In January, the Eurozone’s Target2 balances have reached the highest level since the crisis in 2012 when Greece was on the edge of leaving the common currency bloc. What does it mean for the Eurozone and the gold market?

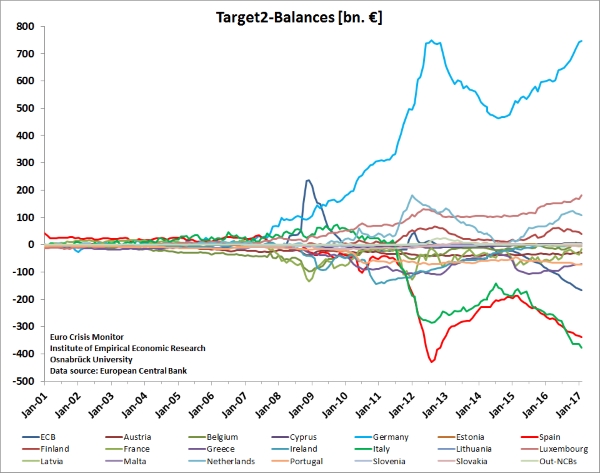

Some analysts have recently noted the growing Target2 balances. In short, the Target2 (Trans-European Automated Real-time Gross Settlement Express Transfer System) is the real-time gross settlement for the Eurozone. A positive balance reflects a net claim vis-à-vis the ECB and a negative balance corresponds to a net liability. As the chart below shows, in January 2017, the German surplus was at an all-time record of €796 billion, while Italy’s deficit was at a record €364 billion.

Chart 1: Target2 balances (bn €) between January 2001 and January 2017.

What do these imbalances mean? Well, in the period leading up to mid-2012, the Target2 balances increased strongly due to intra-euro area capital flight (because of concerns about sovereign risk, private capital fled from Ireland, Italy, Greece, Portugal and Spain into safer markets such as such as Germany, Luxembourg and the Netherlands). However, according to the ECB and the BIS, the current record T2 balances should be viewed, unlike then, as merely a by-product of the decentralized implementation of the asset purchase program (APP). This is because many APP purchases are conducted by national central banks via banks located in other countries.

Although it may be the case, some economists remain skeptical. At the end of February, the 2-year German bund yield fell to record lows of -0.92 percent, which could signal a serious capital flight into German safe-haven assets due to rising political uncertainty in Europe and worries about the prospects of the Eurozone. Indeed, there is a significant spread between Italian or French bonds and German bonds. Gold’s strength in January and most of February could be based on these doubts.

To sum up, the Target2 balances have been rising again recently. However, it does not necessarily signal intra-euro area capital flight. It may just reflect the ECB’s asset purchase program. However, some concerns about the Eurozone banking system remain and the debt markets (credit spreads in the Eurozone) show a certain level of stress. If we see a replay of the crisis from 2012, gold should shine. On the contrary, if concerns about the European banking system and the outcome of elections in Netherlands, France and Germany wane, gold may lose some of its support. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview