The political turmoil in the Trump administration continues. What does it mean for the gold market?

Last week, we wrote that Trump’s administration saw high staff turnover. On July 21, Sean Spicer, the White House press secretary, resigned after he expressed his disagreement with the selection of Anthony Scaramucci as White House communications director. But this is not the end of personal shifts. Yesterday, the White House said that Scaramucci, named by president Donald Trump as communications director only 10 days ago, was leaving the post. The change came only hours after Trump swore in John Kelly, a new chief of staff (he replaced Reince Priebus), to bring discipline to his West Wing (and after Scaramucci’s infamous interview with The New Yorker).

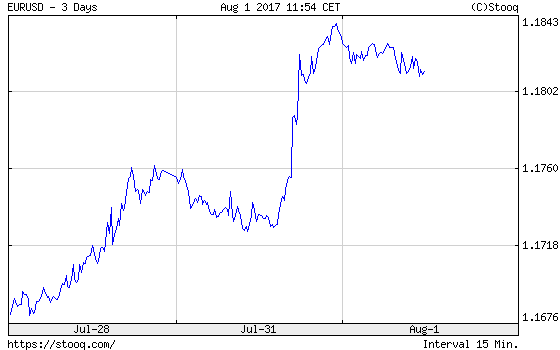

The political tumult could weigh on the U.S. dollar in the short term. The personal turbulence in the White House may further soften expectations that Trump will implement his pro-growth agenda, putting pressure on the greenback (as one can see in the chart below) and supporting the gold prices.

Chart 1: EUR/USD exchange rate over the three last days.

However, the recent changes may have positive effects in the long run. This is because Kelly may tame the chaos and bring order to Trump’s administration. Indeed, there is now a clear chain of command from Donald Trump to John Kelly to the rest of staff. Moreover, the appointment of John Kelly signals a shift from more extreme right positions toward a more centrist stance. Hence, in the medium-term, the odds of introducing a tax reform bill may actually be higher than before the recent political turmoil.

The key takeaway is that the recent days witnessed subsequent personal conflicts within the new administration. The political turmoil should be supportive of the safe-haven demand for gold in the short-run. However, if John Kelly, the new chief of staff, introduces order at the White House, which is yet to be seen, the long-term consequences of the recent political changes may actually be negative for the gold market. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview