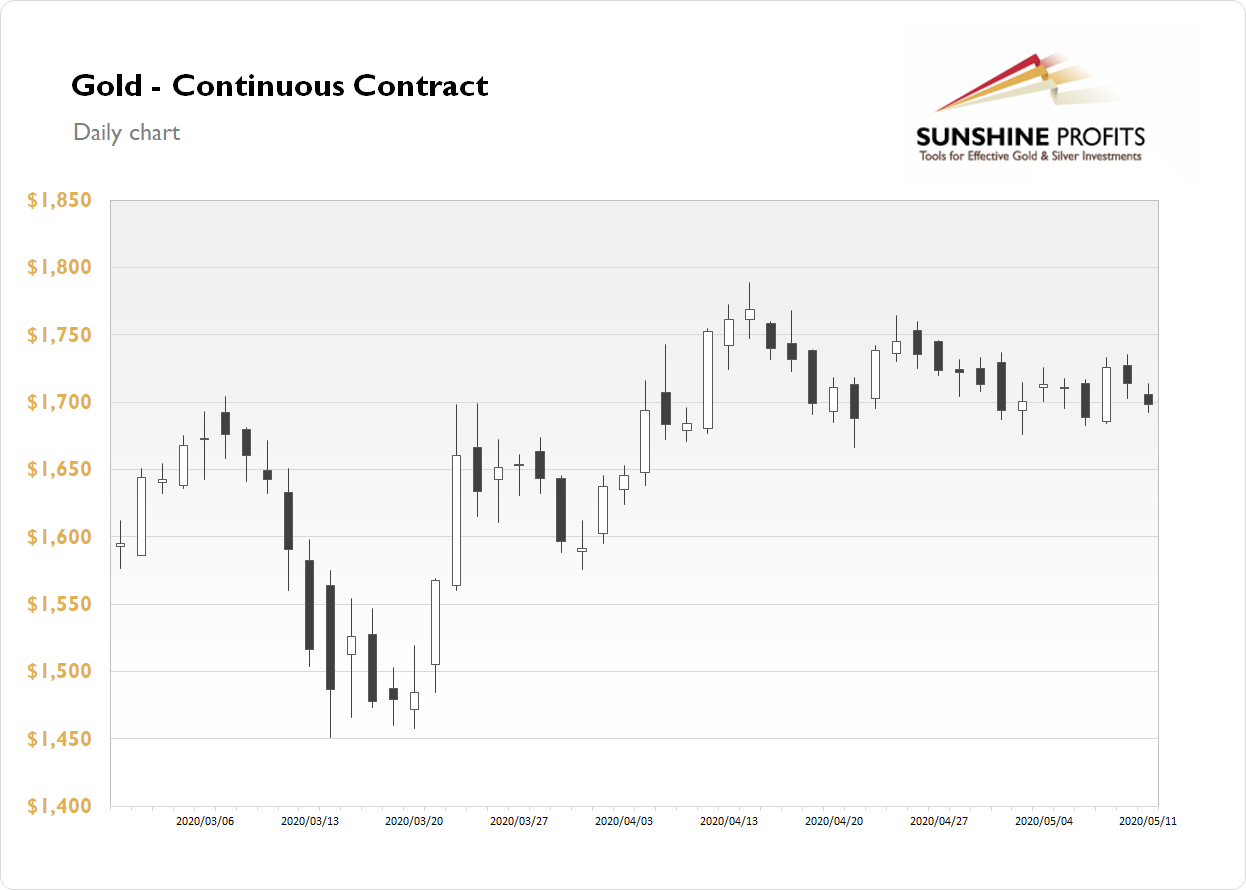

The gold futures contract lost 0.93% on Monday following Friday's bounce from the recent local highs. Gold is still trading within a flat correction after its April's advance. On April 14 it was the highest since November of 2012 and the high was at $1,788.80. Since then we've seen some profit-taking action and a potential medium-term downward reversal.

The price of gold is basically going sideways along $1,700 mark since early to mid April and it's trading above February-March local highs. So it still looks like a consolidation within a medium-term uptrend.

The price of gold is gaining 0.1% this morning, as it continues to trade within a short-term consolidation. Global financial markets remain in a risk-on mode, as stocks are hovering along their medium-term local highs. What about the other precious metals?: Silver lost 0.62% on Monday and today it is 0.4% lower. Platinum lost 1.01% and today it is up 0.5%. Palladium gained 0.38% and today it is 1.8% lower.

Last Friday's Nonfarm Payrolls and the Unemployment Rate release has confirmed coronavirus damage to the U.S. economy. Today's Consumer Price Index came at -0.8% vs. expectations of -0.7%. The negative number was caused by last month's oil prices crash. We will now await tomorrow's Fed Chair Powell speech and Friday's Retail Sales number release, among others. Take a look at our Monday's Market News Report to find out about this week's economic data announements.

Thank you.

Paul Rejczak

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care