Because of the FOMC meeting and media insanity about the Brexit vote, we did not have time to analyze the recent U.S. economic data. What does it mean for the gold market?

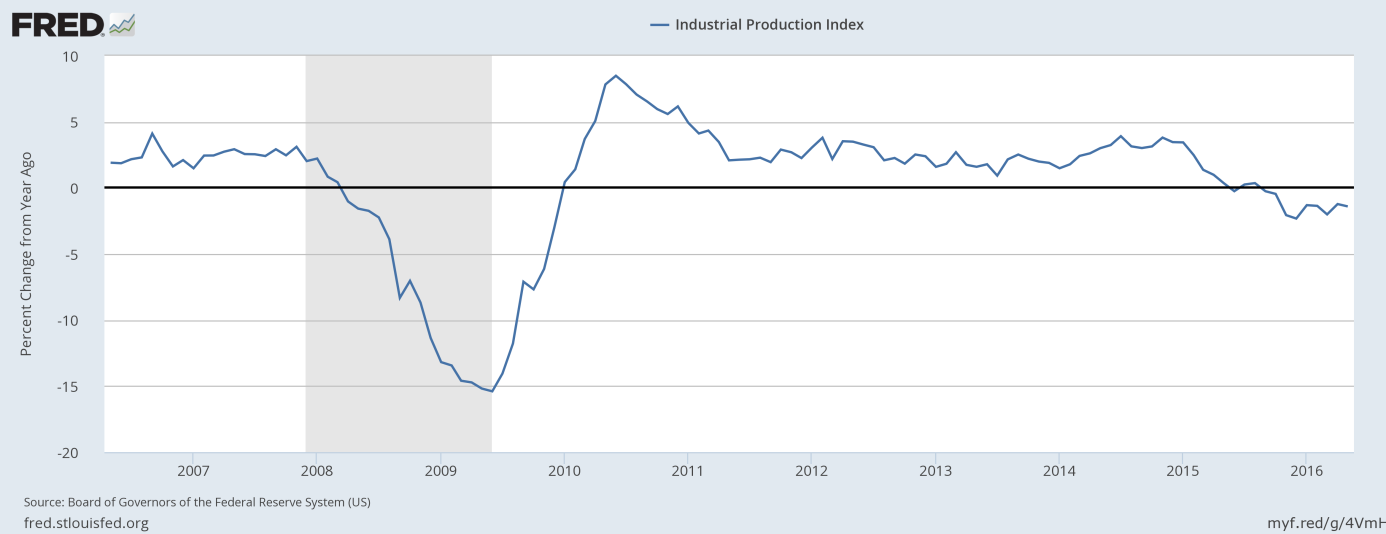

Retail sales were the last important report we managed to cover. Today, we examine data on the U.S. industry. Let’s start with the industrial output, which weakened in May. According to the Federal Reserve, industrial production decreased 0.4 percent in May, after increasing 0.6 percent in April. The decline was led by a sharp 4.2 percent slide in output of motor vehicles, the biggest monthly drop since January 2014. On an annual basis, industrial production fell 1.4 percent. As one can see in the chart below, the industrial output has been weakening since the second half of 2014. Frankly speaking, the graph looks recessionary. It is good news for the gold market, as the shiny metal is a wise choice during recessions.

Chart 1: Industrial production (as the percent change from a year ago) from 2006 to 2016.

Moreover, new orders for manufactured durable goods decreased 2.2 percent in May following a 3.3 percent gain in April. The decline was led by transportation orders which dropped 5.6 percent, but even excluding this volatile sector, orders fell 0.3 percent. Weak orders for durable goods may be a drag on the economy in the second quarter and undermine the confidence in the U.S. economic rebound.

Additionally, the Chicago Fed’s National Activity Index, which is a weighted average of 85 different economic indicators, fell from 0.05 in April to -0.51 in May. And the index’s three-month moving average declined from -0.25 to -0.36.

On the other hand, some regional industrial indexes recovered in June. For example, the Empire State Manufacturing Index surged from negative 9 to positive 6, while the Philly Fed Index rebounded from negative 1.8 to positive 4.7. It may signal an improvement in manufacturing conditions in the U.S., however, details of the latter report (such as current new orders, shipments and employment conditions) were importantly weaker than the headline.

Additionally, June Markit PMI rose to 51.4 from 50.7 in May, the weakest reading since September 2009. The rebound may be welcomed by the Fed, but the U.S. manufacturing is still depressed.

Conclusions

The take-home message is that the U.S. manufacturing remains at recessionary levels, although there may be some improvement in the nearest future. Surely, the U.S. economy continues the recovery and the second quarter should be better than the first one. However, growth remains sluggish and the risk of recession is relatively elevated. The environment of slow economic growth and low real interest rates should favor gold. Anyhow, gold investors – being focused on the Brexit vote – seemed to ignore both positive Markit manufacturing data and weak new orders for durable goods.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview