Trading position (short-term; our opinion): No positions in crude are justified from the risk to reward point of view.

In yesterday's Oil Trading Alert, we wrote that the next two days might include a reversal in black gold, and that if we saw a confirmation that it is indeed the case, we would consider opening a trading position.

In short, the above remains up-to-date - it seems that crude oil is about to reverse today or tomorrow, and we're on the lookout for a confirmation. So far, we haven't seen one.

Based on the daily chart, the reversal is either today or tomorrow.

Based on the 4-hour chart, however, we see that the reversal is more likely to take place later today.

Still, since the above is practically the only indication of the looming reversal, it seems too early to open a trading position. Given the fact that the preceding move was up and that crude oil just reached its recent highs, the odds are that our next trading position will be a short one.

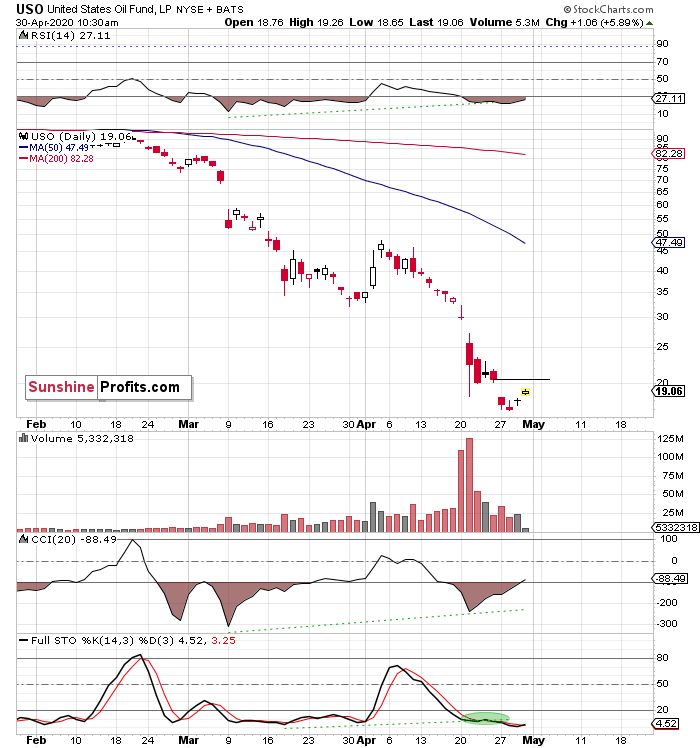

Meanwhile, the USO ETF remains trading below the upper border of the price gap, which means that the gap remains open and continues to serve as resistance

(charts courtesy of www.stockcharts.com ).

This means that we haven't seen enough bullish signs to say that the situation really improved and that the bottom is already in.

In other words, another move to the downside is still possible and a fresh low (maybe even around $4-5.6), is a strong possibility.

Summing up, the bottom in the USO ETF might not be in just yet, and the situation in crude oil futures remains too chaotic to open a trading position with any degree of confidence in a profitable outcome. The situation might clarify as early as today due to the triangle-vertex-based reversal. As always, we'll keep you - our subscribers - informed.

Trading position (short-term; our opinion): No positions in crude are justified from the risk to reward point of view.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager