Gold fell by 1.7 percent after Tuesday’s positive data on core business spending, consumer confidence and new home sales. Is the U.S. housing market really improving?

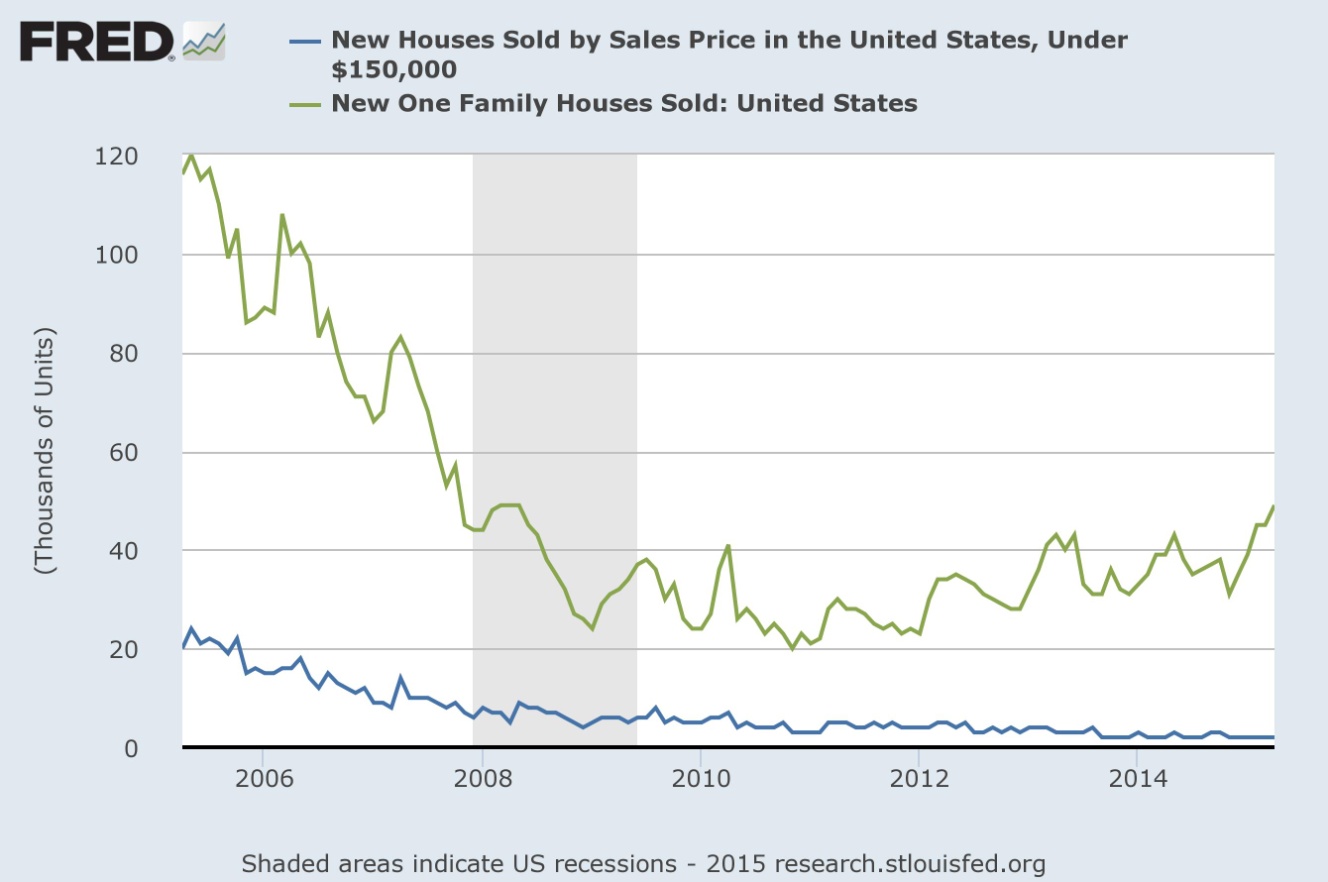

According to the Commerce Department, sales of new single-family homes climbed 6.8 percent in April to an annual rate of 517,000, after a steep decline of 11.4 percent in March. Investors should remember that this series is volatile month-to-month. From the long-term perspective there is hardly any rebound. It should not be surprising, given that wages are lagging behind home prices. According to the Case-Schiller Home Price Indices, home prices rose 5.04 percent in March on an annual basis, while wages increased only by 2.1 percent. Putting this into the long-term perspective, new house sale prices are 26 percent higher than in 2006 (the top of the last housing bubble), while median household income rose around 10 percent. The math is inexorable: as house prices rise faster than incomes, fewer and fewer households can afford them. The sad truth is that the middle class has become less and less able to afford a new home. Almost all new home sales are bought by the people at the top of the income ladder, who benefit from the loose monetary policy. As you can see in the chart below, the American dream is dead for the low and middle income households – sales of houses that cost less than $150,000 have been practically flat for years.

Chart 1: Number of new one family houses sold (at all prices) and new houses under $150,000 between 2005 and 2015

To make matters worse, the sales pace for used homes fell by 3.3 percent in April to a seasonally adjusted annual rate of 5.04 million, according to the National Association of Realtors. It suggests that demand for homes is declining, because home sales declined despite the drop of 30-year fixed mortgage rates to below 4 percent from March to April, which should have supported sales. In other words, existing-home sales fell as prices increased mostly due to investment demand. According to the RealtyTrac’s report, share of homes sold to owner-occupants dropped to a new low in the first quarter.

To sum up, the April housing market data is more bearish than portrayed in the headline reports. It could soon transpire, which should be supportive for the gold prices. However, we need to see more negative headline data on the U.S. economy, or the gold prices may not rise and go sideways at best.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview