With Moderna’s recent success, more vaccines are coming. Does this mean the end of the story for gold?

Who offers more? As you probably remember, last week Pfizer announced that – based on the interim analysis – its vaccine is more than 90 percent effective. Two days later, the Russians entered the game. The developers of the vaccine called Sputnik V announced that their vaccine demonstrated 92 percent efficacy in the first interim analysis of the third phase of clinical trials. However, the skeptics say that those results are based on only 20 confirmed Covid-19 cases. But hey, it’s better to not mess with Russians, so I won’t say a bad word about their vaccine!

On Monday (Nov 16th), Moderna announced that its own coronavirus vaccine trial was also nearing its end, with a 94.5 percent efficacy rate. Most importantly, Moderna’s vaccine requires lower storage temperatures compared to Pfizer’s, making it similar to the standard conditions in the pharmaceutical industry, thereby making it easier to distribute.

Two days later (Nov 18th) Pfizer released the results from its final efficacy analysis, which indicates that its vaccine is 95 percent effective. This means that only five percent of Covid-19 cases among the vaccine trial participants occurred in the group which got the vaccine, while 95 percent occured in the placebo group. The good news for humankind is that Pfizer’s vaccine efficacy held up across the age spectrum (and also across different characteristics such as gender and ethnicity). In people older than 65 (a high-risk group), the efficacy was reported to be 94 percent. Pfizer will therefore request the FDA’s emergency use authorization very soon, followed by Moderna. That’s great for the world. But what about the yellow metal?

Implications for Gold

The positive results from the two vaccines, better than previously expected, have raised hopes for the end of the pandemic. In other words, the positive results from the vaccine trials imply an increased chance of a faster than previously expected economic recovery in 2021. Since the epidemic clearly supported gold prices, its upcoming end means bad news for the price of gold.

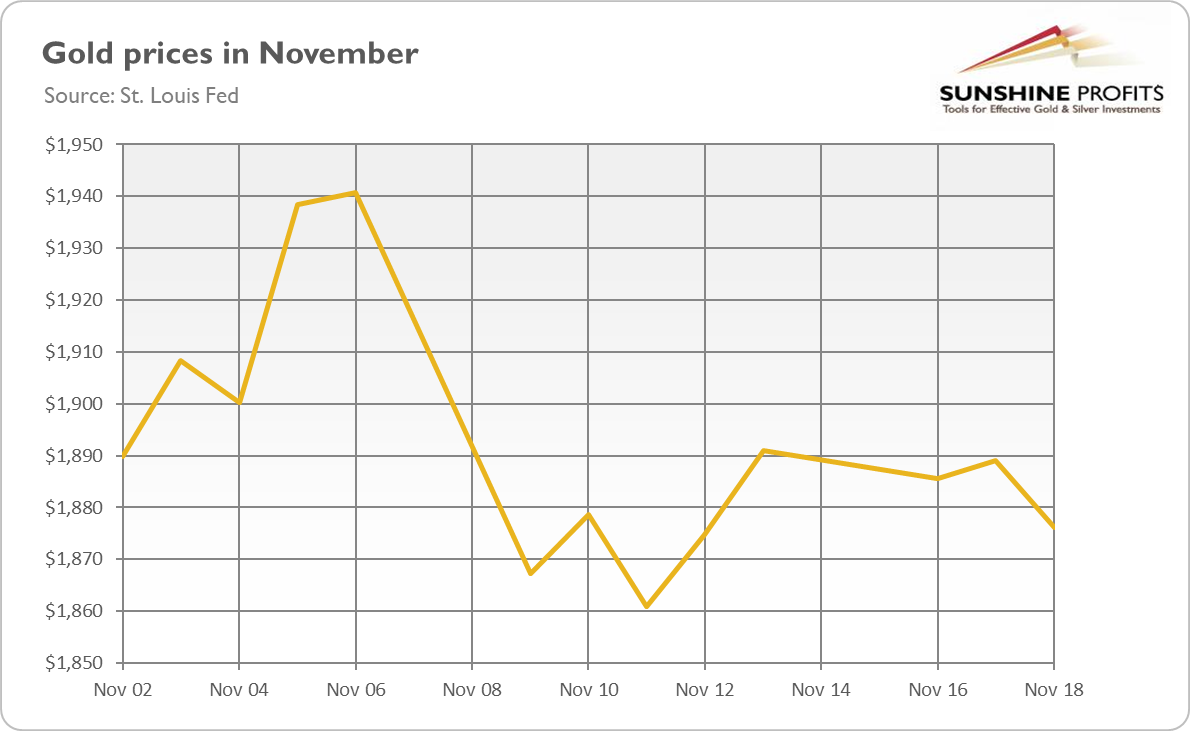

However, after an initial huge drop in response to Pfizer’s initial announcement, the price of gold has somewhat stabilized. As one can see in the chart below, the price of gold plunged from around $1,940 to around $1,860-$1,870 after the first breaking news about the vaccine. But the impact of the subsequent announcements from both Pfizer and Moderna was much smaller.

Why? Well, although the recent news is great, the distribution of vaccines among the general population will take a few months. Consequently, there will be no herd immunity until at least mid-2021. If everything goes well of course, and the FDA approves both vaccines.

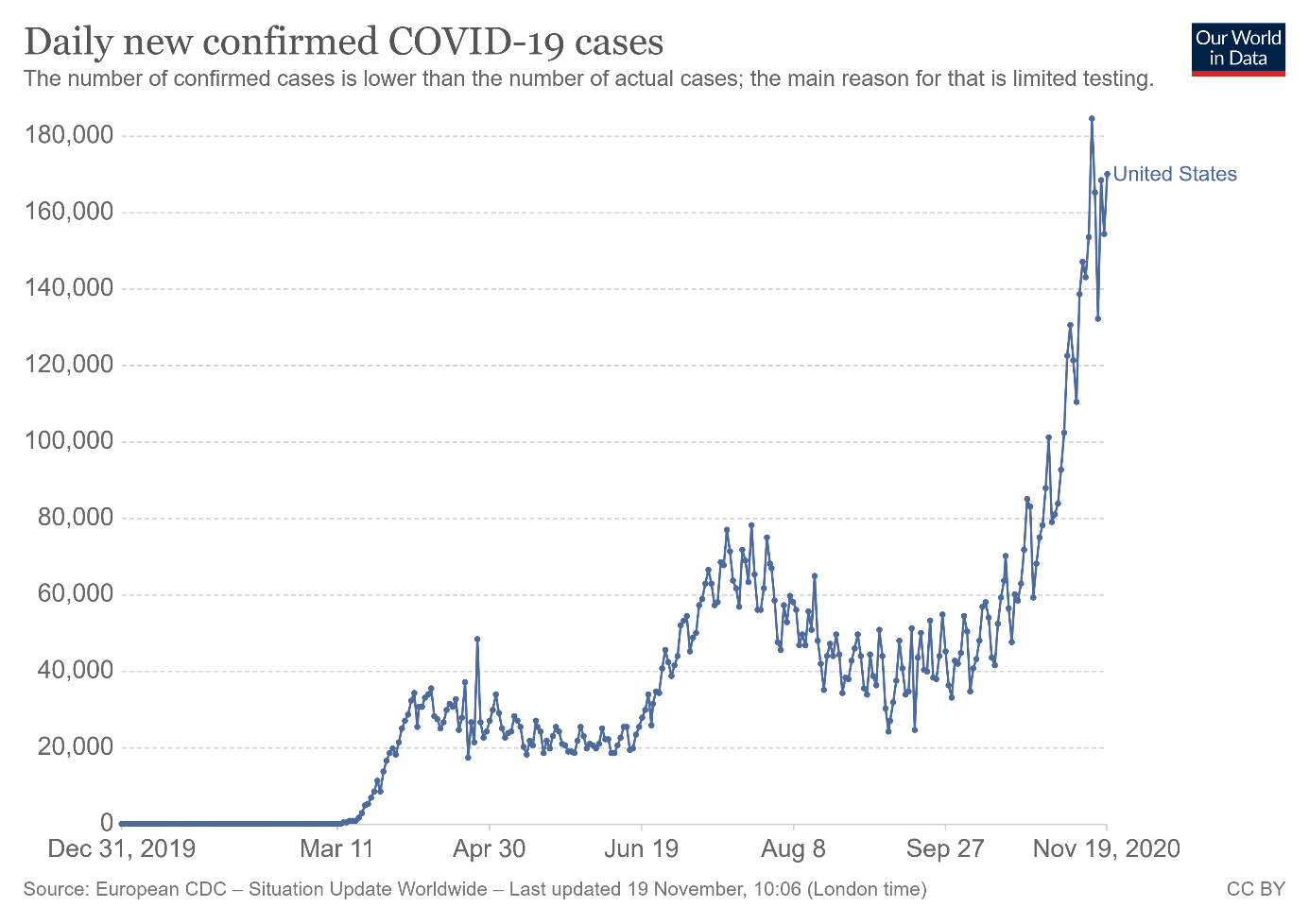

In the meantime, we’ll have to face the harsh autumn and winter seasons. And I’m not referring to the weather or white walkers – I mean the Covid-19 walkers whose population has recently increased. As the chart below shows, the daily infection rate in the U.S. still remains at about 170,000 cases. This means than more than one million new Covid-19 cases per week. So it’s possible that investors have to some extent shifted their attention from the vaccine to the more immediate threat.

The progressing spread of Covid-19 will hurt the economy, which is good news for gold. Indeed, although the upcoming vaccines reduce the pandemic-related uncertainty, the story for gold is not over yet. You see, there is still an elevated economic uncertainty. The public debt is ballooning, the monetary policy will remain very accommodative, and inflation is still a present risk (think about all this pent-up demand that could materialize next year). The vaccines will not fix all these problems and they will not undo the economic crisis that hit the U.S. this year and which will leave some long-lasting scars.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.

-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.