The World Trade Organization (WTO) cut the world trade growth forecast for 2016 to 1.7 percent. What does it mean for the global economy and the gold market?

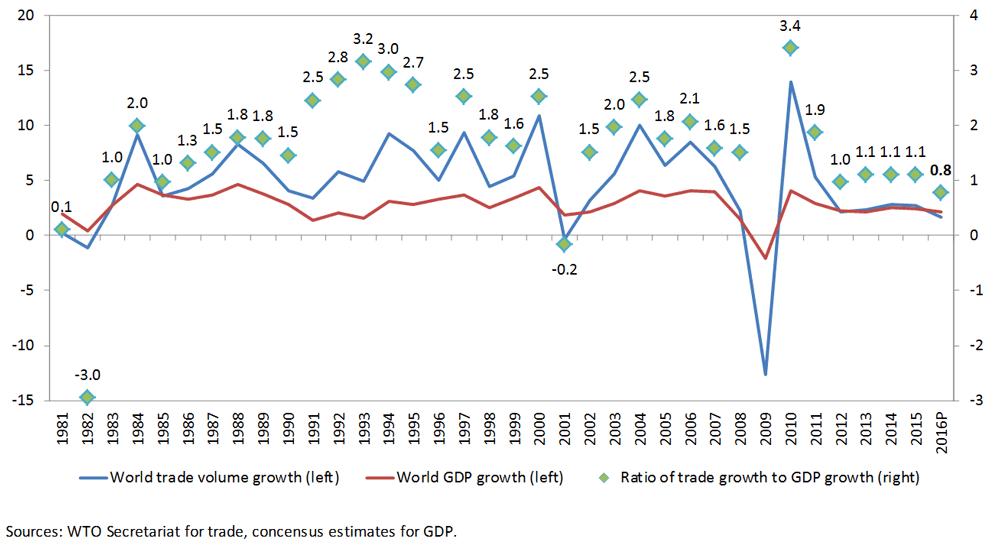

On Tuesday, the WTO reduced its forecast for global trade growth this year by almost 40 percent to 1.7 percent from 2.8 percent in April. It is a major reduction which should serve as a wake-up call. Indeed, this year would mark the slowest pace of trade and output growth since 2009. Moreover, it would be the first time in 15 years when trade growth was slower than GDP growth. Historically, trade has typically grown at 1.5 times faster than GDP or even twice as fast when globalization picked up in the 1990s, as one can see in the chart below.

Chart 1: World trade volume growth (blue line, left axis, percent change), world GDP growth (red line, left axis, percent change), and the ratio of world trade growth to world GDP growth (green points, right axis) from 1981 to 2016.

The decline in trade growth was mainly driven by a slowdown in developing economies such as China and Brazil but also in North America. Surely, pre-crisis trade growth was probably unsustainable due to the economic boom in China. Therefore, the current slowdown is not surprising. However, the pace of the reversal in globalization is rather worrying, as it also signals that protectionism is high and rising.

The bottom line is that trade expansion will no longer outstrip overall economic growth as it did for decades. This is because of an economic slowdown in developing countries, soft demand in developed economies and a growing anti-globalization movement. The slowing trade and economic growth should be a friendly environment for gold prices, as the concerns about the global economy could increase the safe-haven demand for the yellow metal. However, investors should always remember that such fundamental changes often occur gradually exerting only limited impact on gold prices, which react much stronger to sudden and abrupt shifts.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview