The minutes of the Federal Reserve's January meeting were released yesterday. They show that Fed officials worry about hiking rites too soon. What does this statement imply for the gold market?

As we have repeatedly written, the Fed’s hike is not certain and the market is often wrong on timing of interest rate hikes. It is not surprising, given the fact that the Fed itself does not yet know when exactly that time will be (if at all). Frankly speaking, monetary planners even seem to not have any idea what indicators to point to in order to determine their, read our lips, data-dependent decisions.

“Participants discussed the economic conditions that they anticipate will prevail at the time they expect it will be appropriate to begin normalizing policy. There was wide agreement that it would be difficult to specify in advance an exhaustive list of economic indicators and the values that these indicators would need to take.”

Anyway, the key part of the minutes is as follows:

“In connection with the risks associated with an early start to policy normalization, many participants observed that a premature increase in rates might damp the apparent solid recovery in real activity and labor market conditions, undermining progress toward the Committee’s objectives of maximum employment and 2 percent inflation (…) Many participants indicated that their assessment of the balance of risks associated with the timing of the beginning of policy normalization had inclined them toward keeping the federal funds rate at its effective lower bound for a longer time.”

Of course, not all agreed with that point of view.

“Some observed that, even with these risks taken into consideration, the federal funds rate may have already been kept at its lower bound for a sufficient length of time, and that it might be appropriate to begin policy firming in the near term.”, while “Several participants noted that a late departure could result in the stance of monetary policy becoming excessively accommodative, leading to undesirably high inflation.”

However, for us ‘many’ is rather larger than ‘some’ or ‘several’, which indicates that the March hike is presumably off the table. We doubt that the Fed officials read our Gold News Monitor, however they mentioned the same factors as we did, factors may induce the U.S. central bank to postpone the start of policy normalization. Just as a reminder, we pointed out a few times that the gloomy global economic growth, problems in the oil industry, labor market not as strong as commonly believed, current foreign central banking policies and low inflation prices may still keep the Fed patient about a rate hike. Similarly, the Fed officials were aware of the global concerns (China’s slowdown, financial uncertainty in Greece) and the risk of a further appreciation of the greenback, as well as the situation in the oil industry:

“Several participants noted that there were signs of layoffs in the oil and gas industries, and that persistently low energy prices might prompt a larger retrenchment of employment in these industries.”

However, the main discussion regarded disinflationary pressure and whether the hike is appropriate, when “inflation had moved further below the Committee’s longer-run objective.” The Fed’s consensus is that stubbornly low inflation (oh, poor consumers) largely reflects “declines in energy prices and other transitory factors”.

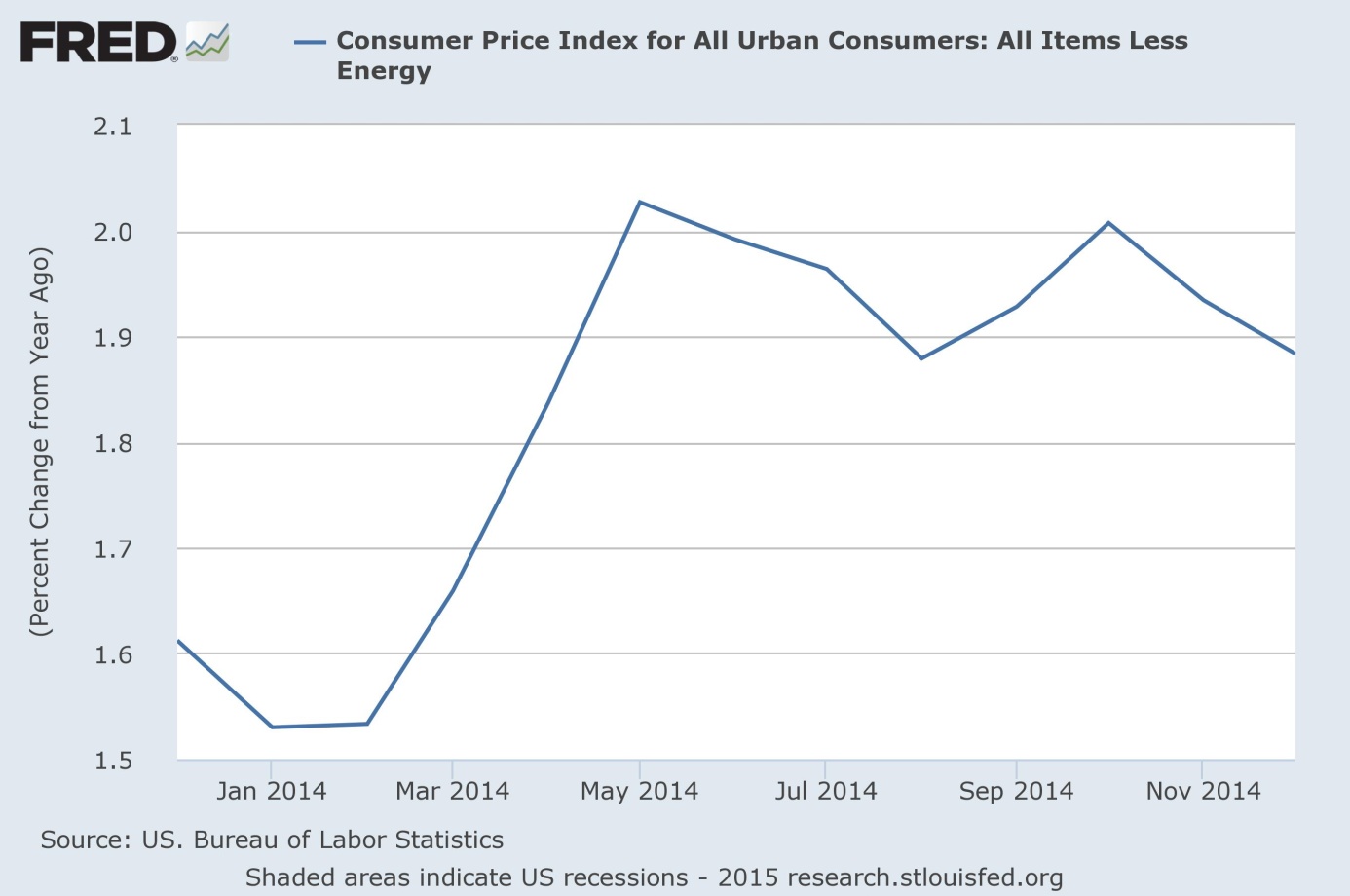

We hardly agree. The declines in energy and other prices are not transitory, but they reflect the global slowdown and the crack-up phase of the business cycle. Moreover, and what was also noticed by several participants, “inflation measures that excluded energy items had also moved down in recent months” (Figure 1), which strengthens disinflationary pressure and makes the Fed’s hike less likely in the nearest future.

Figure 1: Consumer Price Index for All Urban Consumers without energy prices from December 2013 to December 2014 (percent change from year ago).

To sum up, the Fed’s minutes confirm our thesis that the U.S. central bank could keep low interest rates near zero for longer. Taking into account inflation below the target and global risks, the Fed may still be ‘patient’. Why should the increase rates if the future of the Eurozone is currently at stake, risking even more capital inflows into the U.S. market? Although the SNB’s recent example showed that the central banks’ action may be really surprising, it seems that the Fed will not hike interest rates until June.

Therefore, the minutes support the gold market, because low real interest rates are negative for the U.S. dollar and positive for gold prices. Indeed, some analysts say that the bullion's move up after the FOMC minutes may be attributed to an easing of the investors' rate hike concerns.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview