We know the results. Biden will be the next president of the United States. Will gold shine under him?

It was a very close race but we finally know the results: Joe Biden has been elected as the next President of the United States. He got 50.65 percent of nationwide votes, but in some states, he won by just a margin of several thousands of votes. Nevertheless, Biden won 290 electoral votes, so he will probably move to the White House in January. My guess is that the coronavirus pandemic helped Biden score a victory, as older Americans could believe that he will handle the epidemic better than Trump.

I wrote “probably”, as in some states we do not have yet the results from 100 percent of the state vote count. Moreover, Trump said on Saturday that “this election is far from over” and that he was cheated. Since the current president started challenging the election results this week, recounts in several states are likely.

However, Biden’s lead in the Electoral College is so large that reversal of the results is rather unlikely, as the recounts would have to reverse in at least two states. So, even if some mistakes or irregularities are found, they don’t have to affect the outcome.

Therefore, we assume that Biden will be the next POTUS and will assume office at the age of 79, the oldest in history. Meanwhile, Kamala Harris will become the Vice-President, and the first woman, the first Black American and the first American of Asian descent to carry that title.

In the House, the blue wave didn’t materialize. Although Democrats retained their majority, they lost some seats, as Republicans were able to reclaim several seats lost in the 2018 midterm elections, securing 196 seats in total.

Now, the key question is what about the Senate? As for now, there is a tie and each party has 48 seats. Control of the U.S. Senate will not be decided until January 5th, when the runoff races in Georgia will take place for both of the state’s seats. Republicans are also expected to win North Carolina and Alaska, but it won’t be enough. If they lose both seats in Georgia, there will be a tie – and then the Vice-President has the final say. For the markets, it would be better if Republicans retained a majority in the Senate, thereby checking Biden’s proposals. In such a scenario, the Republican Senate could prevent any major tax increases or regulatory tightening. Good for Wall Street, but not necessarily for gold.

Implications for Gold

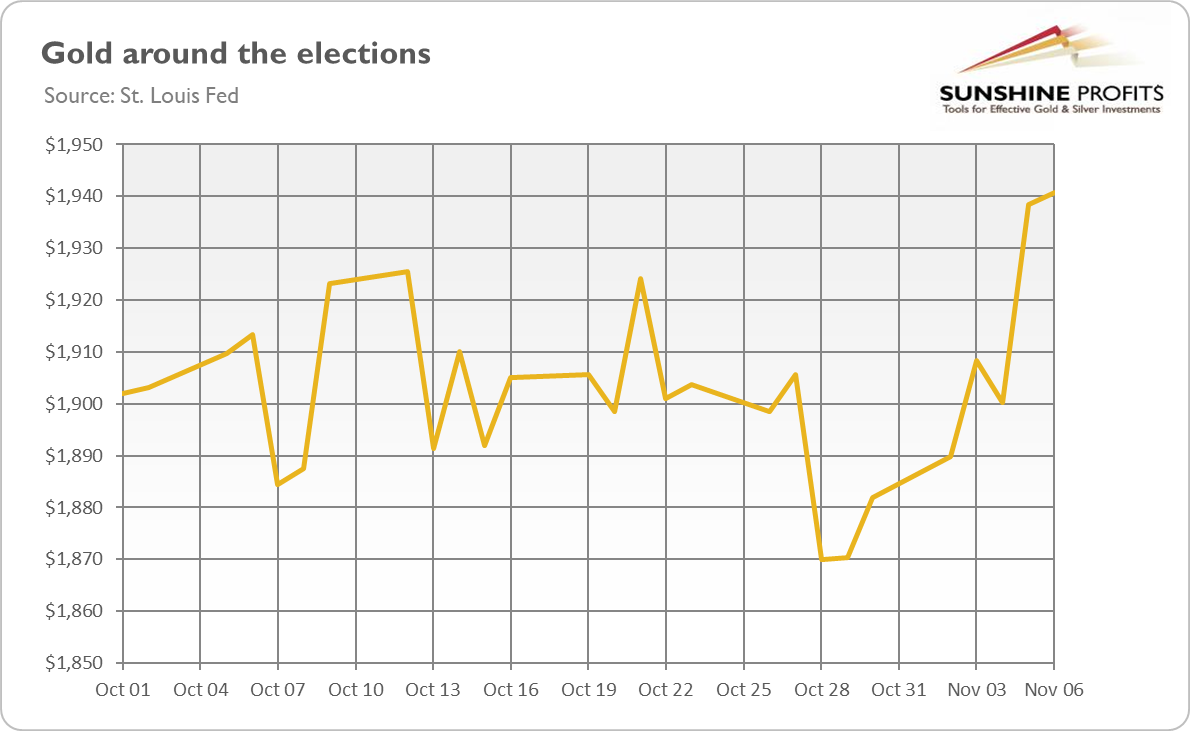

However, gold gained after the elections, as the chart below shows.

Actually, the price of gold did not merely increase – as one can see, it jumped above the crucial level of $1,900, even touching $1,960 on Friday. This is in line with our Thursday’s analysis suggesting that gold could be the biggest winner of these election in the long-term. By that I mean when the dust settles, the price of gold could continue its rally. After all, the financial markets were on the sidelines before the elections, waiting for the results. And remember, Biden will move to the White House in rather bad times, unless somebody likes epidemics. But this is good for gold. You see, the number of Covid-19 cases is steadily increasing, meaning that a larger fiscal stimulus would be needed in the future. Gold could therefore shine under Biden – at least until the macroeconomic outlook radically improves, which is not likely to happen in the near future.

Having said that, the price of gold plunged on Monday on news of successful Covid-19 vaccine testing. This news is bad for gold in the short-term, but it’s not yet clear that it will damage the long-term fundamentals of gold. Although the vaccine will help to fight the pandemic, the macroeconomic outlook remains fragile, which should support the gold prices. Moreover, there is still a long way to go before any widespread vaccination – and before the real interest rates will rise above zero.

If you enjoyed today’s free gold report, we invite you to check out our premium services. We provide much more detailed fundamental analyses of the gold market in our monthly Gold Market Overview reports, and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. To enjoy our gold analyses in their full scope, we invite you to subscribe today. If you’re not ready to subscribe yet, and you are not on our gold mailing list yet, we urge you to sign up there as well for daily yellow metal updates. Sign up now!

Arkadiusz Sieron, PhD

Sunshine Profits: Analysis. Care. Profits.

-----

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.