President Obama signed legislation that avoids a default on U.S. debt. What does it mean for the U.S. economy and the gold market?

Despite various concerns, there will be no government shutdown as Congress and the White House suspended the debt limit into March 2017 and lifted limits of discretionary spending levels for the next two fiscal years. The budget deal ends months of uncertainty and improves the credibility of the U.S. government. Therefore, this is not good news for the gold market.

However, the budged deal did not raise the debt ceiling, but it temporarily suspended it, which means that the passed bill allows the government, at least in theory (in practice, an increase in spending needs the consent of Congress), to borrow unlimited amounts of money. And Congress raised caps on defense and non-defense spending in 2016 and 2017, instead of enforcing some spending cuts in exchange for avoiding the government shutdown.

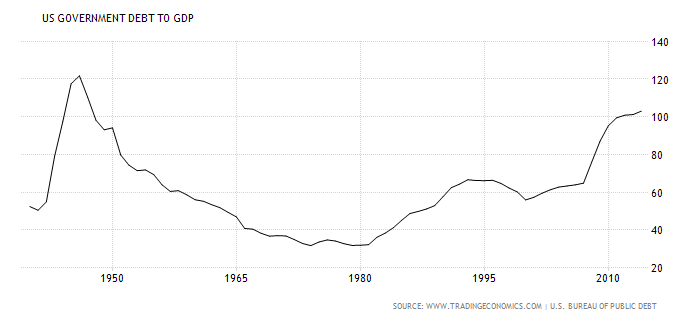

Therefore, in the long-run there is still an important debt problem. The U.S. government debt amounts to 103 percent of GDP and it is approaching the level unseen since World War II (see the chart below). The total debt (which includes also private debt) to GDP ratio is even worse, as it is at 370 percent. However, as you can see in the chart below, the debt-to-GDP ratio has stabilized lately, after a dramatic rise since 2008.

Chart 1: U.S. Government Debt to GDP from 1940 to 2015

Therefore, the current U.S. financial policy, although far from being sound, is more rational than a few years ago and in many other developed countries. This is positive for the U.S. economy and for the greenback’s long-term prospects, and negative for the gold market outlook.

The take-home message is that the debt ceiling was not reached as President Obama signed legislation suspending the debt limit into March 2017. The lack of a government shutdown and reduced political risk will not help the price of gold in its struggle with the expectations of a Fed interest rate hike.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on the fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview