We wrote yesterday that the Fed might keep low interest rates near zero for longer than investors commonly believe due to the inflation rate below the target. Information from the passing week could strengthen the Fed’s undecided stance (“I want, but I am afraid”), which would be supportive for gold prices.

I have in mind specifically the U.S. Producer Price Index, which fell by a record 0.8 percent in January (a third decline in a row), according to data published by the Labor Department on Wednesday.

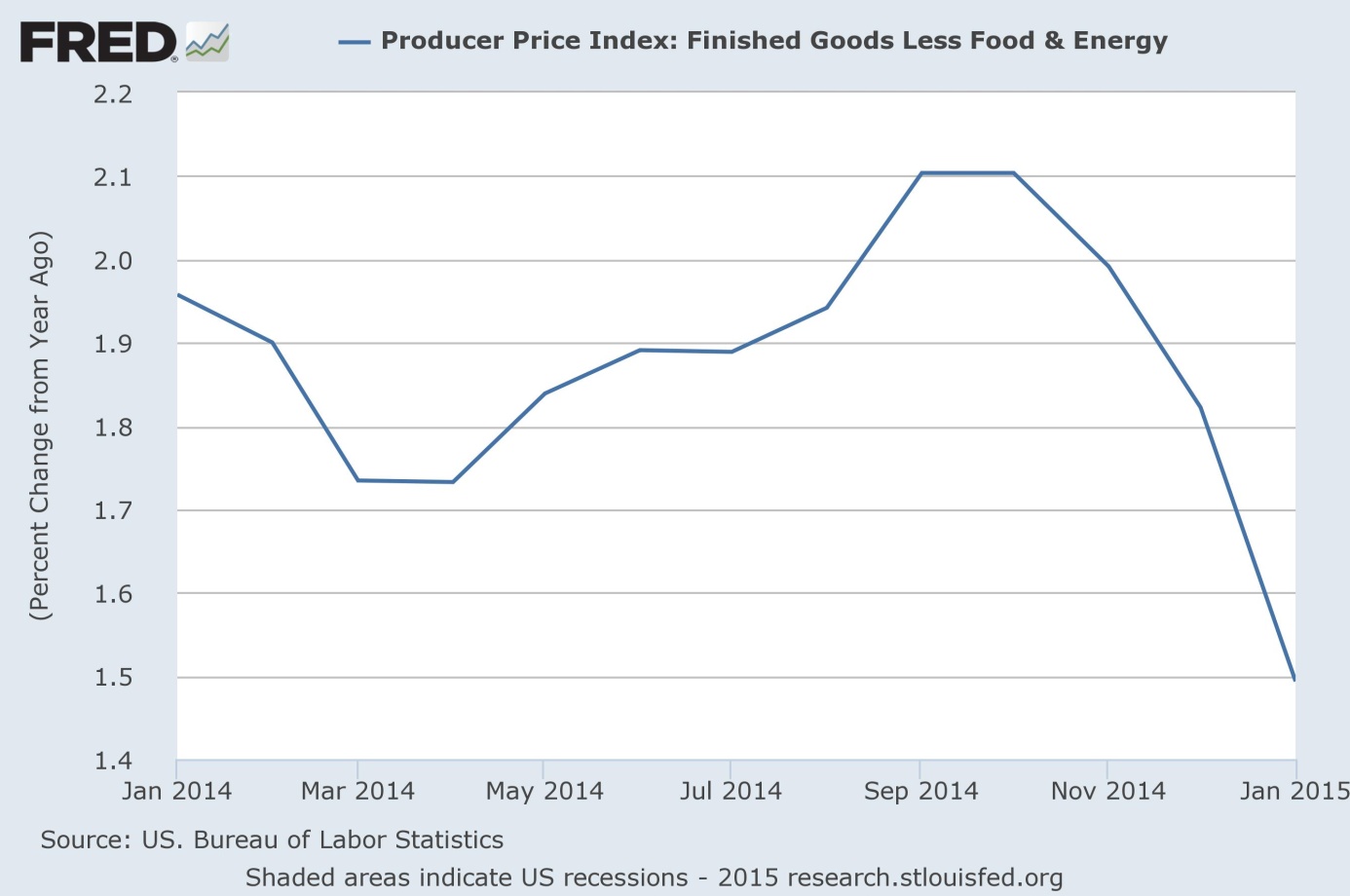

The common explanation is energy. It is true that the plunge in prices of energy was very visible, with a decline of 10.3 percent (led by 24-percent plunge in gasoline prices), however the core PPI rate (i.e. excluding food and energy) also fell (Figure 1), exerting disinflationary pressure, which the Fed officials are afraid about.

Figure 1: Producer Price Index (finished goods less food and energy) from January 2014 to January 2015 (a percent change from year ago).

Somebody could ask “so what?” The Fed is concerned about the CPI, not the PPI. This is partially true, however the PPI can be regarded as the leading indicator of the CPI and, as such, is also carefully studied by the Fed’s officials. In some sense, the PPI is a more accurate gauge of economic activity than the CPI, because it tracks price changes at the wholesale level. So the CPI measures rather the cost of living (at least, it tries), while the PPI reflects the prices paid by the entrepreneurs, businessmen and investors. In other words, the PPI measures inflation at earlier stages of production (this is why it is a leading indicator), which is more sensitive to the business cycle.

The conclusion is that the declining PPI (as well as the BDI) means that entrepreneurs are pessimistic about the economic outlook and are contracting their operations. They demand fewer commodities and intermediary goods, so their prices drop. It makes the eventual interest rate hike even less probable, which is positive news for gold investors.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview