This week, the price of gold reached five-month highs. What does it mean for the gold market?

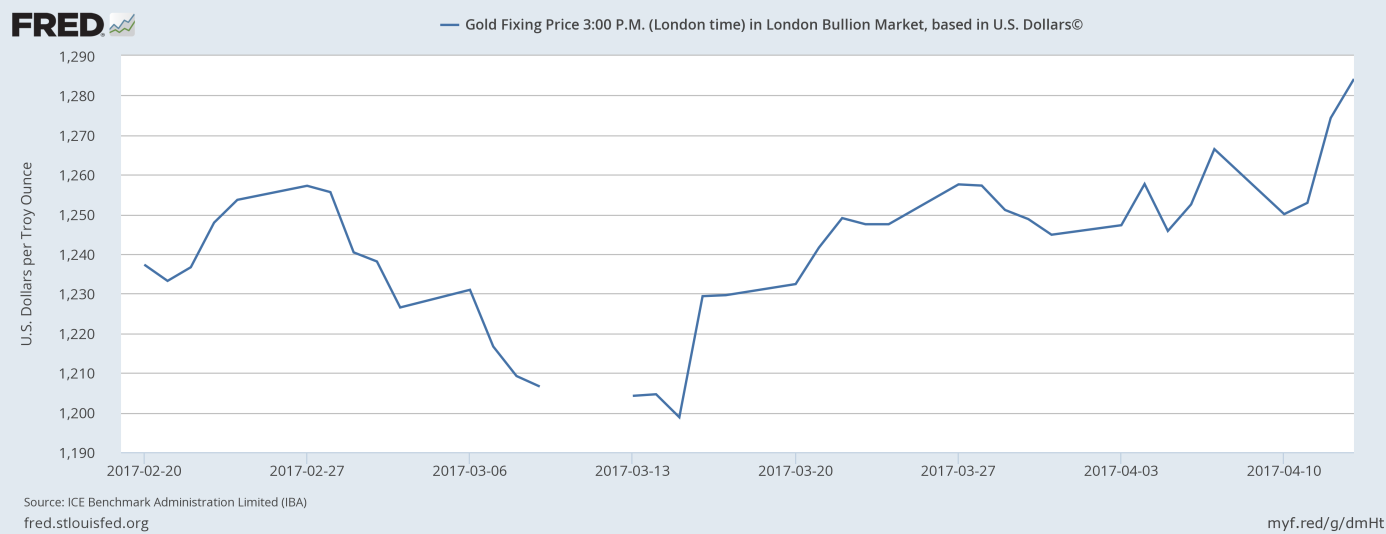

It has been a good week for the gold market. The London price of yellow metal reached $1,284 on Thursday, the highest since November 2016, as one can see in the chart below. Gold has gained almost 3 percent this week, the biggest weekly gain since June 2016.

Chart 1: The price of gold between February and April 2017.

The main reason behind these gains were geopolitical tensions. On Thursday, the U.S. launched an attack on Syria with 59 Tomahawk missiles. The strike may deteriorate the relations between the U.S. and Russia. One week later, Secretary of State Rex Tillerson met with Putin in Moscow, but tensions remained. Additionally, the U.S. opened another front, sending a Navy task force to waters off North Korea. These political tensions in both North Korea and Syria supported gold prices.

Moreover, the U.S. March nonfarm payrolls disappointed last week. And Trump’s remarks about a too strong greenback also helped gold prices. He said in an interview with The Wall Street Journal that the U.S. dollar was “getting too strong” and he would prefer the Federal Reserve keep interest rates low. In consequence, the greenback dropped, while gold continued its rally.

Now, the question arises: are the recent gains sustainable? On one hand, there is no clear direction in which the U.S. foreign policy is heading, so the geopolitical uncertainty may remain elevated, supporting the price of gold. Yesterday, the U.S. dropped a GBU-43 bomb in eastern Afghanistan as part of the fight against ISIS. On the other hand, the current tensions should cool in the near term (the U.S. does not continue strikes in Syria), so gold prices could decline. The current geopolitical tensions are, of course, different than terrorist attacks in Europe, since they concern the U.S. and may evolve into a military conflict.

However, investors should be aware that gold’s rallies in response to geopolitical tensions often end or even reverse when these tensions ease (in other words, one-off risks do not create sustainable rallies in gold prices). Saturday may be a key point, as there will be the Day of the Sun, the most important public holiday in North Korea. Hence, the country could add some nuclear fireworks to celebrate the birthday of its founding father Kim Il-sung. Stay tuned! We wish you – in spite of all these tensions – Happy Easter and Passover!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview