Last week, North Korea fired another missile, while data on U.S. second quarter gross domestic product was published. What do these events imply for the gold market?

Another North Korean Missile and Gold

On Friday, North Korea fired another missile. It was probably an intercontinental ballistic missile, which landed within 230 miles of Japan’s coast. President Donald Trump condemned the move. He wrote in an official statement:

“North Korea’s test launch today of another intercontinental ballistic missile—the second such test in less than a month—is only the latest reckless and dangerous action by the North Korean regime. The United States condemns this test and rejects the regime’s claim that these tests—and these weapons—ensure North Korea’s security. In reality, they have the opposite effect. By threatening the world, these weapons and tests further isolate North Korea, weaken its economy, and deprive its people. The United States will take all necessary steps to ensure the security of the American homeland and protect our allies in the region.”

The launch could spur safe-haven demand for gold, as it clearly shows that North Korea is definitely committed to the missile program and is not likely to abandon. Indeed, Pyongyang has carried out 12 missile tests since February, becoming a nuclear and missile power faster that everyone thought. Moreover, it was the second test of an intercontinental ballistic missile – and some experts believe that it could have the range to hit major U.S. cities, such as Los Angeles, Denver and Chicago, or even New York City and Boston. Hence, firing such missiles poses a greater threat for U.S. security, having greater potential for a safe-haven rally. Although geopolitical events often offer only short-term support for gold prices, the rising tensions on the Korean Peninsula are more likely to provide a medium-term underpinning for the gold market.

Second Quarter GDP and Gold

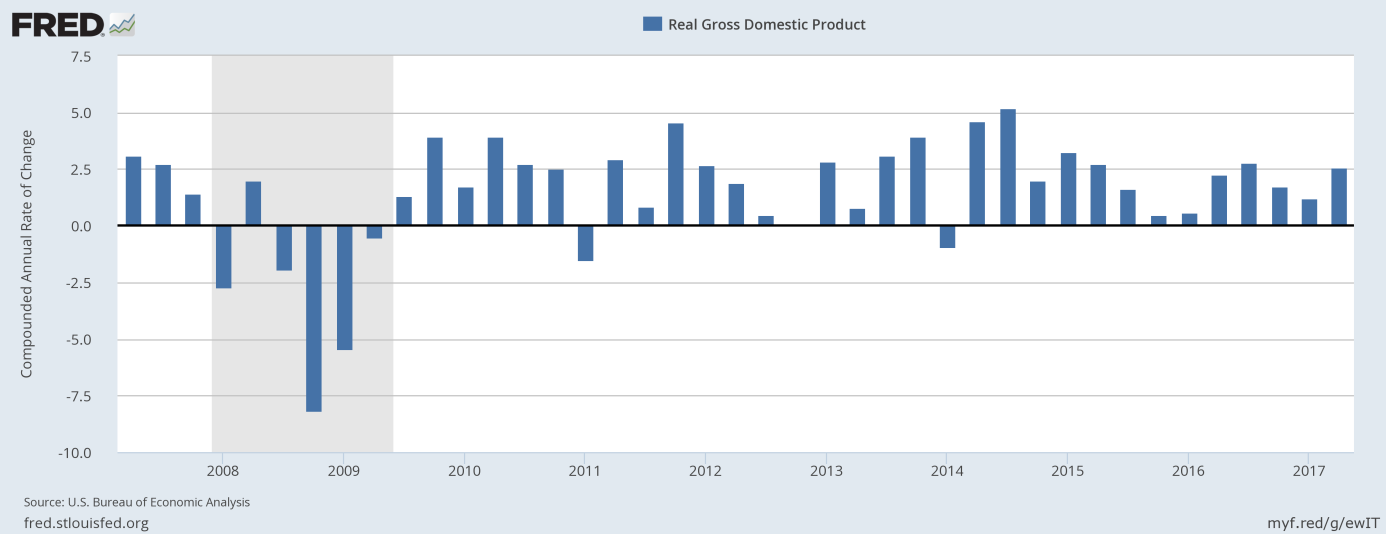

The U.S. economy grew at a 2.6-percent annual pace in the second quarter. The expansion, triggered mainly by strong consumer spending and an upturn in federal government spending, means a rebound from a weak first quarter, as one can see in the chart below.

Chart 1: Real GDP growth over the last ten years.

The increase was in line with expectations, but the growth in the Q1 was revised down from 1.4 percent to 1.2 percent. Moreover, the GDP price index was only 1.0 percent, less than expected. The weak GDP deflator followed a modest 0.5-percent rise in the U.S. employment costs. These data show little evidence of a broad upswing in the cost of labor and inflationary pressures in the economy. This is probably why the GDP report did not manage to spur excitement and change the negative sentiment towards the U.S. dollar. The slowdown in inflation could prompt a more dovish stance among the FOMC members, which is supportive for the gold market. Indeed, the U.S. dollar fell further against the euro after the release of the second-quarter GDP, while the price of gold increased to a six-week high, as the chart below shows.

Chart 2: Gold price from July 26 to July 28, 2017.

Conclusions

The bottom line is that the current sentiment is negative for the U.S. dollar, while positive for the euro and the yellow metal. The failure to pass the healthcare bill, the increased geopolitical uncertainty due to rising tensions on Korean Peninsula and data showing a slowdown in the U.S. inflation dampened expectations that the Fed would aggressively tighten its monetary policy and added to the recent rally in gold. Unless we see some upside catalyst for the greenback, the current sentiment may sustain. Stay tuned!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview