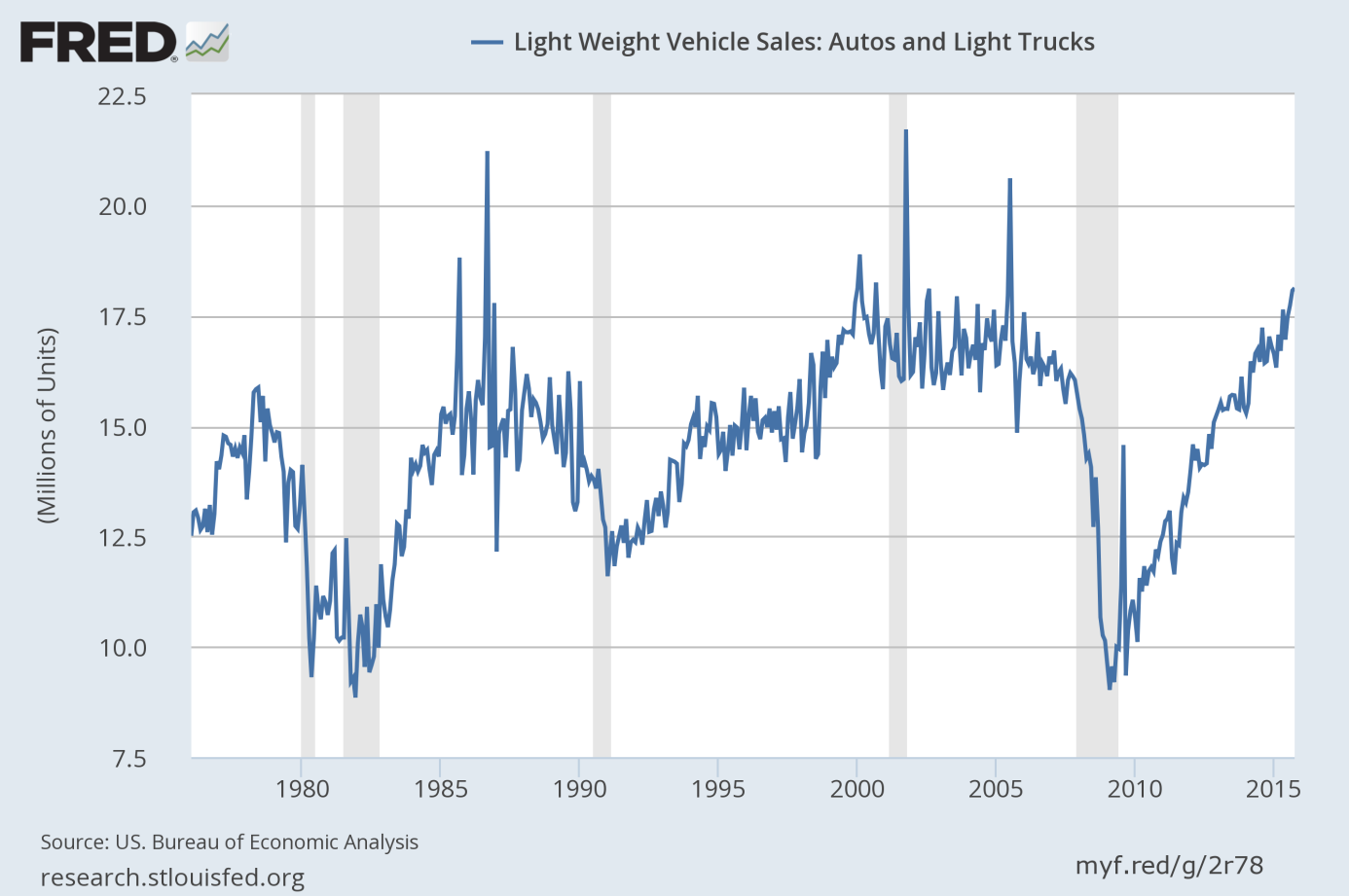

The autos and light truck sales rose from 9 million units for the year ended in February 2009 to 18 million units for the year ended in October 2015 (see the chart below). Is there a bubble in the automotive market? How could the situation in that market affect the price of gold?

Chart 1: Annual auto and light truck sales (in millions of units) from 1976 to 2015.

The auto loan bubble is a replay of the housing bubble. Seven years of Fed’s easy-money policy have accelerated sales in recent years. For example, from June 2014 to June 2015, U.S. consumers incurred $101 billion in auto loans, outstripping the pace of growth for other kinds of consumer debt, including mortgages. Automotive and student loans now account for more than 70 percent of total U.S. consumer credit. And the amount of money borrowed to pay for new and used vehicles climbed to an all-time high of $968 billion in the third quarter of 2015.

As in the case of mortgages, securitization is behind the bubble. New issues of auto loan-backed ABS account for more than half of total consumer loan-backed issuance and are expected to rise 25 percent in 2015. Competition among lenders to take advantage of the strong demand for ABS backed by auto loans induce them to accept more risk, extend loan maturities and increase the share of loans for subprime borrowers. Sounds familiar?

The consequences of the end of this artificial boom may be quite significant. New cars and light trucks comprise about a quarter of U.S. durable-goods. Investors should not forget that the automotive sector is one of a few bright spots in the U.S. economy. The question is how much of recent GDP growth can be attributed to people buying cars that they cannot afford in the long term.

Undoubtedly, nobody knows when the end will come, but the Fed hike should speed up this process. The Federal Reserve Bank of New York has recently published an interesting paper entitled “Interest Rates and the Market for New Light Vehicles”. According to its authors, the Fed hike would drag demand, production and sales down. If interest rates increase by 1 percentage point, the automobile production will fall nearly 12 percent and sales will decrease 3.25 percent at an annual rate.

The bottom line is that there are many signs that there is an auto loan bubble. The Fed hike could trigger its burst. This would be a replay of the housing bubble. The Fed’s tightening cycle from 2004 to 2006 led to the collapse of the housing mortgage market. There is no need to remind how the last crisis affected the price of gold. After initial fire sales, its price surged. The same may happen when the automotive bubble pops.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on the fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview