2016 is an U.S. presidential election year. What does it mean for gold?

Theory of Presidential Election Cycle

According to the theory of presidential election cycle, U.S. stock markets are weakest in the year following the election of a new U.S. president, and after the first year, the market improves until the cycle begins again with the next presidential election. What is the logic behind this theory? The answer lies in the politicians’ scheme of actions. They tend to implement unpopular reforms (such as curbing inflation or spending cuts) at the beginning, where their approval ratings are high and there is plenty of time until the next elections. Interestingly, it does not matter which party is in office. As the election approaches, politicians adopt a more cautious and accommodative stance. In other words, incumbent presidents try to stimulate the economy and keep the public focused on good economic news to be reelected. This is why stocks tend to see an above-average increase during the year preceding an election year, as increasing equity prices and a booming economy shed positive light on the incumbent political party.

Moreover, as the predictability of government policy rises with time after the elections, investors are more eager to take risk. This is another reason why the stock market improves until the cycle begins again.

Presidential Election Cycle and Gold

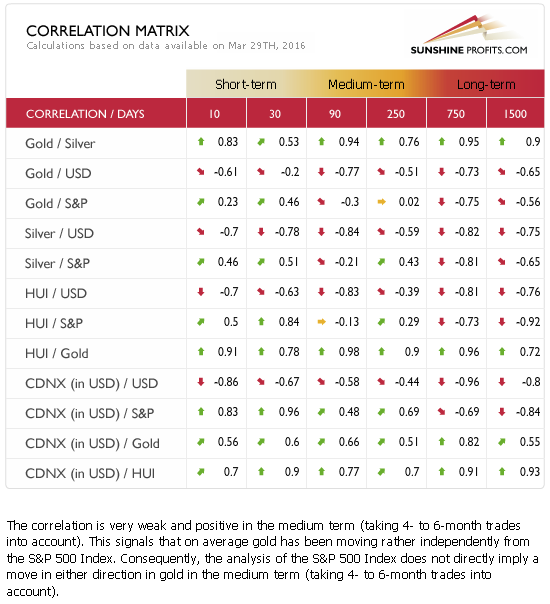

Some analysts believe that gold is negatively correlated with the stock market, hence its price should move in opposite direction than stocks during the presidential cycle. According to them, the gold market should be strongest in the year following the election of a new U.S. president, and after the first year, the gold market should weaken until the cycle begins again. We do not agree, as we showed that there is no causal link between stocks and gold prices, and instead, they are both determined by external macroeconomic factors. Indeed, as the Correlation Matrix below shows, the correlation between stocks and gold in the medium term (250 days) is practically zero.

Figure 1: Correlation Matrix based on data available on March 29, 2016.

Therefore, the medium-term gold market cycles seem to be independent from the presidential election cycles. Indeed, gold’s behavior does not fit well with the above theory. For example, gold gained 17.8 percent in 2005, the year following the presidential elections, 22.5 percent in 2006, 30.5 percent in 2007 and only 4.9 percent in 2008. The next four years better fit this theory (as gold gained 24 percent in 2009, but only 6.6 percent in 2012), however, 2013 (the first year following the presidential elections) was horrible for gold, as it lost 28.3 percent.

However, gold may be affected by elections in the short-term. For example, gold prices plunged nearly $200 an ounce during a two-week span in late October, but rallied after Obama was elected. Surely, 2008 was unique due to the Lehman Brothers’ bankruptcy, but we saw the same pattern in 2004. In that year, gold was down in the first three weeks of October before it started to rally 10 days before the election. In 2012, gold also declined in October, but rose (for a while) after Obama was reelected.

What is important is that the upcoming elections may be different. The first reason is that we have an open election this year – markets dislike the uncertainty and changes associated with the new president being elected (the uncertainty is particularly high when the executive power goes from one to another party). The second issue is that the uncertainty is very high this year, mostly due to Donald Trump, who is a dark horse with unknown economic views. His candidacy makes it difficult for investors to assess the financial implications of the next administration. This is why the uncertainty regarding the U.S. election should be negative for the U.S. dollar and positive for the yellow metal. However, as the elections approach, the uncertainty should ease (as the parties will choose candidates which will hopefully present more elaborated economic programs), unless Trump gets the nomination and has favorable polls – in such a scenario, nobody would really know what to expect and gold should gain on such uncertainty as a safe-haven.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview