On Sunday, Angela Merkel’s party won in a key German state election. What does it mean for the gold market?

The French presidential election is behind us, but it’s not the end of crucial elections in Europe. In June, the snap general election is held in the UK, while in September Germans will vote in the federal election. Let’s focus today on the latter.

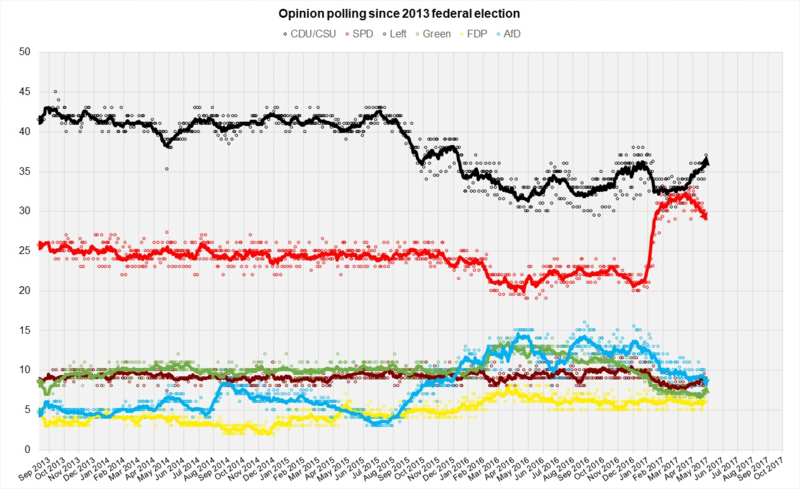

Merkel’s Christian Democratic Union/Christian Social Union (CDU/CSU) leads in polls. It has maintained a huge advantage over the Social Democratic Party (SPD) over the years, but it has narrowed significantly in early 2017, when the SPD chose Martin Schulz, the former President of the European Parliament, as their candidate for chancellor. However, as one can see in the chart below, the surge in opinion polls for socialists might be only temporary, as the gap between the two main parties has risen again recently.

Chart 1: Opinion polls for 2017 German federal election.

Moreover, on Sunday, Merkel’s party won a state election in North Rhine-Westphalia (it gained about 33 percent of the votes, while the SPD took around 31 percent). It’s a significant development, since the region is Germany’s most populous state where one-fifth of the voters live). And it's SPD’s heartland and home state of Martin Schulz. Hence, the CDU/CSU’s triumph is an important harbinger for the federal election.

Surely, there are still more than four months away and a lot may happen. But investors should not count on large safe-haven bids for gold because of this election. The pro-EU Merkel’s party comfortably leads in polls, while its main rival is also a mainstream, pro-EU party. Thus, the situation is completely different than in France, where a nationalist, anti-EU candidate could have become president. The nationalist Alternative for Germany (AfD) won only about 7.4 percent of votes, so it should not threaten the outcome of the national election.

The key takeaway is that Merkel’s party won the state election in North Rhine-Westphalia, the most populous and socialist state. It’s a good sign for CDU/CSU before the federal election. However, it’s rather bad news for the gold market, as Merkel’s pro-EU party is likely to win in September. It implies a conservation of status quo, while the yellow metal shines during radical and uncertain changes. Hence, investors should not expect the German federal election to trigger a similar reaction in the gold market as was the case with the French presidential election. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview