The financial markets believe that the Fed will raise rates in December. Is the market right? What does the hike mean for the gold market?

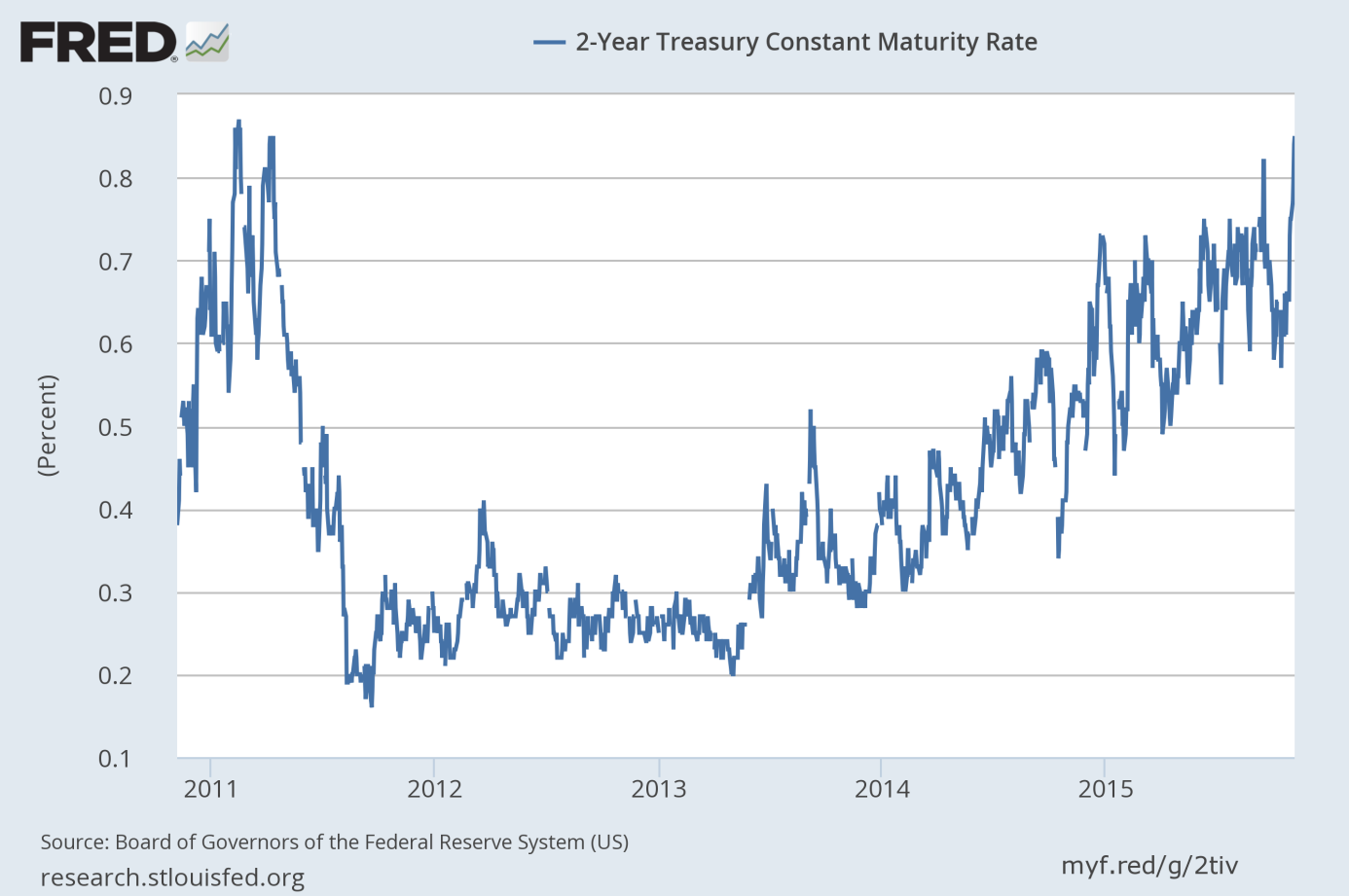

After months of guessing whether the Federal Reserve will hike interest rates this year, investors became convinced that the U.S. central bank would tighten its monetary stance in December. Indeed, after the strong employment report in October, traders' expectations for future interest rates jumped to show a 70 percent probability of a Fed hike in December, the highest reading yet ahead of a Fed decision. And the yield on two-year Treasury notes hit a level unseen since 2011 (see the chart below).

Chart 1: Two-year Treasury yield from 2010 to 2015.

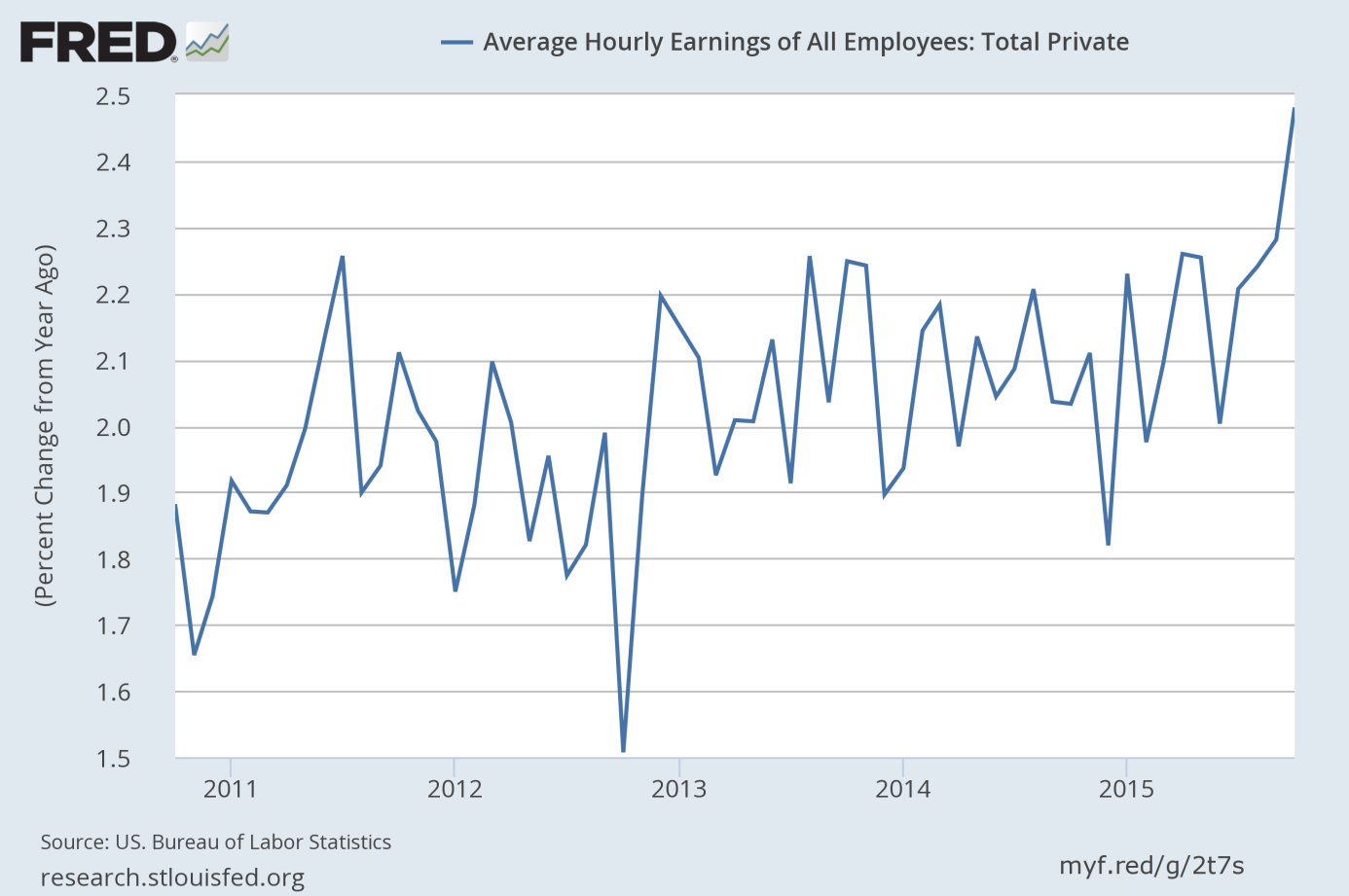

Of course, another stock market selloff, or a truly disastrous November payroll report could postpone the Fed’s move, but the hike is now the default scenario. The October FOMC statement was hawkish and directly pointed to the December meeting as a very possible date for hiking. Later, Yellen confirmed that December was a “live possibility”. Even the dovish Dudley, the New York Fed President (together with the San Francisco Fed President John Williams), agreed with the Fed chairwoman on that. And finally, the recent employment report showed not only strong job gains, but also a rise in wage growth. As one can see in the chart below, the year-on-year wage growth is the strongest since 2011. According to orthodox economic theory, higher wages should result in higher prices sooner or later. Therefore, wage growth could convince the Fed that 2-percent inflation is really coming in the future.

Chart 2: Average hourly earnings of private employees from 2010 to 2015.

Lastly, the Fed can raise rates now, because market expectations caught up with the Fed’s projections. Previously, the Fed's projections for interest rates were higher than the market's, because the markets did not believe that economic conditions allowed to hike. Now, the situation has changed. This is bad news for the gold market. The strong belief that the Fed will raise interest rates in December is bullish for the U.S. dollar and bearish for gold, at least for the short term.

The take-home message is that the investors started to believe that the Fed will hike interest rates this year. This is a default scenario, which is bearish for the shiny metal, at least until the expected move is conducted (investors often sell the rumor and buy the fact).

If you enjoyed the above analysis, we invite you to check out our other services. We focus on the fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview