The U.S. trucking industry is slowing down. What does it imply for the U.S. economy and the gold market?

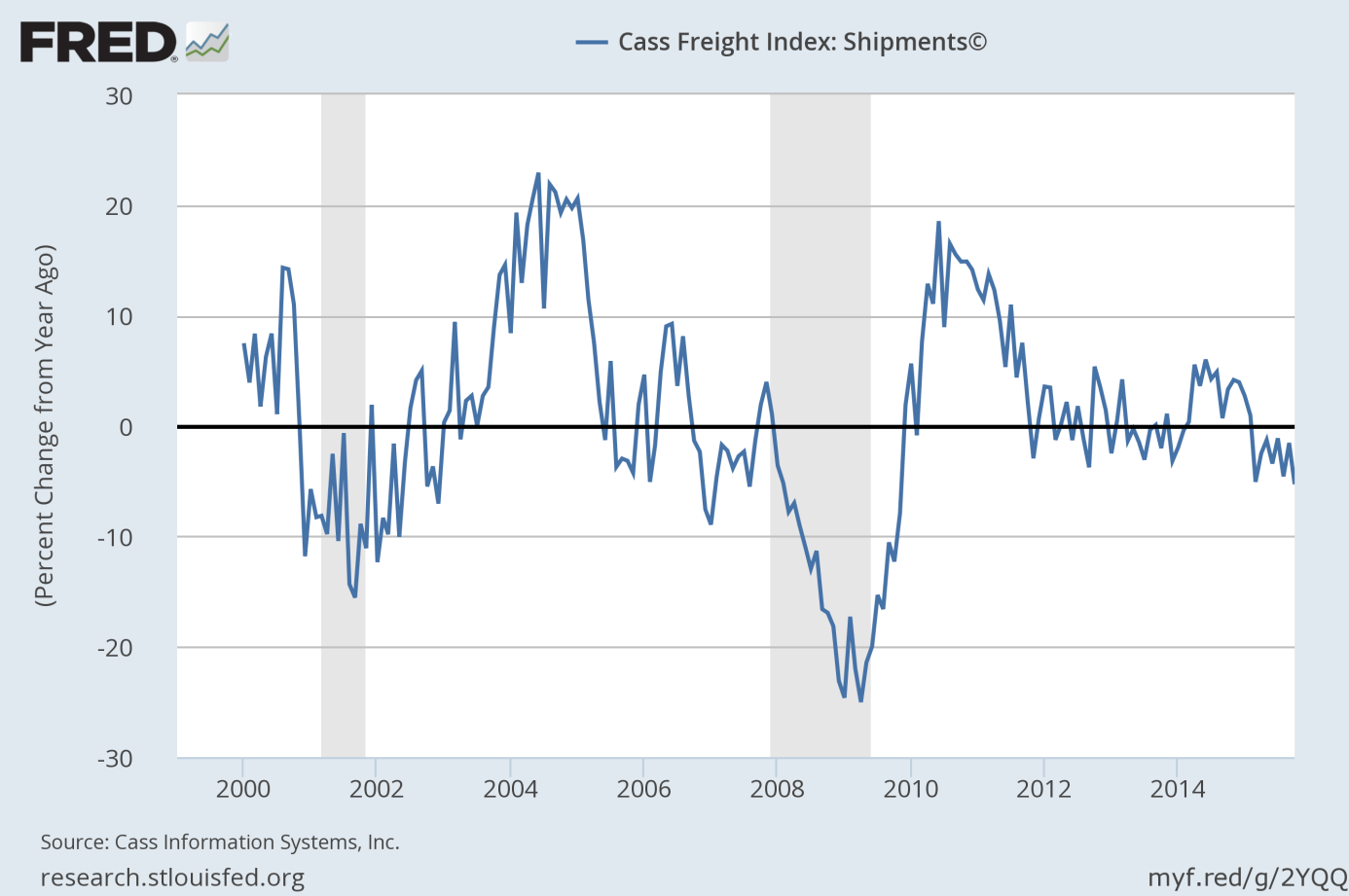

The conditions for trucking companies have been deteriorating recently. The DAT spot freight (the amount of freight available in the spot market) fell 15 percent in November on a monthly basis. On an annual basis, the freight volume fell 45 percent. And the Cass Freight Index has been falling down this year (see the chart below).

Chart 1: The Cass Freight Shipments Index from 1999 to 2015 (as percent change from year ago).

Trucking is an excellent leading indicator of the economy, since physical movements often precede financial transactions. It is also a cost included in virtually every other good or service in the economy – this is why it is a measure of economic activity and a thermometer for the merchandise economy. Usually, when the trucking industry is strong, so is the economy. When the trucking industry struggles, the U.S. economy often follows. This is why gold investors might want to pay attention to the trucking industry.

Therefore, the slowdown in trucking – despite the plunge in oil prices – means that the demand is softening. This is not a very surprising development, given that manufacturing is experiencing a recession. As in a cargo ship, there is overcapacity in the U.S. trucking industry and many companies from that sector reported weak third quarter earnings and warned of weakness going forward. The slowdown in the trucking industry could negatively affect the automotive industry – one of the few current bright spots in the U.S. economy.

The bottom line is that the situation in the trucking industry is another – alongside recessionary manufacturing, busting mining, increased levels of inventories, stalled corporate profits, turbulences in the high-yield bond market and widening spreads – indication that the U.S. economy is slowing down. The Fed hike will only rub salt in the wound, thus the central bank could be forced to reverse its monetary policy, which would be positive for the gold market.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on the fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview