border of the price gap, so the outlook for it remains bearish. This doesn't add clarity to the situation, as the breakout in crude oil futures points to higher prices.

Summing up, it seems that "when in doubt, stay out" is still the best course of action with regard to the crude oil market. There will be a favorable risk to reward situation in the future (likely shortly), but we don't have it in place right now.

Trading position (short-term; our opinion): No positions in crude are justified from the risk to reward point of view.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager