The stronger than expected February job market report triggered speculation that the Fed is a bit closer to raising interest rates, which led to a surge in the U.S. Dollar Index. What does the multi-year peak of the greenback’s value mean for the global economy and the gold market?

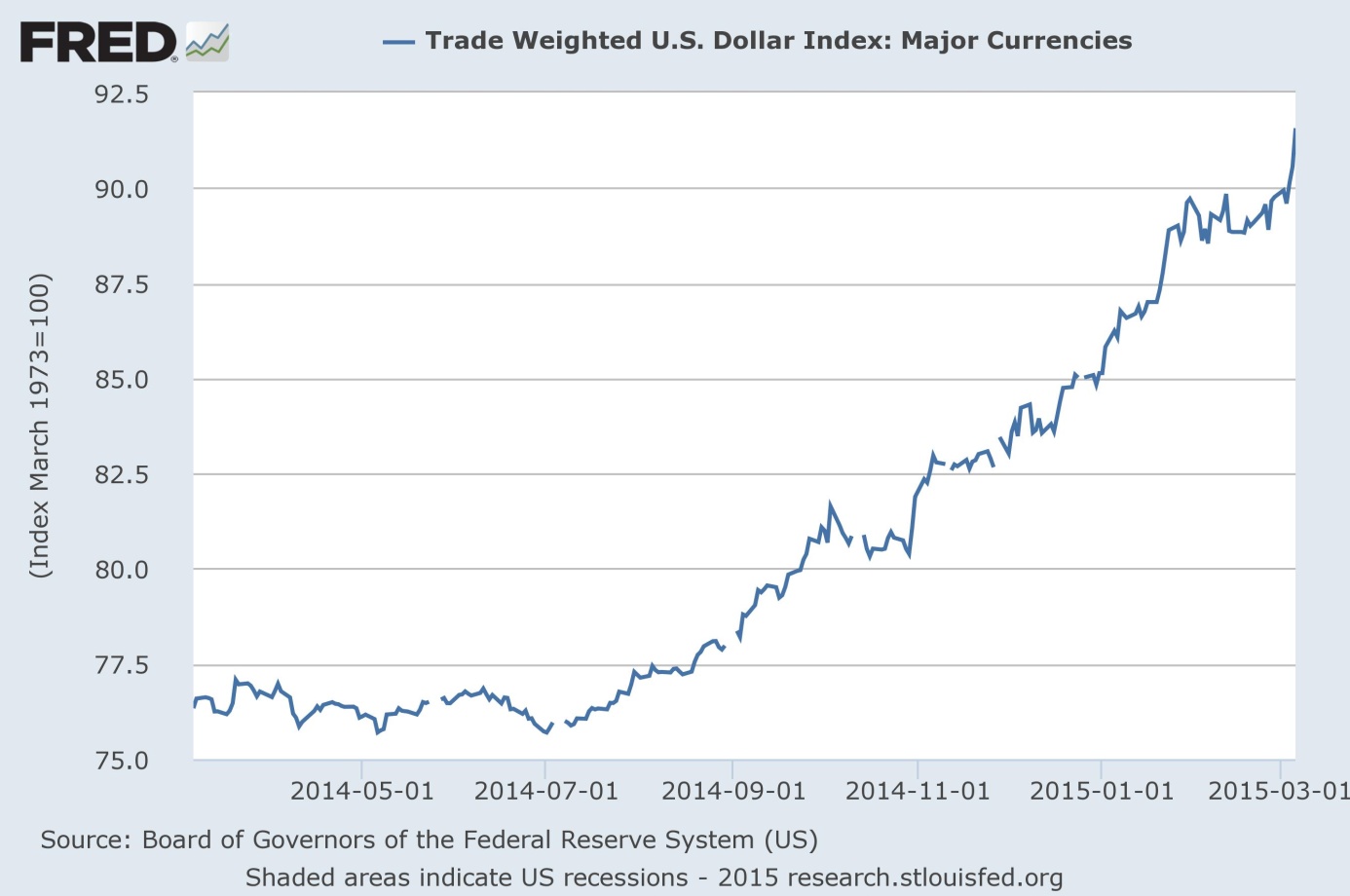

As you can see in the chart below, the U.S. Dollar Index soared after the data on the employment situation was published on Friday. Although the labor market did not fully recover, investors apparently considered the report as a clear sign that the long awaited interest rate hike is coming sooner than expected. The just launched EBC’s quantitative easing and the weak euro additionally support the greenback, as the euro is the main component of the U.S. Dollar Index.

In other words, as we have already explained in one of the Market Overviews, the monetary policy divergence, i.e. European and Japan easing while the Fed promises the normalization of monetary policy (although in a bit shilly-shally manner in regard to the timing), makes the greenback “the best looking of the ugly sisters”, which further strengthens its rally observed since the second half of the last year.

Figure 1: The U.S. Dollar Index (trade weighed, major currencies) in the last year.

What are the possible consequences of this surge for the global economy and the gold market? The strengthening of the U.S. dollar threatens the emerging market carry trade, as it reduces the investors’ gains from the interest rate differential, which may trigger a next round of capital outflows from emerging markets. Their situation may be aggravated by the lower commodity prices (which are expressed in the greenback) and higher U.S. dollar denominated debt repayment costs (more than 1.7 trillion dollars in U.S. dollar denominated bonds has been issued by developing countries since 2010). Thus, we may witness nervous capital flight into U.S. assets in the future if the greenback’s surge significantly hurts the emerging economies (thing about Russia currently struggling with a severe crisis).

The potential impact on gold is mixed. On the one hand, rising greenback will be negative for the gold prices (in terms of U.S. dollars). On the other hand, the negative correlation between the greenback and the yellow metal has not held in the last few months, as investors have been choosing both the U.S. dollar and gold as a safe haven.

To sum up, the recent surge in the greenback is a continuation of the fundamental trend of the strengthening of the greenback due to the Fed’s relative monetary tightening (compared to other main central banks). As long as the negative relationship between gold and the U.S. dollar holds, the yellow metal may lose on this rally. However, global risks and slowdowns in other economics may raise the demand for gold as a safe haven.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview