Volatility in gold has been decreasing recently. What does it mean for the gold market?

While Bitcoin is prone to wild swings, gold’s volatility remained muted (which may, by the way, explain the recent divergence between gold and gold miners). According to this interesting article, gold option traders expect that the price of gold will not move more than 2.4 percent in the next month. That number results from the cost of a long straddle strategy, which implies the purchase of both call and put option with identical strike prices. Since these options are very cheap, the strategy will bring gain on any move greater than 2.4 percent, no matter which direction.

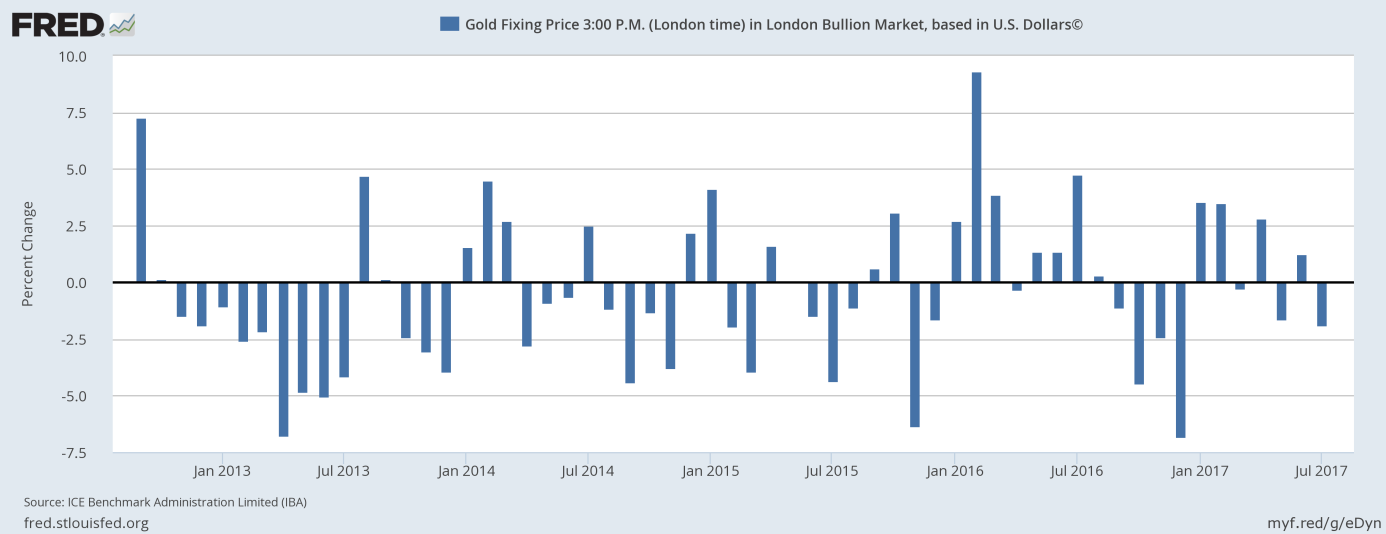

Historically, market swings of 2.4 percent on a monthly basis were nothing unusual, as one can see in the chart below. The volatility started decreasing at the beginning of 2017.

Chart 1: Monthly percent change of gold prices over five last years.

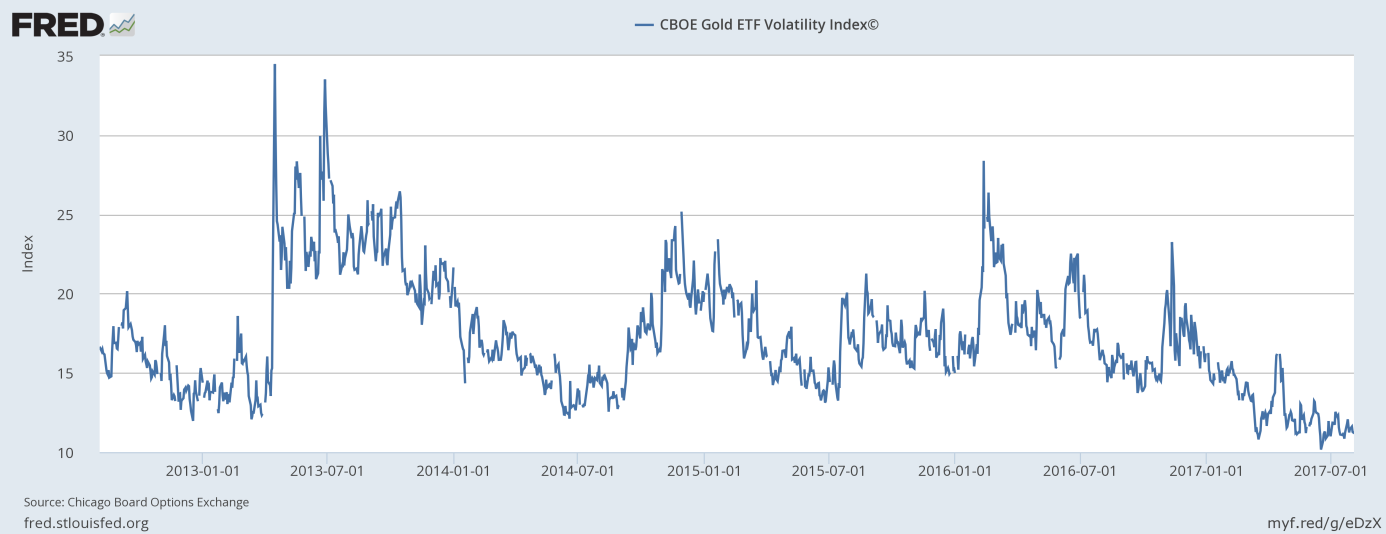

Indeed, other indicators show the same trend. The CBOE Gold ETF Volatility Index, which measures implied volatility calculated through call and put options, has been declining since the U.S. presidential election in November 2016. As the next chart shows, the index fell from 23.25 then to about 11.3 now.

Chart 2: CBOE Gold ETF Volatility Index over the last five years.

The author of the linked article believes that gold’s volatility will eventually increase, so investors should consider using options to position themselves in gold. Indeed, the current sideways trend will not last forever. And it may be the case that the emergence of Bitcoin diminished the role of gold as a hedge against market uncertainty. However, investors should not forget that almost all financial instruments have had very low volatility this year. There are different theories on low market volatility: the presence of central banks in the market, the rise of passively-managed funds, the high level of excess cash among investors and so on. Hence, there might be good fundamental reasons behind the recent decline in volatility. So, as stock and bond markets have been historically quiet, gold had to follow.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview