The total amount of student loans outstanding in the United States amounts to nearly $1.3 trillion. Is it a cause for concern and how could the burst of the student loan bubble affect the gold market?

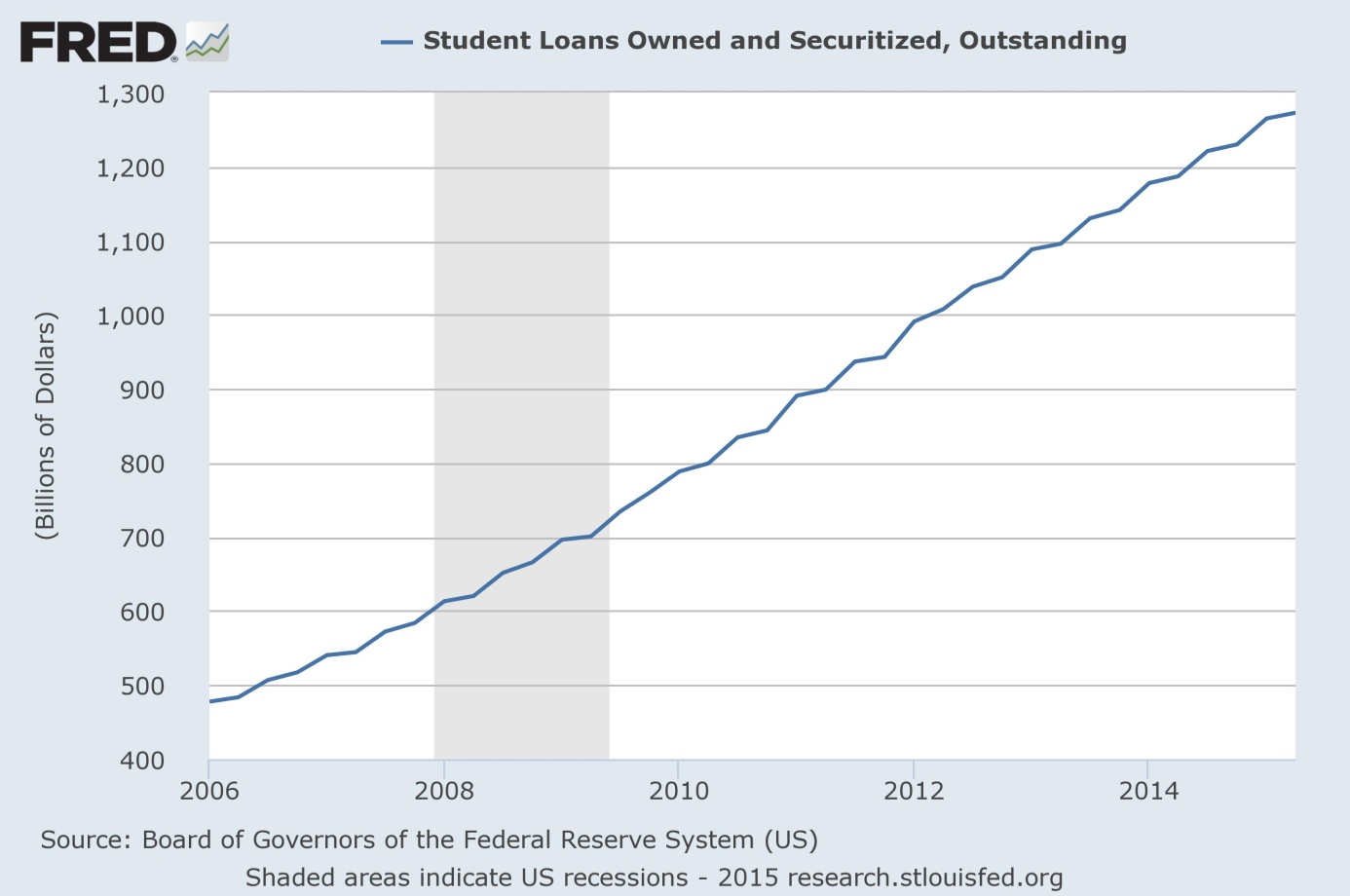

More and more analysts are noticing the student debt problem. Actually, it is hard to miss it, with 40 million Americans having student loans and more than $1.27 trillion in student loan debt (see the chart below), which represents the second largest category of consumer debt after home mortgages. The class of 2015, the most recent class of graduates, is the most indebted class in American history, which will graduate with $35,000 in debt, on average.

Chart 1: Student loans owned and securitized, outstanding in billions of U.S. dollars, 2006-2014

What is the cause of the student loan bubble? We will probably not surprise anyone by saying that the government interfering in the economy. As in the case of the housing bubble, easy lending rules and wrong government policies created a student loan bubble. With the housing bubble, the government wanted to increase the home ownership and guarantee the American Dream of a home for all Americans – regardless of their credit rating. Now, the housing mania (prices of houses always rise) is replaced by an education fever (education is always and for all a great investment in human capital) as the government wants to guarantee the American Dream of higher education for all young people – regardless of their mental abilities and financial capacities.

But the results are similarly disastrous. Student loans were supposed to make higher education more available for possible candidates, but they simply push the price of a college education out of reach for most American families. The consequence of government meddling is that graduates become debt slaves for the rest of their lives with degrees often providing little help in the job market (the proverbial “French literature”). And do not forget that only a part of these indebted young people will ever graduate. It goes without saying that the debt hangover and higher national debt will not help the U.S. economy. Additionally, the student bubble means lower employment, delayed household formation and downward pressure on home ownership and house prices with simultaneous inflation of house rents.

What is also scary is that nearly seven million Americans with student loans (17 percent of all borrowers) are in default. This means that this bubble – as each bubble – will not end well – its burst will add to the already massive debt burden. It is good news for the gold market, since more debt burden will eventually translate into slower economic growth and reduced faith in the U.S. economy. However, investors should not expect a sudden collapse in financial markets similar to the outburst of the financial crisis in 2008, because there are no exotic derivatives tied to student loans, which are issued mainly by the federal government.

Summing up, the student loan bubble is an important problem for the U.S. economy, particularly the young generation. As with the housing bubble, it was caused by easy money and government subsidies. Although its burst should entail less severe consequences for the financial markets than the housing bubble, it will lead to loses for the federal government and deteriorate the long-term U.S. economic prospects, which should be supportive for the price of gold.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on the fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview