Americans purchased fewer goods and services at retail stores in June. What does it imply for the Fed’s policy and the gold market?

According to the U.S. Census Bureau, retail sales fell by 0.3 percent last month. It was the first decline in fourth months. Moreover, May's retail sales were revised down from 1.2 percent to 1.0 percent increase. Obviously, one month does not tell a story and some slowdown was expected after a strong May, but June retail sales definitely surprised economists, who forecasted a 0.3 percent gain.

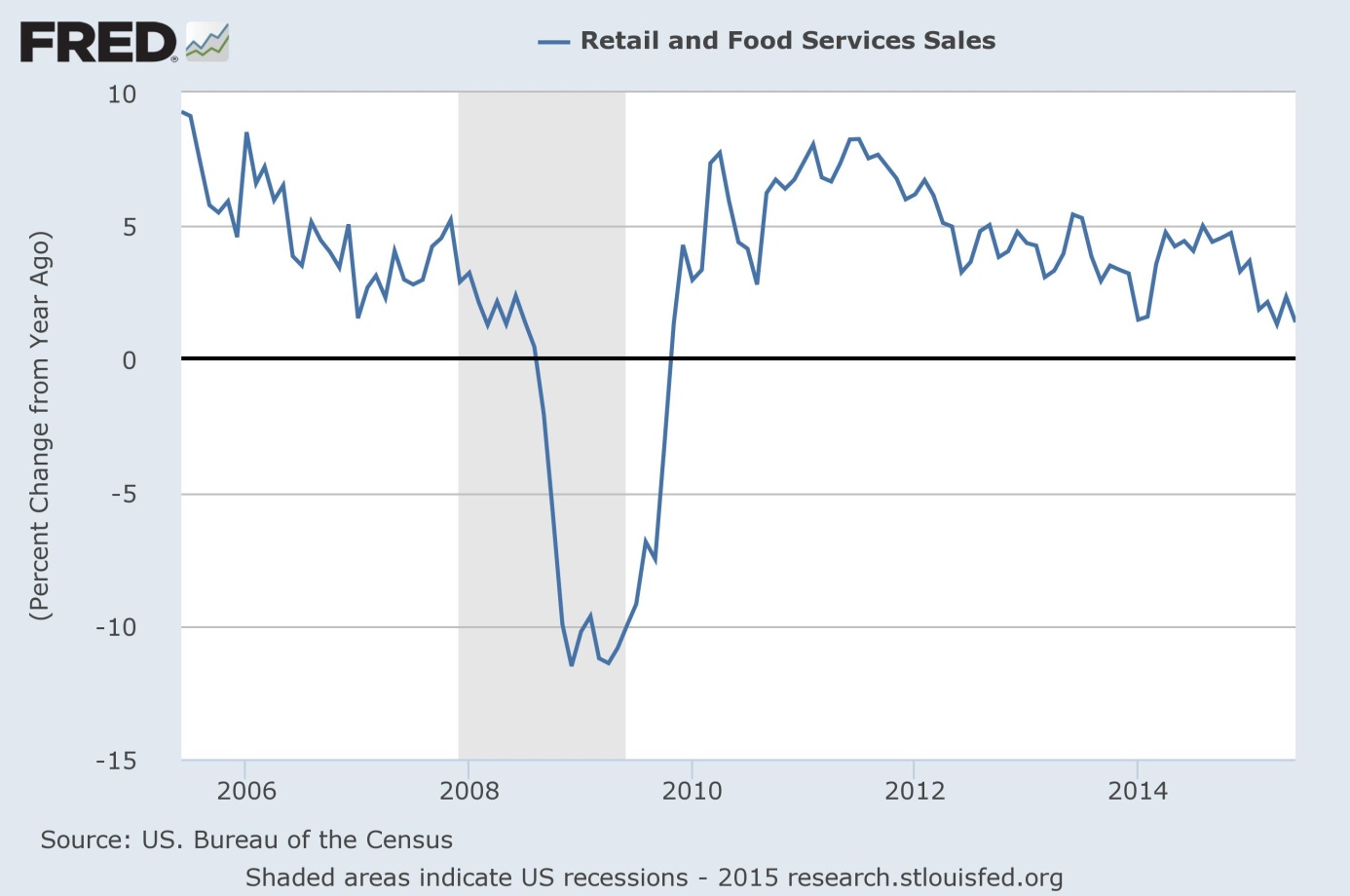

It is a bit funny to see how the permanent optimists explain this weak number. They point out an early Memorial Day holiday that may have boosted sales in May at the expense of last month, and a longer school year that may have been partially responsible for weaker sales performance for the quarter. Surely, these factors may contribute somehow to the little appetite to boost spending, however the slowdown in retail sales started in 2011 (see the chart below).

Chart 1: Retail and Food Services Sales (percent change from year ago) between 2005 and 2015

Source: research.stlouisfed.org

Why? The reason is quite simple: debt overhang. According to many economists, (see this paper), the increased household indebtedness (due to mortgage lending) explains the slow pace of recovery from global financial crisis of 2007-2008. So, analysts should drop their silly excuses and realize that U.S. consumers are deleveraging. In fact, the main driver for retail sales is spending on cars fueled by subprime auto loans. Without it, the recessionary trend in the consumer spending would be obvious. Indeed, excluding motor vehicles and parts, retail sales were practically flat (0.1 percent gain) over the last 12 months.

Given the soft June data, Yellen’s remarks on “recent encouraging data about retail sales (…) which could be an indication that the pace of consumer spending is picking up” looks not very unconvincing. Although she expects interest rate hike this year, she also underlined many times that the Fed is data dependent. Therefore, the weak data on retail sales casts doubts on a possible September interest rate hike, which should be supportive for the gold prices.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on the fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview