The Fed is widely expected to hike interest rate this week. What does it imply for the gold market?

Hike Is Coming

The U.S. central bank has a monetary policy meeting scheduled this week. According to futures markets, it is almost certain that the Fed will hike its main interest rate by 25 basis points to a range of 0.50 percent to 0.75 percent at its upcoming meeting on December 13 and 14. It is believed that the market odds should be above 70 percent to make the Fed comfortable enough to hike. Last year, they were about 80 percent. Now, the market odds of an upward move at the next meeting are 94.9 percent. Given such elevated expectations, the FOMC has no other option but to deliver a hike. If it fails and does not raise interest rates, it will trigger market turmoil. In a sense, the U.S. central bank is a hostage to the market, thus investors should brace themselves for a higher federal funds rate. With the markets prepared, the election uncertainty removed, the stock market rising and economy improving, a next financial crisis or nuclear disaster would have to happen to prevent the Fed from raising interest rates. Having said that, investors should remember that this year was full of surprises and there is little chance, really little (about 5 percent according to futures markets), that the Fed will not deliver a hike.

What Will the Fed Hike Mean For the Gold Market?

OK, we already know that the U.S. central bank is likely to raise interest rates. But what does it imply for gold prices? Well, as usually, there are many opinions, often contradictory. Some people argue that the Fed will send gold prices south, given the negative correlation between non-yield bearing gold and interest rates. Others believe that after the FOMC meeting the uncertainty will decrease which push the price of gold up. And finally, there is also an opinion that the Fed hike is already priced in, so the raise will not result in any significant price moves.

Which narrative is correct? Well, there is a grain of truth in all these theories. The price of gold is definitely linked to interest rates, but to real interest rates, not the nominal federal funds rate. And these rates have already risen, partially in expectations of the Fed hike. Therefore, this channel of influence does not have to work this time.

Actually, a lot depends on the message sent by the Fed officials regarding the path of future hikes. This is because the hike is widely expected and already factored into the prices. However, the Fed statement will be associated with the economic projections and Yellen’s press conference. Therefore, the impact of the FOMC meeting on the gold market will depend not only on a decision to hike or not, but also on the telegraphed path of future hikes.

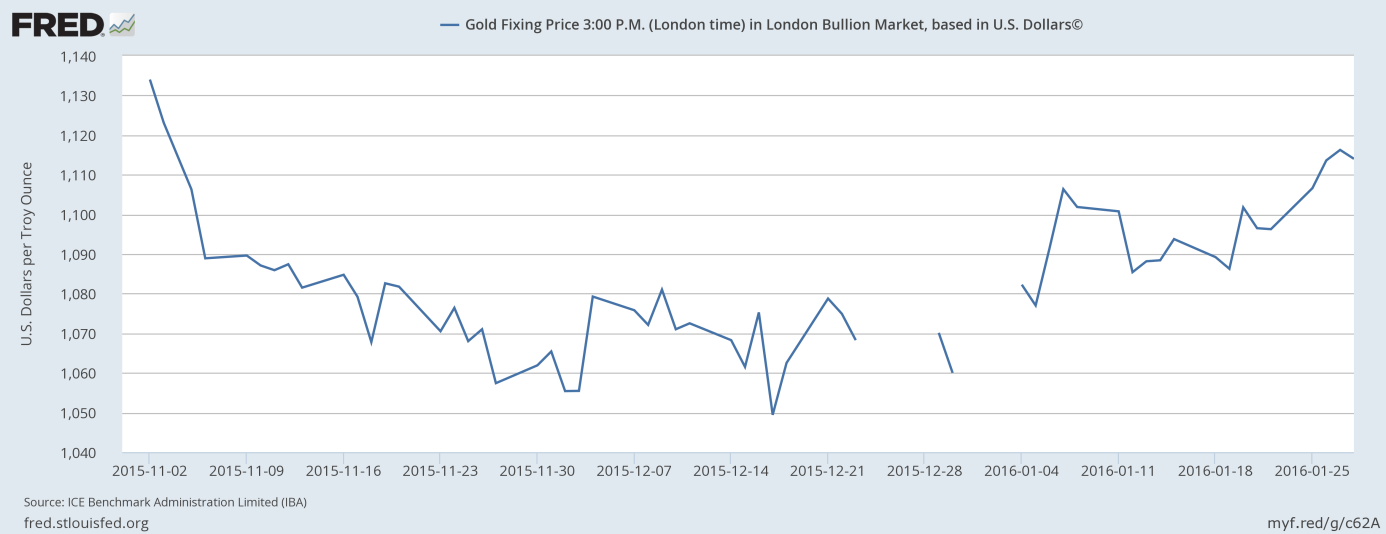

Indeed, as the chart below shows, one year ago the price of gold actually rose after the FOMC meeting in December 2015 at which the Fed managed to deliver a 25-basis point hike. One possible explanation is that the FOMC members lowered their projections for the federal funds rate, which was interpreted as dovish move.

Chart 1: The price of gold (London P.M. Fix) around the FOMC meeting in December 15-16, 2015.

Another reason for such counter-intuitive performance of gold after the last Fed raise may be that investors adopted a “sell the rumor, buy the fact” strategy. Markets were preparing for the worst scenario, but the reality was better and the world did not shake after the hike. On the contrary, the Fed’s action removed rate-related uncertainty from the gold market (just as the Trump’s victory removed the election-related uncertainty). Hence, if history is any guide, the price of gold may catch its breath after the Fed’s meeting, at least in the short term (we discuss it in more detail in our Friday’s Gold & Silver Trading Alert). From the fundamental point of view, a lot depends on the Fed’s stance about the path of interest rate hikes in 2017. A U.S. central bank more hawkish than expected would be negative for the gold market, and vice versa. We will return to this topic in our next editions of Gold News Monitor, stay tuned!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview