Trading position (short-term; our opinion; levels for crude oil’s continuous futures contract): Full (100% of the regular position size) speculative short positions in crude oil are justified from the risk to reward point of view stop loss $45.63 at and $30.22 as the initial target price.

Based on our previous expectations and in tune with our current trading position and our predictions, the decline in yesterday's pre-market crude oil trading was more than evident. But still, this doesn’t mean that there weren’t any changes in crude oil’s chart whatsoever.

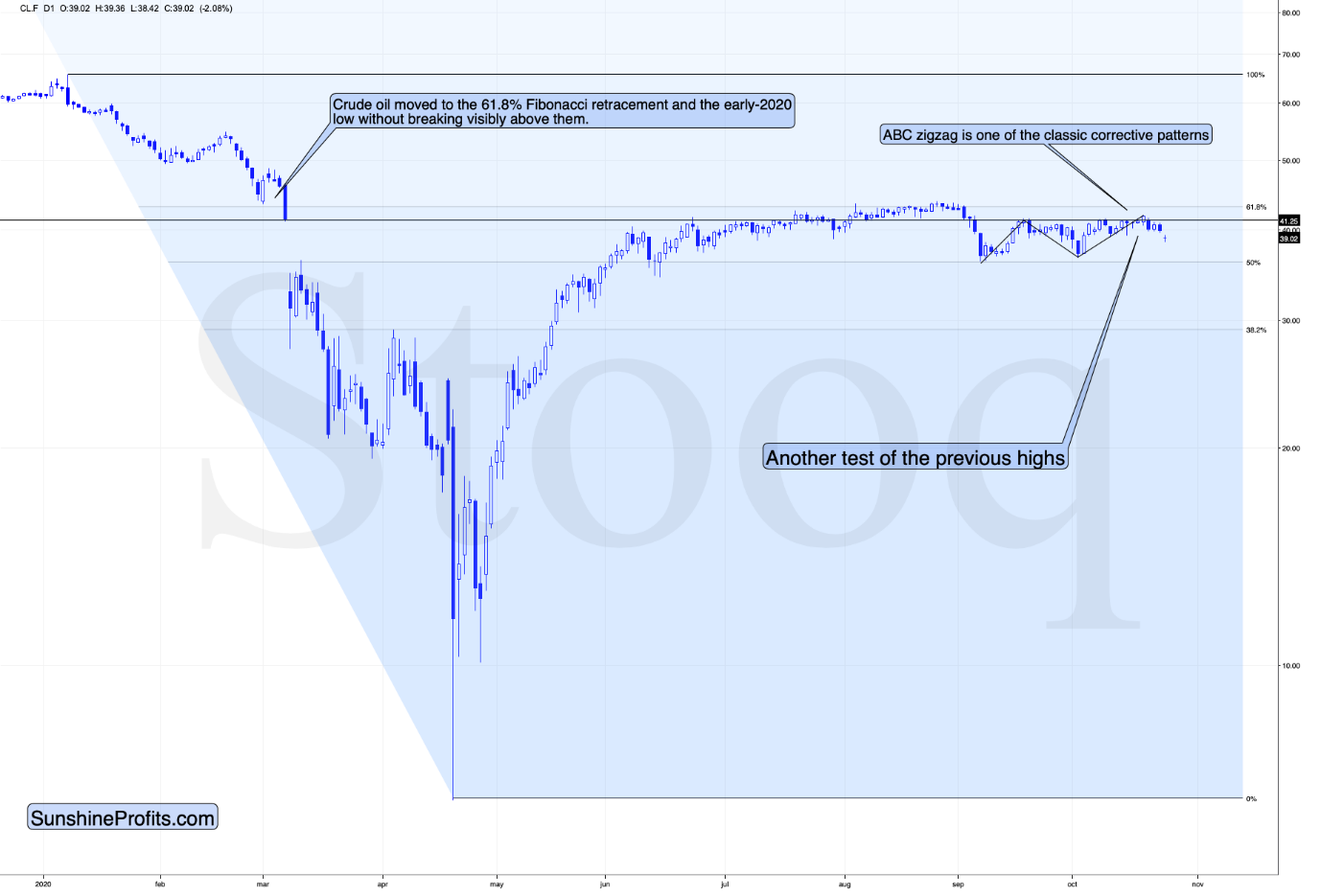

According to yesterday’s decline, the price of crude oil topped on October 20th. You might wonder - why would that be so important? It is because this top was slightly above the September 18th top, and at the same time, the early-October bottom was somewhat above the early-September bottom.

We know that the above might sound puzzling to you. But please take another look at the chart above. We connected these price extremes with the black lines. These lines create a zigzag pattern as of the classic ways for any market to correct its preceding move before it resumes it. The preceding move was downward – the decline that started in late August and ended in early September.

Since what we saw was one of the popular corrective patterns, the odds are that the correction is already over. In other words, instead of consolidating further, the price of black gold can finally move lower once again.

To summarize, for the upcoming weeks, the outlook for crude oil stays bearish, and the most recent upswing did not change that at all. Moreover, based on the completion of the zigzag pattern, the odds are that the correction in crude oil is already over.

As always, we’ll keep you, our subscribers well informed.

Trading position (short-term; our opinion; levels for crude oil’s continuous futures contract): Full (100% of the regular position size) speculative short positions in crude oil are justified from the risk to reward point of view stop loss $45.63 at and $30.22 as the initial target price.

In the future contracts that are more distant than the current contract, we think adding the premium (the difference between the July and other contracts) to both: stop-loss and initial target prices is justified.

Thank you.

Nadia Simmons

Day Trading and Oil Trading Strategist

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager