The Fed may not be alone in the tightening of the monetary policy. The analysts expect that the Bank of England is going to hike interest rates at the beginning of 2016. How will this action affect the gold market?

Mark Carney, the current Governor of the Bank of England, said two days ago that it would be foolish to cut interest rates or pump more money into the economy in response to low inflation. This statement was considered as hawkish, because it reflects an almost completely different view than the one accepted by the ECB and most of the other central banks. The Bank of England is positive about the prospects of the British economy and believes that the current low inflation is mainly caused by the drop in energy and food prices, which is considered to be a transitory factor. Carney explained that “the impact of that extra stimulus would happen well after the oil price fall had moved through the economy and we would just add unnecessary volatility”. This statement suggests that the Fed may not be the only major central bank on the difficult path to normalization of monetary policy. As the Governor of the Bank of England added, “it’s pretty clear in terms of our central expectation that the most likely next move in monetary policy is an increase in interest rates”.

However, the exact date of the interest rate hike is also uncertain. It is even possible that the Bank of England will actually cut its interest rate if the rate of inflation dives into negative territory. Some analysts believe that the Bank of England is just playing with investors’ expectations to avoid further growth of the property bubble. Back in August last year the market expected that the Bank of England would hike before the Fed, while now it seems that it might wait much longer than the American central bank. The reason may be stronger risks associated with the situation in the Eurozone.

We analyze the actions taken by the Bank of England, because the British and American central banks conducted very similar monetary policy during and after the financial crisis. Therefore, the sudden eventual dovish shift in the policy of the Bank of England may impact the Fed’s stance.

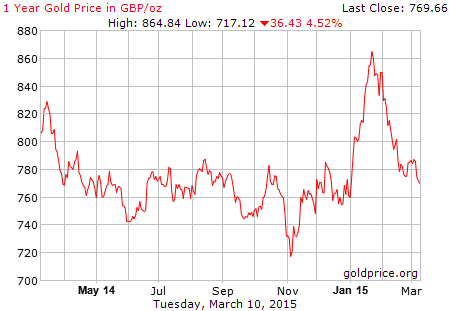

What are the connections between the Bank of England’s actions and the gold market? The relatively hawkish policy and expected interest rate hike next year has been negative for gold prices expressed in the British pound since the beginning of this year (see the chart below).

Figure 1: The gold price in GBP per ounce in the last year.

Source: goldprice.org

Another important point is that the global divergence in the central banks’ monetary policy may lead to capital inflows to the U.S., but also to the U.K. due to Britain’s perceived safe-haven status (the U.K. is currently attracting capital from Russia which has plunged into a crisis). It means that gold has another competitor as a safe-haven currency, which negatively affects its prices.

Summing up, the global monetary policy divergence is a fact. The Fed and the Bank of England are going to relatively tighten their stance (compared to the ECB and the Bank of Japan), however, the latter is expected to hike its interest rate a few months later. It will be negative for the gold market. On the other hand, the Bank of England seems to be even more undecided about the proper time of the hike than the Fed (it does not even rule out further cuts), which means that the medium-term outlook for gold is not necessarily negative.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview