Evergrande is on the brink of bankruptcy. Will gold prices collapse together with the real estate developer or benefit from its default?

Generals are always prepared to fight the last war, while economists are always prepared to fight the last recession. But what if the next economic crisis doesn’t start in the US financial sector, but in China’s real estate?

Naturally, I refer to Evergrande, a Chinese developer with total liabilities of more than $300 billion — around 2% of China’s GDP! A default of one of China’s largest and most indebted companies could entail significant repercussions for the global economy.

Although the Evergrande crisis won’t necessarily be China’s Lehman Brothers moment (I will elaborate on this in the upcoming edition of the Gold Market Overview), it will certainly curb China’s economic growth. Actually, the slowdown has already begun, as the country’s GDP grew just 4.9% in the third quarter of 2021, much less than the 7.9% seen in Q2. It was the slowest pace recorded in a year.

The slowdown is not surprising. After all, China faces a massive energy crunch, shipping disruptions, and a burst of the property bubble. Until recently, the bubble was tolerated or even actively boosted as it drove income and growth, benefiting everyone: developers, authorities, and also ordinary citizens who placed most of their savings in real estate. The property sector has grown so much that it accounts for about 30% of China’s GDP! So, given the size of China’s economy, it has become one of the most important sectors in the world.

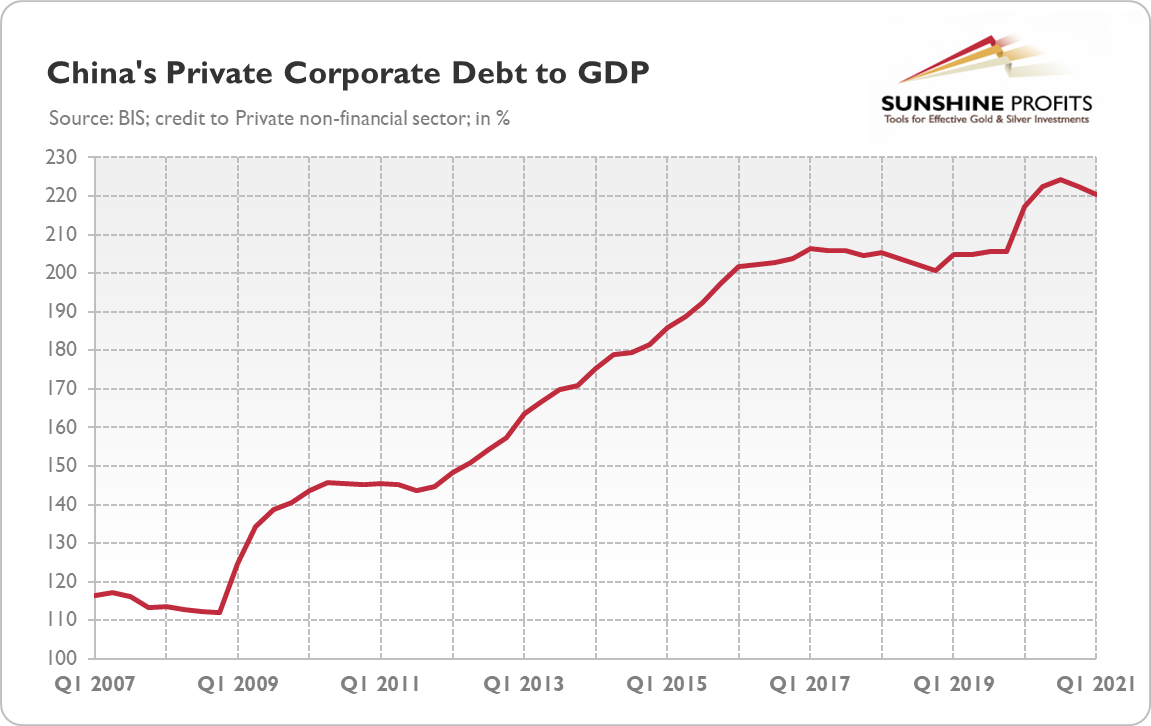

However, China’s government decided to curb excessive borrowing and deflate the bubble. Perhaps the irrational exuberance became too irrational – just think about all these ghost towns with millions of empty apartments, not to mention the surge in corporate debt from 112% of GDP in 2008 to 222% in 2020 (see the chart below). So, last year, China’s government introduced the policy of “three red lines” which made it much more difficult for large developers such as Evergrande to issue more debt. This tightening caused a liquidity crisis, as well as a drop in property investment by 4% in September.

Here is the problem: the government wants to move away from a growth model based on investment and debt, but the country hasn’t transitioned to a consumption-led model yet. Thus, given the size of China’s property sector and a lack of new growth engines, we should expect a further slowdown in China’s (and global) economic growth.

Implications for Gold

What do China’s economic problems imply for the gold market? Well, the price of gold hasn’t been affected by the Evergrande crisis so far, remaining stuck below $1,800. Although, please remember that gold is most sensitive to the US economy, and we haven’t seen any signs of contagion spilling over the Chinese borders yet. However, the slowdown in global economic growth caused by the burst of China’s real estate bubble should bring us closer to the stagflationatory scenario, which should be positive for gold prices. The deceleration in China’s economic growth could abruptly change the narrative about a solid recovery from the pandemic, making investors worry more about inflation. A slowdown in economic growth could also lower bond yields, which should be supportive for the yellow metal.

Furthermore, even though most of the pundits downplay the risk of financial contagion stemming from the collapse of Evergrande (or other Chinese real estate developers), such a risk exists. If it materializes, gold should shine as a safe-haven asset.

Another possible implication is that China might devalue the yuan again. As investments are weakening and consumption hasn’t become a sufficient driver of the economy, the government could bet on exports to support the GDP growth. This could trigger some safe-haven inflows into gold, but there are also some risks here. As I wrote in 2017, “in the summer of 2015, China devalued the yuan, which pushed global equities lower. Hence, a devaluation of the renminbi would imply an appreciation of the U.S. dollar, which does not sound good for the gold market.”

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.

-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.