On Tuesday, U.S. President Donald Trump fired FBI Director James Comey. What does it mean for the gold market?

Comey is capturing headlines again. This time it’s because of his abrupt dismissal. Trump’s move was shocking because the FBI director is a nonpartisan post serving for a 10-year term and new presidents usually kept their predecessors’ FBI directors in place. Moreover, Comey had been leading an investigation into the Trump 2016 presidential campaign’s possible collusion with Russia to influence the outcome of the election. Trump’s firing of him ignites a political firestorm, as it raises questions about whether the president is trying to blunt this probe.

How could Comey’s firing affect the gold market? Well, the long-term consequences may be large if it leads to a significant political crisis. In such a scenario, the safe-haven demand for gold should rise. Some Democrats even compare Trump’s move to the events surrounding Watergate that eventually led Nixon to resign. However, the effect of Comey’s dismissal has been muted so far. Actually, as the chart below shows, the price of gold declined yesterday, indicating that gold continues to be under pressure.

Chart 1: Gold prices over the last three days.

Surely, it may be the case that the full repercussions have not been fully digested and priced in. However, the muted reaction may simply imply that we are not yet in a ‘constitutional crisis’ as some people believe.

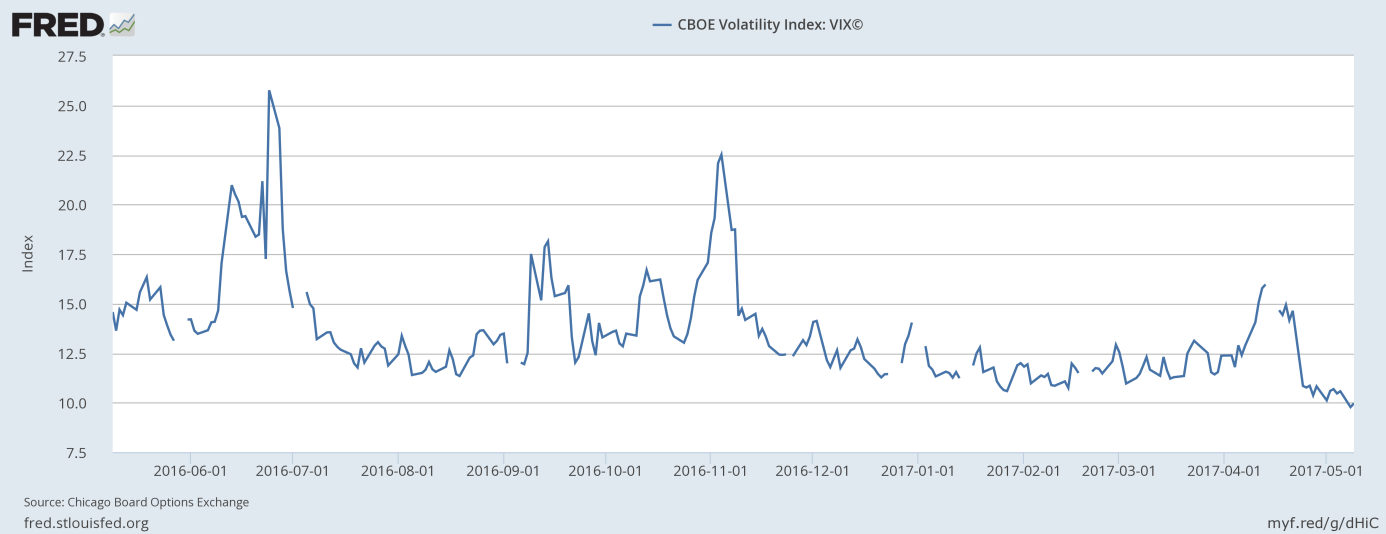

To sum up, Trump fired FBI director James Comey. Despite it being a surprise move with potential significant political implication in the long term, gold has been unable to attract safe-haven demand. It may suggest that the current sentiment is bearish. Investors should also remember that the uncertainty perceived by the markets is very low.

Chart 2: CBOE Volatility Index.

As one can see in the chart above, the CBOE Volatility Index plunged after the French presidential election, which is bearish for the gold market. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview