Last week, the House voted to impeach Donald Trump. This is the third time in the U.S. history such an event has happened to the sitting President. What does it imply for the gold market?

Trump's Impeachment, Explained

On Wednesday, the House of Representatives impeached Donald Trump. He became only the third U.S. president in history to be impeached, following Andrew Johnson in 1868 and Bill Clinton in 1998.

According to the Constitution, the President "shall be removed from Office on Impeachment for, a Conviction of, Treason, Bribery, or other high Crimes and Misdemeanors". Democrats created two articles of impeachments which refer to these other high crimes and misdemeanors. The first one accuses Trump of abusing his power by pressuring Ukraine to investigate Joe Biden, the former U.S. Vice President, in order to interfere in the 2020 presidential election.

The House of Representatives also accused Trump of obstruction of Congress by directing administration officials and agencies not to comply with lawful House subpoenas for testimony and documents related to impeachment. The abuse of power article was passed on a 230-197 vote and the obstruction article was passed by 229-198.

Trump denies any wrongdoing, calling the impeachment inquiry a "witch hunt". Who is right? Well, we do not know. We are neither Trump's supporters, nor Democrats' fans - but let's face it: the whole process is very political. Democrats are still furious after Hillary Clinton's loss in 2016 and hate Trump. They hoped for several months that "Russiagate" would enable them to remove Trump from office, but it didn't work out. So they are taking their chances once more, although the White House's record of the call between Trump and Ukraine President is far from being a clear case for high crime, especially when you compare it to the Watergate scandal or Bill Clinton's lying under oath about his sexual relationship with Monica Lewinsky.

However, there may be more to the story than politics and hatred of political parties. We mean here the hostility of the so-called "deep state" or "intelligence community" directed at Trump who is an outsider. Interestingly, even mainstream media started to notice that there is a real enmity between Trump and agencies such as the CIA and the FBI (to be clear, we do not claim that Trump is without sins, but that there is a kind of bias against Trump among the so-called establishment).

Anyway, impeachment does not imply removal from office. No president has been ever removed from office by impeachment and Trump is not likely to become the first one. That would require a two-thirds majority in the Republican-controlled Senate. So, at least 20 Republicans would have to join Democrats in voting against Trump to convict him. This is unlikely to happen.

Implications for Gold

What does the impeachments theater mean for the gold market then? The risk of impeachment should theoretically support the safe-haven assets such as gold. However, given the low odds of Trump being removed from office, the markets are little moved. The yellow metal also has shrugged off the news from Washington, DC, as the chart below shows.

Chart 1: Gold prices from December 16 to December 19, 2019

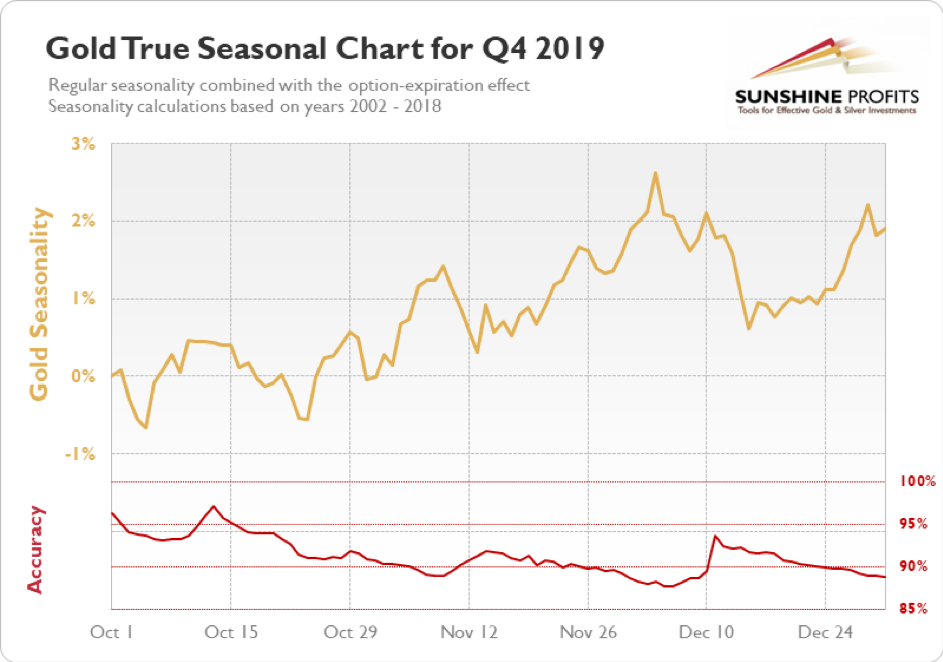

The price of gold has increased the following day, but it can hardly be called a rally. Having said this, the end of year is positive for the gold market, given the unfavorable environment. I mean here the fact that the phase one trade deal between the U.S. and China was signed, while the Conservative Party's victory in the UK parliamentary elections cleared the path to Brexit in 2020. As two important headwinds for the global economy softened, one could reasonably expect that the price of gold would dive. After all, the risk appetite came back to the markets, bond yields increased, while equity markets reached record highs. And yet gold remained in a narrow trading range of $1,460 and $1,480. It seems that the yellow metal is preparing for a big move - now the question is in what direction (fundamentals suggest rather a decline, while the gold seasonal pattern favors an increase).

Chart 2: Gold True Seasonal Chart for Q4 2019

Depending whether you are a bull or a bear, we wish you to be content with the upcoming move!

We hope that you behaved well all the year and that Santa Claus will not impeach you... Merry Christmas!

If you enjoyed today's free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. In order to enjoy our gold analyses in their full scope, we invite you to subscribe today. If you're not ready to subscribe yet though and are not on our gold mailing list yet, we urge you to sign up. It's free and if you don't like it, you can easily unsubscribe. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits - Effective Investments Through Diligence and Care

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Trading Alerts.