U.S. consumer spending rose 0.1 percent in February. What does it imply for the gold market?

Consumer Spending

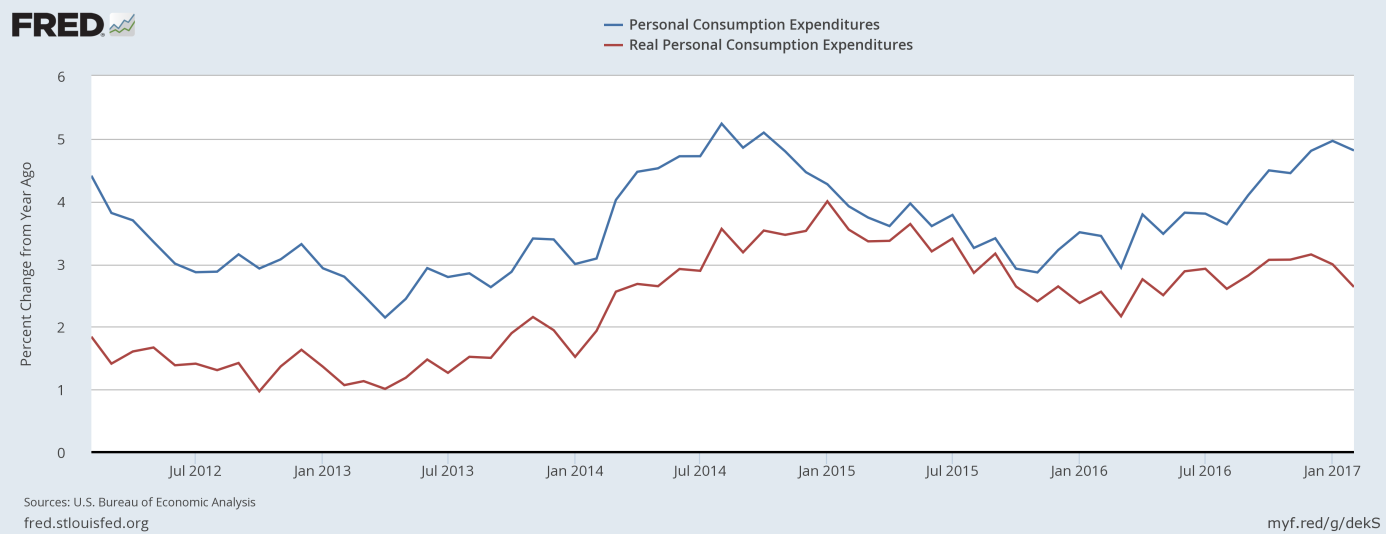

Personal consumption expenditures increased just 0.1 percent in February after a 0.2 percent jump in December. The result is below consensus due to weak spending on services (such as utilities). On an annual basis, consumer spending rose 4.8 percent, slightly less than in the previous month, as one can see in the chart below. Importantly, real personal consumption expenditures declined 0.1 percent (and rose only 2.6 on an annual basis).

Chart 1: Nominal personal consumption expenditures (blue line) and real personal consumption expenditures (red line) from 2012 to 2017 (as percent change from year ago).

It means that the scant increase in nominal PCE was caused only by rising inflation. Soft consumer spending does not bode well for economic growth. After the data was released, the Atlanta Fed’s forecast for real consumer spending growth in the first quarter of 2017 fell from 1.4 percent to 0.8 percent, while the forecast for real GDP growth dropped from 1.0 to 0.9 percent.

Personal Income

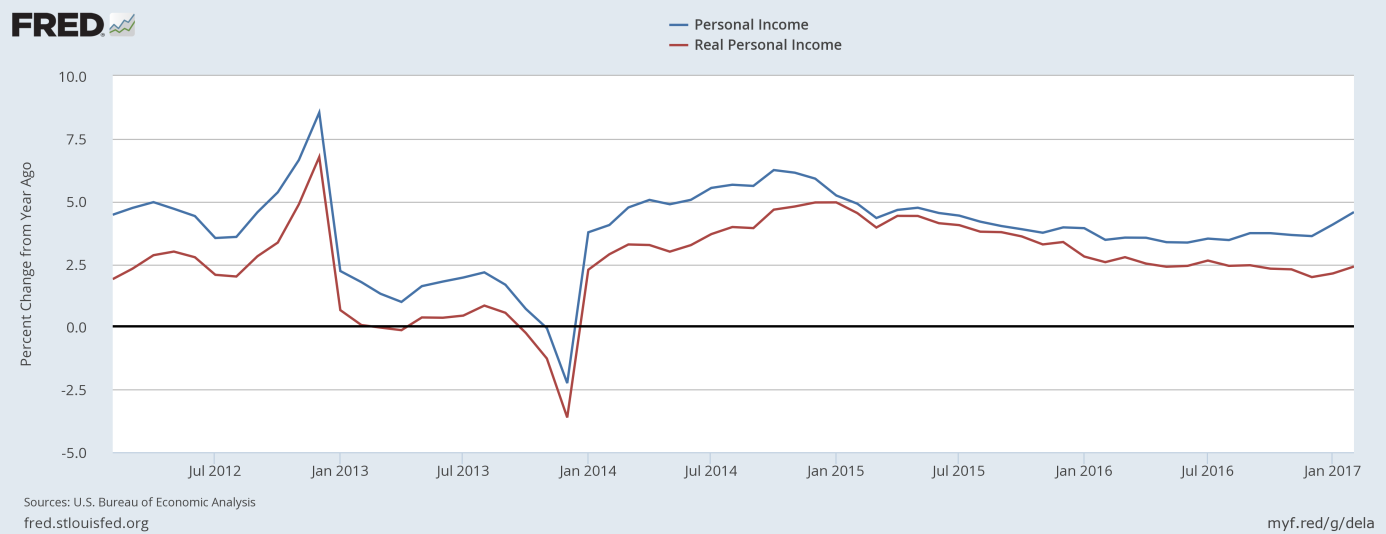

The income side of the report was more favorable, as personal income jumped 0.4 percent in February, following a 0.5 percent increase in the previous month (after revision). The rise was in line with expectations. Importantly, the wages and salaries component rose 0.5 percent. As one can see in the chart below, personal income rebounded in 2017 on an annual basis. That uptick should be welcomed by the Fed, especially that it is driven by rising wages.

Chart 2: Personal income over the last 5 years (as percent change from year ago).

PCE Price Index

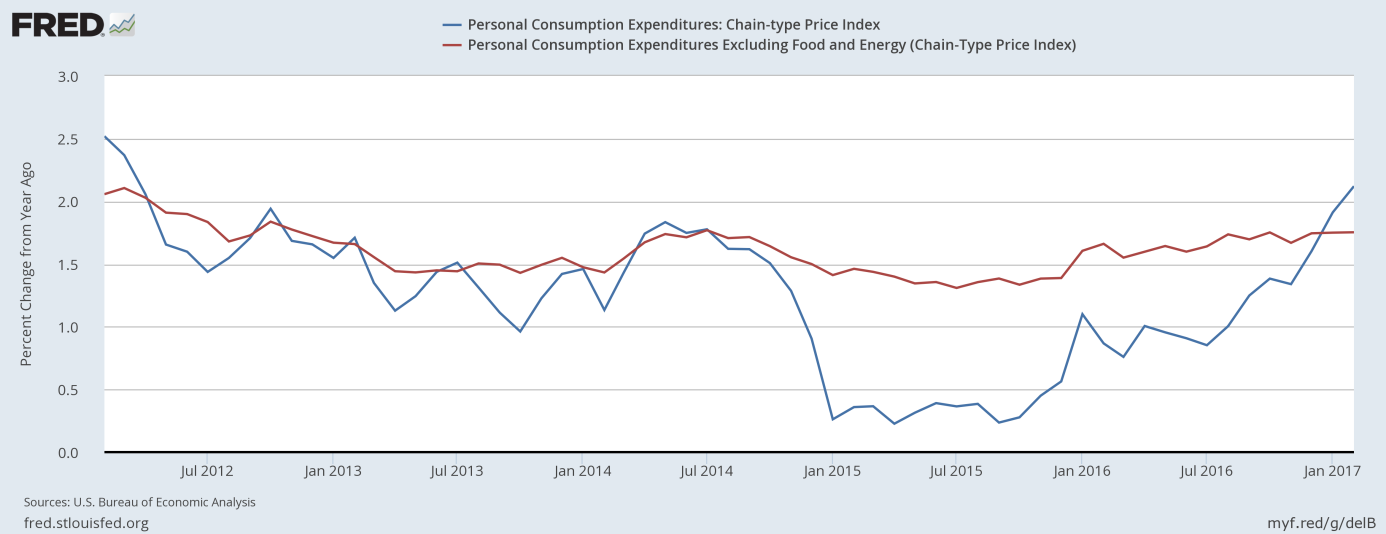

The PCE price index rose 0.1 percent in February, after a 0.4 jump in the previous month, while its core version edged up 0.2 percent, after a 0.3 rise in January. Although monthly rates are tame, year-on-year rates are impressive. On an annual basis, the core PCE price index excluding food and energy prices rose 1.8 percent, while the overall PCE price index jumped 2.1 percent. It means that the PCE price index is over the Federal Reserve’s 2 percent target for the first time since 2012, as one can see in the chart below. Therefore, inflationary pressures strengthened further in February, which could trigger more interest rate hikes in the months ahead.

Chart 3: PCE Price Index (blue line) and Core PCE Price Index (red line) as percent change from year ago, from 2012 to 2017.

Other Data

When it comes to other data, the most important news from last week concerned the upward revision of U.S. GDP growth in the fourth quarter of 2016 from 1.9 to 2.1 percent. However, the general picture of economic growth remains largely the same, so the final revision shouldn't affect the gold market significantly.

Conclusions

To sum up, the February personal income and outlays report was mixed. Although personal incomes rose, consumer spending declined and lowered the forecast of GDP growth in the first quarter. Inflationary pressures increased further, which could support the camp of U.S. monetary policy hawks.

The more hawkish Fed is theoretically bad news for the price of gold, but two hikes this year are already reflected in the price of gold and we do not forecast more moves from the Fed, especially that inflationary pressures may soften in the near future due to the March declines in oil prices.

Another important issue for the gold market is that rising inflation decreases real interest rates which are negatively correlated with gold prices. Hence, the strengthened inflationary pressures may actually be positive for the yellow metal, despite a potentially more hawkish Fed.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview