We wrote in August that the yields on the riskiest junk bonds had been rising. Since then, the situation has worsened. What does the selloff in the high-yield bond market mean for the U.S. economy and the price of gold?

The junk bonds become even more junk. The bear market started in mid-2014 as the price of oil collapsed, but the real panic began several days ago when Third Avenue Management suspended investor redemptions from its nearly $800 million high-yield bond fund, while the price of oil plunged below $35.

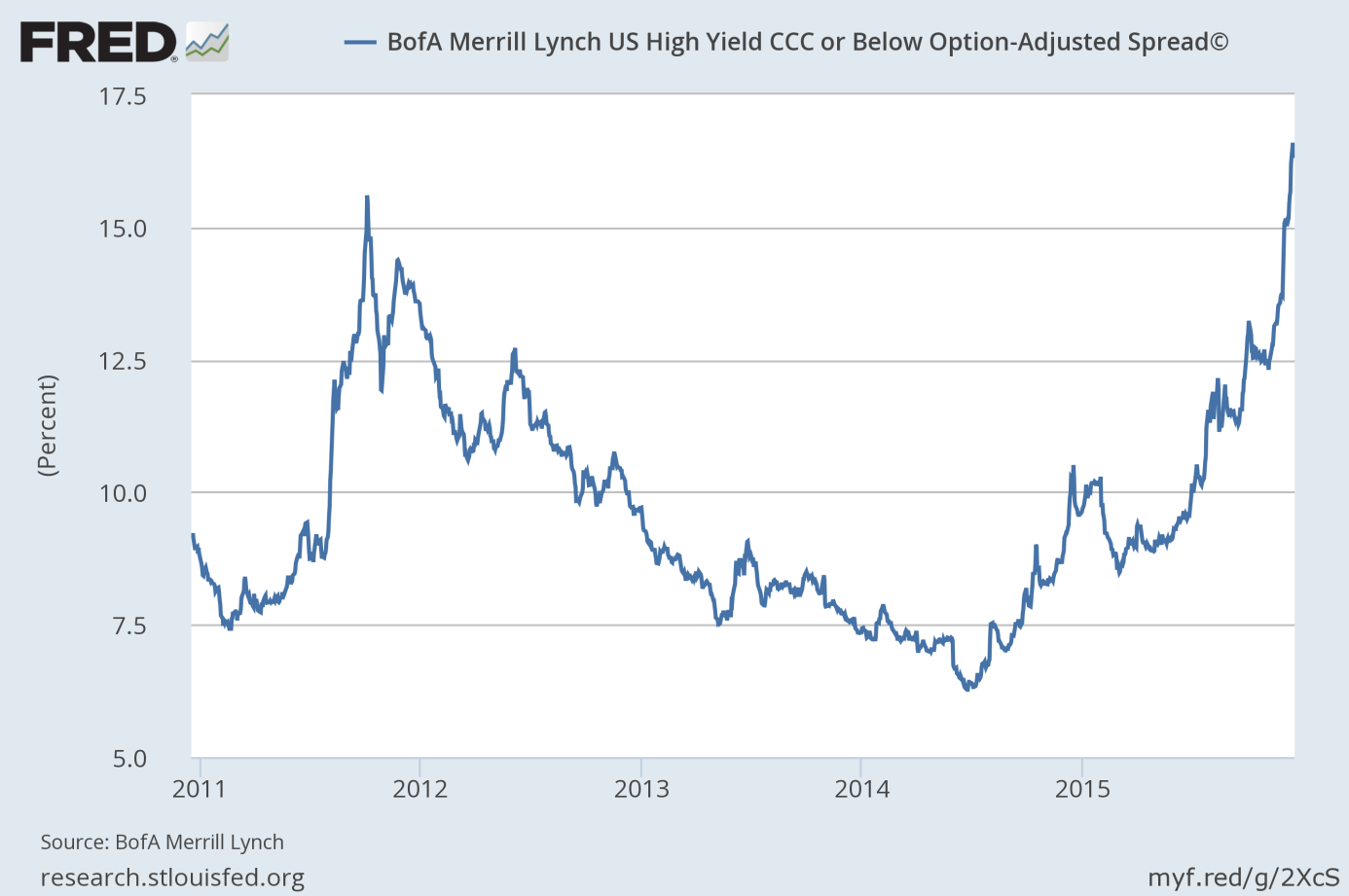

As one can see in the chart below, the spread between bonds rated CCC or below and Treasury bonds widened from 6.32 in June 2014 to 11.00-12.00 in August 2015, and 16.37 on December 17. The current spread is higher than in September 2008.

Chart 1: The spread between corporate bonds rated CCC and below and Treasury bonds from 2010 to 2015

The Third Avenue fund might be just the tip of the iceberg. Many companies have sprang up recently only on the back or rising commodity prices and the debt issues during extended period of ultra-low interest rates. The crash in commodity prices led the junk bond market to blow up. It goes without saying that the Fed hike will not help those companies, as they could have problems to refinance their debts when the interest rates increased.

Some analysts suggest not worrying about the selloff in the junk bond market, as the turbulences are confined only to commodity-related entities. It does not matter. The dot-com bust was also limited only to technology companies, while the 2007-2008 crash was initially restricted to only sub-prime mortgage companies. All markets are interconnected and usually, the high-yield bond market leads the stock market when signaling economic troubles. Indeed, hedge funds will probably experience their worst performance this year since 2011.

What do the turbulences in the junk bond market means for the gold market? The widening spreads indicate that investors have become more risk-averse and fly more intensively to the safety. Therefore, the lower risk appetite in the markets should change sentiment towards gold – the ultimate safe-haven.

The take-home message is that the high-yield bond market is collapsing. The widening spreads between junk and Treasury bonds usually precede problems in the stock market. The lower risk appetite (and higher odds for the U.S. recession) should be fundamentally positive factor for the gold market next year.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on the fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview