According to the U.S. Census Bureau, new orders for manufactured durable goods decreased by 1.4 percent in February. What does it mean for the U.S. economy and the gold market?

The February report on U.S. durable goods orders is really depressing, but it fits perfectly with a long line of weak economic data. Like in the case of earlier reports, economists were too optimistic and the data missed significantly their expectations. Indeed, the Bloomberg Consensus Estimate was for a 0.7% rise, which signals that the economists do not want to admit that the U.S. economy is slowing down. They stubbornly blame the weather, which is clearly nonsensical, because the trend turned down last summer. Yes, excluding the volatile transportation sector, orders fell 0.4%, the fifth consecutive monthly decline.

Why are businesses cutting their investment? Part of the story is definitely the plunge in oil prices, which started, oh… also last summer, and the following cutbacks in the oil sector. Another reason may be the stronger U.S. dollar and slowing exports, however the most important factor (as U.S. exports amount to only several percent of GDP) seems to be weak global demand and slowing economy.

Why is data on durable goods so important? The durable goods report is a great leading indicator, as drops in orders are followed by a build-up of inventories and, eventually, a decline in production. The demand for durable goods is more sensitive to the changes in the interest rates and business cycles than demand for consumption goods. The falling trend may, thus, reflect the global slowing down. Investors should remember that the global economy is interconnected and there is one worldwide structure of production. Simplifying, the U.S. is mainly a producer of capital goods, while the emerging markets produce raw materials and China supplies consumer goods. Now it is not difficult to see that the global (Chinese) slowdown, weaker foreign currencies (compared with the greenback), and expectations of the Fed’s hike may lead to a drop in the orders for durable goods.

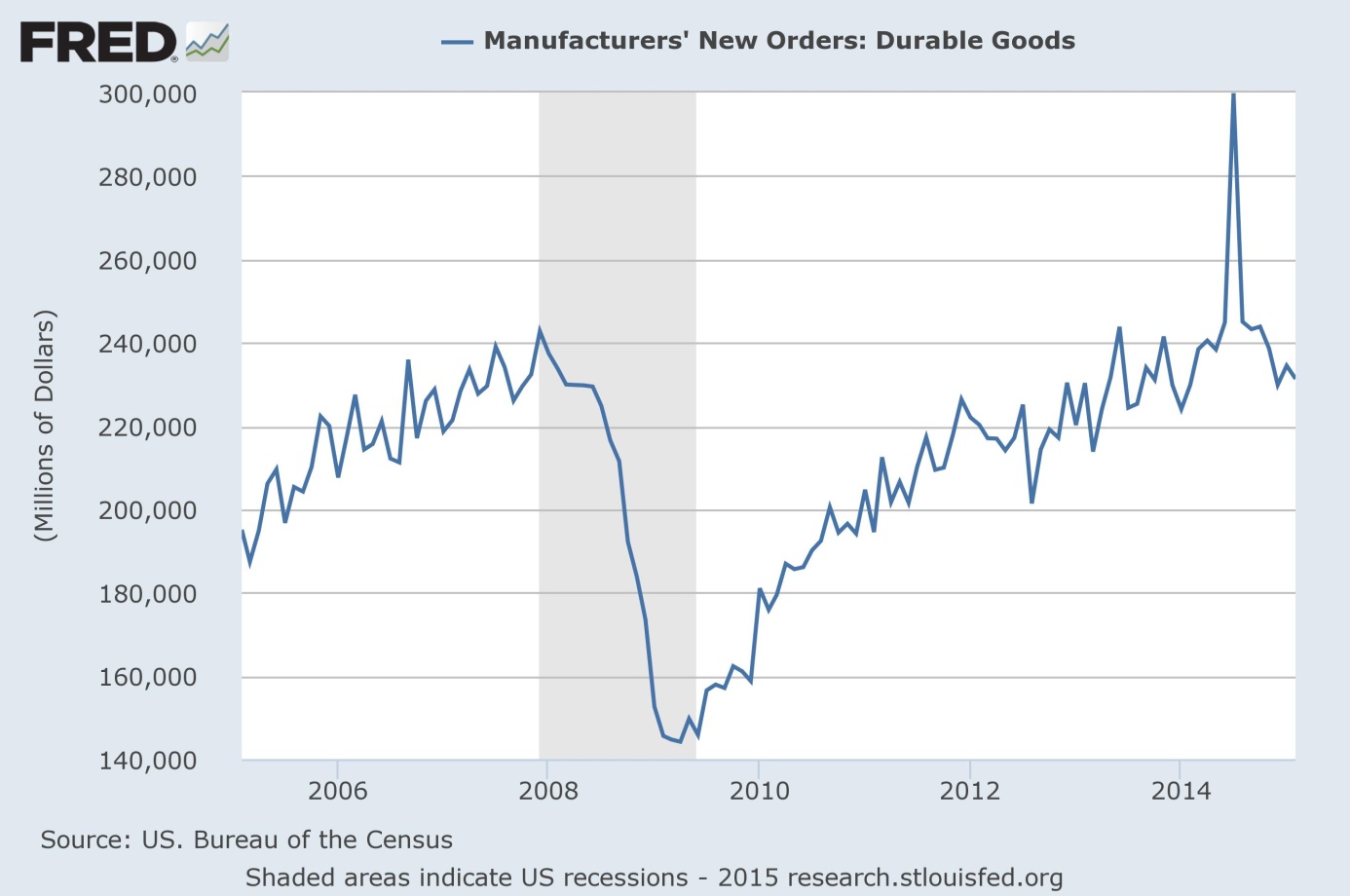

The consequences may be profound. The data on durable goods is a leading indicator - we hope investors remember the pre-Lehman times and that at that point new orders for durable goods had been falling since December 2007 (see the chart below) - which means that the future of the U.S. economy is not very bright now since we have similar conditions.

Figure 1: New orders for durable goods from 2005 to 2015.

Summing up, the February report on U.S. durable goods orders is another piece of pessimistic data on the U.S. economy, which signals a slowing down. This is good news for the gold market, as it may postpone the Fed’s decision about the interest rates hike. Low real interest rates and an economic slowdown are one of the favorite environments for the yellow metal.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview