Merkel’s party won the German parliamentary election. What does it mean for the gold market?

On Sunday, the bloc of the Christian Democratic Union of Germany and the Christian Social Union in Bavaria won the German federal election, gaining 34.70 percent of seats. The Social Democratic Party got 21.58 percent of seats. The CDU/CSU and the SPD remained the two largest parties, but they received fewer votes than in the previous election. Actually, the conservative bloc scored its second-worst result since 1949, as voters punished it for its refugee policy. Indeed, the anti-immigrant Alternative for Germany gained 13.26 percent of seats, becoming the third largest party in the Bundestag.

The results and the SPD’s refusal to participate in a coalition imply that Merkel will have to form an alliance with the Free Democratic Party (11.28 percent of seats) and the Greens (9.45 percent of seats). We actually like this scenario, as the coalition with the pro-business and fiscally conservative FDP seems to be better than an alliance with socialists. However, markets are afraid that Merkel’s worse-than-expected results and the necessity to build a difficult coalition will weaken her position in Europe and limit her maneuver space to reform and further integrate the EU.

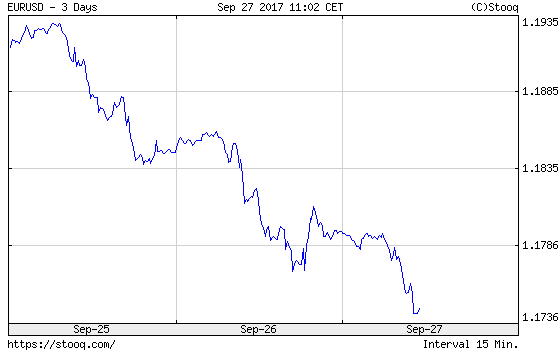

This is why the euro depreciated against the U.S. dollar, as one can see in the chart below.

Chart 1: EUR/USD exchange rate over the last three days.

As a result, the price of gold also declined, despite Monday’s spike due to fresh worries about North Korea, as the chart below shows.

Chart 2: Gold prices over the last three days.

To sum up, Merkel’s party won, but it lost a lot of ground to the nationalist AfD. The results were, thus, worse than expected and encouraged investors to take profits on the euro. The correction could last a while, as the euro was overbought and the greenback oversold, which is not good news for the gold market. A lot now depends on the ECB’s actions and Trump’s policies. If Draghi turns out to be more dovish than expected, while Trump finally manages to pass his economic agenda, the U.S. dollar will gain further (and vice versa). Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview