It really happened: Britons decided to leave the European Union! What does this historical decision imply for the global economy and the gold market?

As we wrote yesterday, polls gave a slight lead to the ‘Remain Camp’ before the referendum. Markets and bookmakers also did not believe in Brexit. They all were wrong, as 51.9 percent of the voters supported the divorce with the EU.

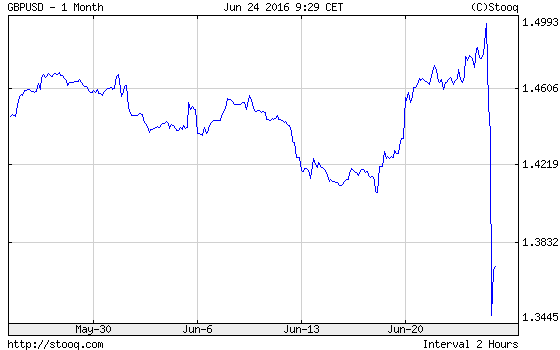

This is why the results came as a financial shock for the global markets, hammering equities across the world. British equities listed on FTSE 100 fell 7 percent, while a sharp drop in U.S. stock index futures suggest that the S&P 500 will drop more than 4 percent. In line with expectations in case of such an outcome, sterling plunged to a 31-year low. The euro also declined against the U.S. dollar, but to a lesser extent.

Chart 1: The exchange rate between the British pound and the U.S. dollar over the last month

The financial turmoil and rise in uncertainty boosted the shiny metal, a traditional safe-haven. The price of gold skyrocketed more than 7 percent to around $1,360, the highest level in more than two years and much beyond an important level of $1,300.

Chart 2: The spike in the price of gold after the Brexit vote.

What does the Brexit vote imply for the global economy and the gold market? Well, nobody knows what happens next. Theoretically, the British government should now invoke Article 50 of the Lisbon treaty, which represents a formal notification of a decision to leave the EU. However, the Brexit vote is not legally binding and we may witness some political tricks to not recognize the results or to organize a second referendum after another round of negotiations.

One thing is certain: the Brexit vote importantly elevated economic and political risks. For example, other European countries may now want to organize their own referenda about membership in the EU. Some analysts also point out that Scotland and Northern Ireland who voted “Remain” may organize independence referenda.

Gold should benefit from this rise in uncertainty. However, the biggest shock is probably behind us, as the markets tend to overact after important events, according to the strategy “act first, think later”. Today, gold opened lower and was declining in Asian markets.

To sum up, the British people surprisingly decided to divorce the EU, mainly by votes of older Britons. The Brexit vote led to financial turmoil with global equities and pound sterling hammered. Gold surged. As markets tend to overact initially, we may see now some corrections, especially that Brexit is not yet certain.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview