Yesterday, the minutes of the Federal Reserve’s July meeting were released. What do they say about the Fed’s stance and what do they mean for the gold market?

How can we summarize the recent FOMC minutes? Well, the FOMC members agreed that “the labor market had continued to strengthen and that economic activity had been rising moderately so far this year”. But the most important discussion concerned three other issues.

First, several participants noted uncertainty about the future course of the fiscal policy. A few of them even suggested that “the fiscal stimulus likely would be smaller than they previously expected.” The declining odds of significant fiscal stimulus imply less need for a more hawkish Fed. Thus, this is a bad development for gold.

Second, the several FOMC members pointed out further increases in equity prices. They argued that the rising valuations, together with continued low longer-term interest rates, are equivalent to an easing of financial conditions. Hence, the Fed could be potentially more hawkish as its tightening of monetary policy has been largely offset by other factors influencing financial markets. This is good news for the yellow metal.

Last but definitely not least, the U.S. central bankers discussed the recent low readings of inflation. Although many of them saw the softness in inflation as caused by idiosyncratic factors and thus temporary, the FOMC members noted the downside risks to the inflation outlook. The key paragraph is as follows:

“Participants discussed the softness in inflation in recent months. Many participants noted that much of the recent decline in inflation had probably reflected idiosyncratic factors. Nonetheless, PCE price inflation on a 12 month basis would likely continue to be held down over the second half of the year by the effects of those factors, and the monthly readings might be depressed by possible residual seasonality in measured PCE inflation. Still, most participants indicated that they expected inflation to pick up over the next couple of years from its current low level and to stabilize around the Committee's 2 percent objective over the medium term. Many participants, however, saw some likelihood that inflation might remain below 2 percent for longer than they currently expected, and several indicated that the risks to the inflation outlook could be tilted to the downside.”

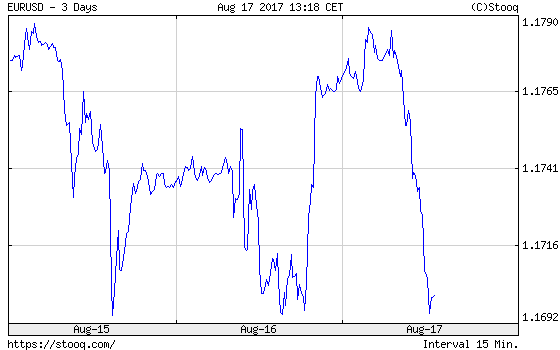

Hence, the recent minutes showed rising worries about inflation. Therefore, the U.S. dollar fell after their release (however, it rebounded today against the euro), while the shiny metal rose, as one can see in the charts below.

Chart 1: EUR/USD exchange rate over the last three days.

Chart 2: Gold prices over the last three days.

To sum up, the July FOMC minutes were released and they were generally a bullish event for the gold market. The reason is that they showed the increasing worries about the recent softness in inflation. Although most of the FOMC members still believe that inflation will stabilize around the Committee’s 2 percent objective over the medium term, the size of the cautionary group is expanding. It means that the odds of a December hike are lower, which is fundamentally positive for the yellow metal. However, there is plenty of time before the December meeting, so a lot may change. Now, all eyes are on the today’s minutes from the ECB meeting in July and on the Jackson Hole conference held next week. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview